Bitcoin Dips to 2026 Low as Altcoins Crumble: Is BTC at $56K Next?

Key points:

-

Bitcoin remains under pressure as the bears attempt to hold the price below the crucial $74,508 level.

-

Several major altcoins are struggling to bounce off their support levels, increasing the likelihood of the resumption of the downtrend.

Bitcoin (BTC) (CRYPTO: BTC) is facing renewed selling pressure after bulls pressed for a recovery but failed to sustain gains, with the price slipping beneath the key mark of $72,169. In a Monday note, Galaxy Digital research lead Alex Thorn warned that BTC could slip toward its realized price near $56,000 in the coming weeks, citing a lack of catalysts capable of reversing the trend. The absence of strong on-chain or macro catalysts has kept buyers on the defensive, and the market has yet to demonstrate a convincing bid at higher levels.

Not everyone is certain the bottom is in. On X, Bitwise chief investment officer Matt Hougan argued that the crypto markets are likely to rebound sooner rather than later, signaling that the longer-term setup could still tilt toward a renewed rally even as near-term momentum remains fragile. The disagreement among market voices highlights a broader question: are macro conditions enough to spark a durable relief rally, or will the market continue to test major support zones?

Crypto market data daily view. Source: TradingViewIn the near term, a classical pattern is reemerging: BTC’s recovery could take time, with some observers noting a historical tendency for extended periods below the 100-week simple moving average. A noted commentator recently recalled that when BTC breaks below the 100-week SMA, it has stayed under that threshold for many months in prior cycles, with the COVID-19 shock offering a rare exception where BTC rose above the level within weeks. The question for traders remains whether this time will echo the longer baselines or deliver a quicker bounce spurred by renewed risk appetite. The gravity of the current setup is underscored by the fact that several top altcoins are testing notable supports, increasing the risk of a broader downturn if those levels give way.

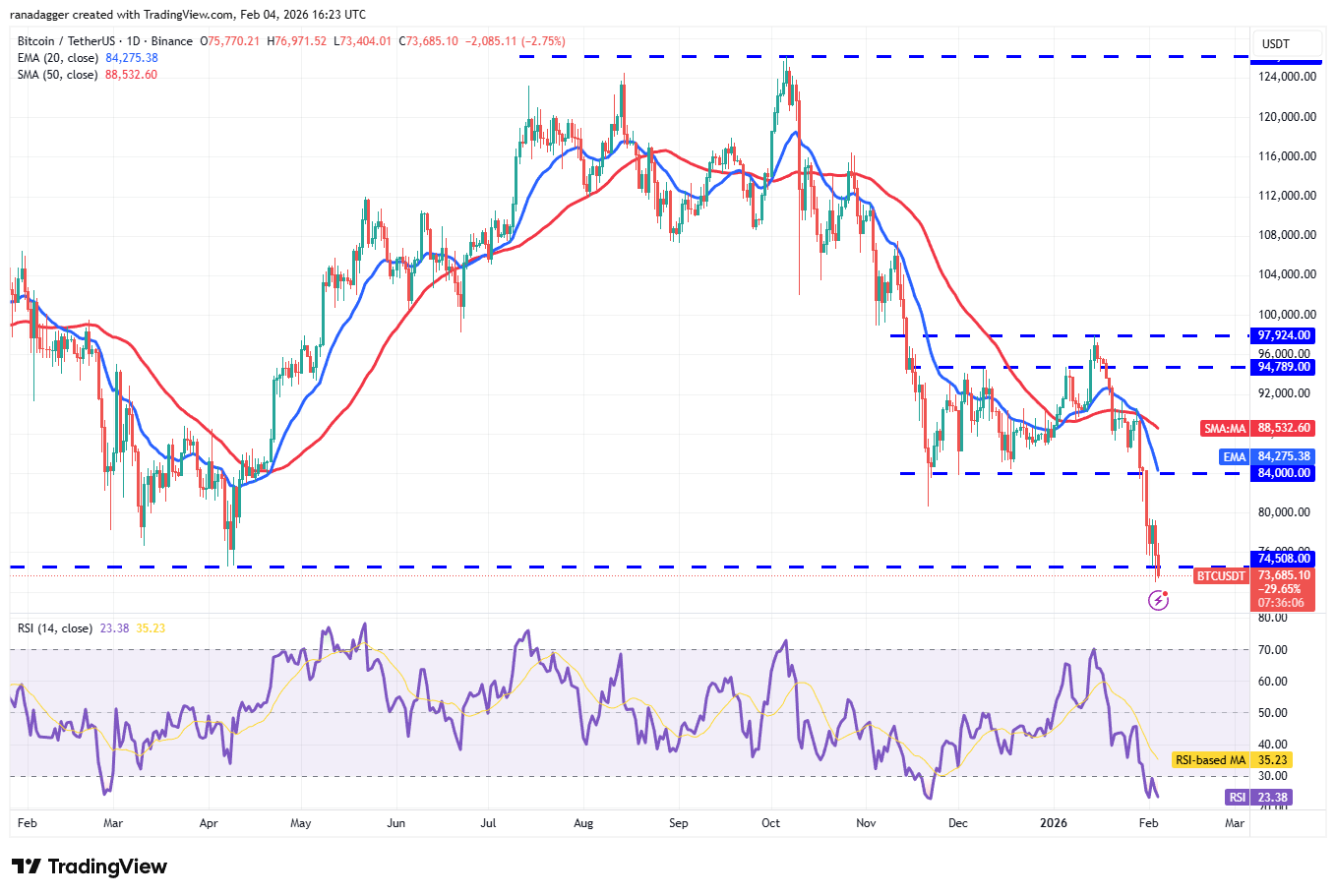

Looking at the price architecture: BTC’s next crucial defense is at the $74,508 support, but buyers have struggled to hold above that level, and the price has hovered around the $72,000s region. If selling accelerates and BTC breaks decisively below $72,945, the path toward the next meaningful support near $60,000 could open, potentially inviting a broader re-pricing across the leading cryptos. The relative strength index (RSI) sits deep in oversold territory, suggesting that a relief rally could materialize if near-term selling pressure eases and buyers reclaim the vicinity of $79,500. A sustained move above the $79,500 resistance could re-energize momentum toward $84,000, though bulls still face a challenging environment amid ongoing risk-off sentiment in broader markets.

Bitcoin price prediction

Bitcoin’s trajectory hinges on how price behaves around the critical $74,508 support and the subsequent $72,945 region. A breach below those levels would likely intensify selling pressure and could revive a test of the $60,000 zone. Conversely, a rally through $79,500 and then $84,000 would lend credence to a relief rebound, potentially drawing momentum into the broader market. The current configuration remains tricky for bulls, with the macro backdrop and ongoing competition among risk assets keeping upside attempts cautious.

BTC/USDT daily chart. Source: TradingView

BTC/USDT daily chart. Source: TradingView

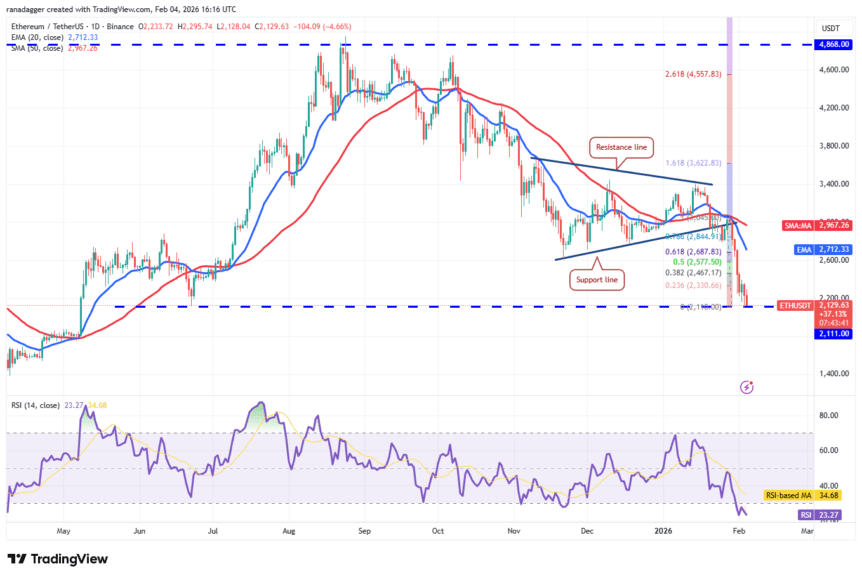

Ether (ETH) entered Tuesday defending a critical level near $2,111, but the bounce remained shallow, signaling a lack of aggressive buying support from bulls. If selling pressure resumes and the price breaks below the $2,111 mark, the ETH/USDT pair could slide toward $1,750. The RSI’s oversold condition hints at a potential short-term relief rally, yet confirmation is needed through a move above the 38.2% Fibonacci retracement at around $2,467 and the 20-day exponential moving average near $2,712. A daily close above the 20-day EMA would be a constructive sign for bulls, indicating a shift in near-term momentum.

ETH/USDT daily chart. Source: TradingView

ETH/USDT daily chart. Source: TradingView

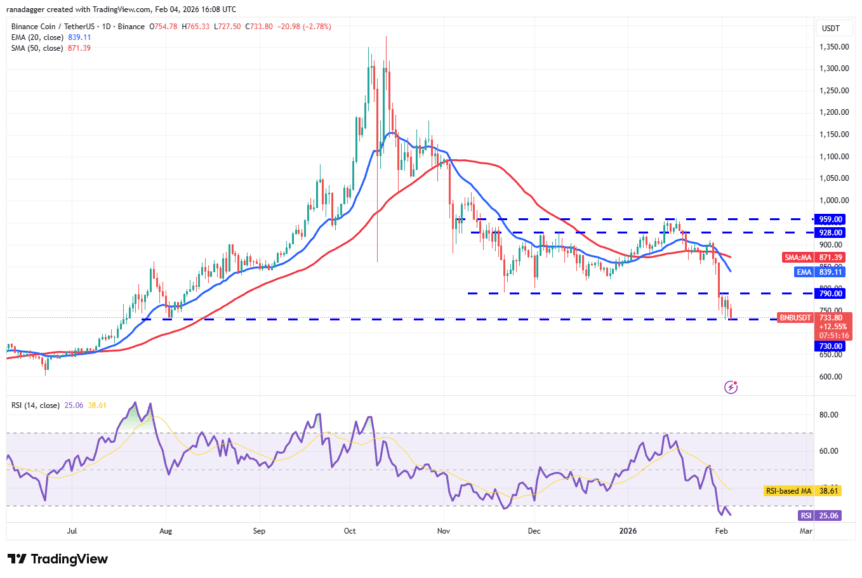

BNB (BNB) continues to trade below the $790 level, keeping the risk of a sharper dip intact should bears reclaim momentum. A close below $730 would mark a shift in control, potentially driving the pair toward $700 and then to the $645 area. Bulls, meanwhile, will need to sustain a move above the $790 resistance and push toward the 20-day EMA around $839 to reassert control over the immediate path. The clock is ticking for the buyers, with the market closely watching for a sustained rebound that could anchor a broader recovery in the altcoin complex.

BNB/USDT daily chart. Source: TradingView

BNB/USDT daily chart. Source: TradingView

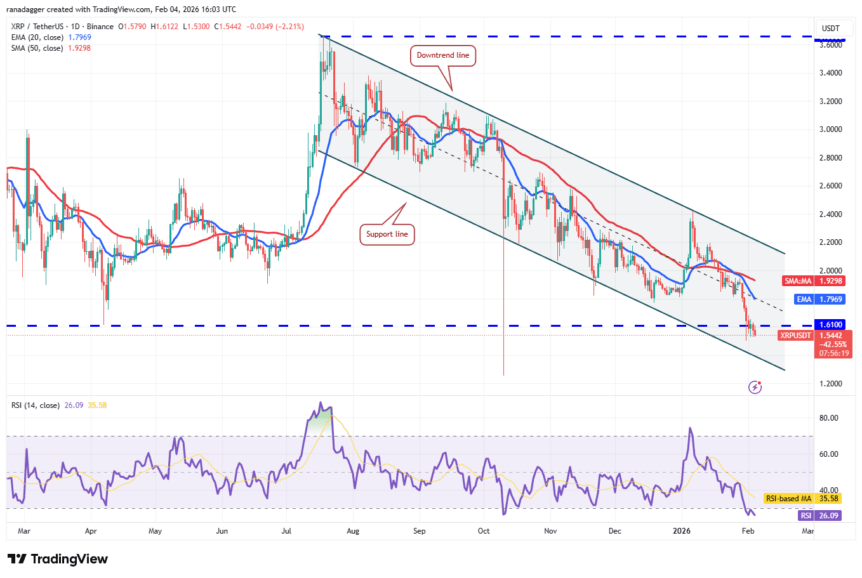

XRP (XRP) has struggled to sustain a break above the $1.61 threshold, a sign that bears are actively selling on relief rallies. A downside break from the descending channel could bring the token back toward the $1.25 region. To preserve a more constructive count, bulls would need to push above the moving averages and, ideally, above the downtrend line to keep the channel intact and hint at a longer-lasting shift in trend.

XRP/USDT daily chart. Source: TradingView

XRP/USDT daily chart. Source: TradingView

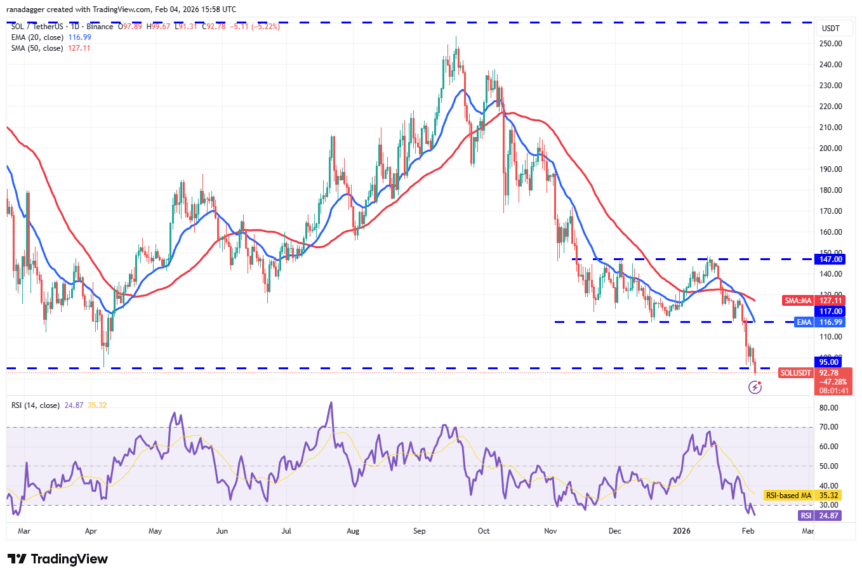

Solana (SOL) has faced renewed selling pressure after failing to clear the $107 resistance. A close below $95 would likely mark the continuation of the downtrend toward the next major support around $79, with the potential for further weakness if bears dominate the short-term action. A breakout above $107 could reframe the near-term outlook, steering the pair toward the 20-day EMA near $117, where selling pressure may re-emerge as bears attempt to reassert control.

SOL/USDT daily chart. Source: TradingView

SOL/USDT daily chart. Source: TradingView

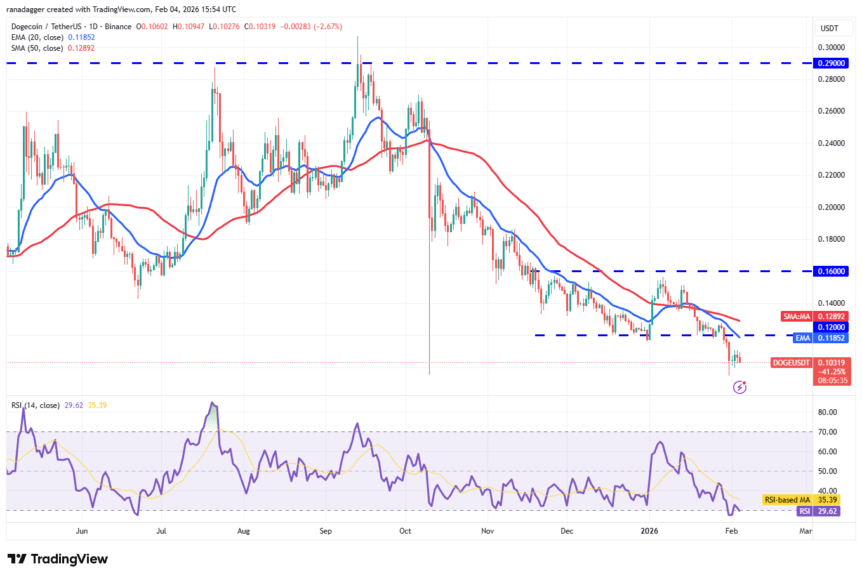

Dogecoin (DOGE) is attempting a relief move, but the bounce has been shallow, implying ongoing pressure from sellers. A relapse below the $0.10 level could drag DOGE down toward $0.08, while a move above the 20-day EMA around $0.12 could open a path toward $0.16 if buyers gain traction. The market’s reaction to the current level will help determine whether DOGE is merely testing a bear wall or laying the groundwork for a more sustained reversal.

DOGE/USDT daily chart. Source: TradingView

DOGE/USDT daily chart. Source: TradingView

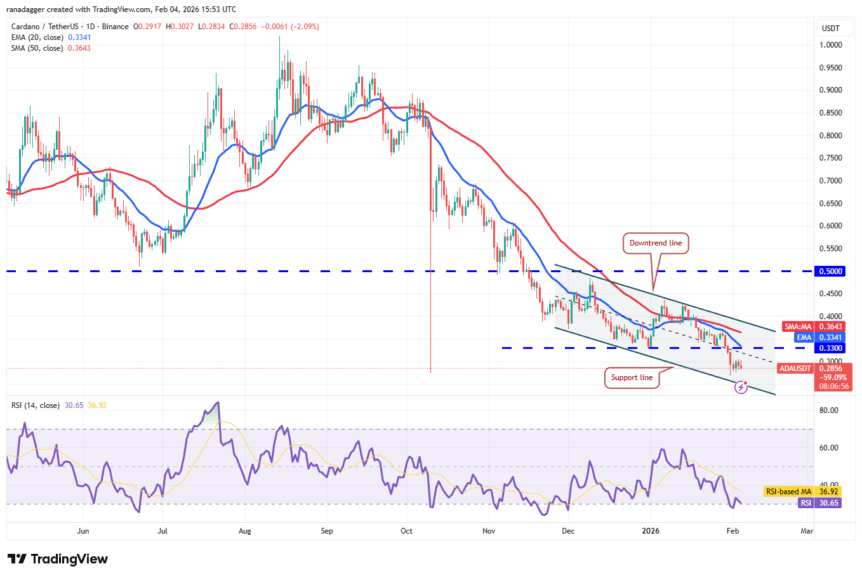

Cardano (ADA) is trying to bounce off the descending channel’s support, but the relief rally lacks strength. A turn down from the current level or the 20-day EMA near $0.33 would signal that the bears retain the upper hand and could push ADA toward the next major support around $0.20. Conversely, a decisive move above the 20-day EMA would keep ADA within the channel and could set up a test of the downtrend line, with a potential rally toward the $0.50 area if buyers reclaim control.

ADA/USDT daily chart. Source: TradingView

ADA/USDT daily chart. Source: TradingView

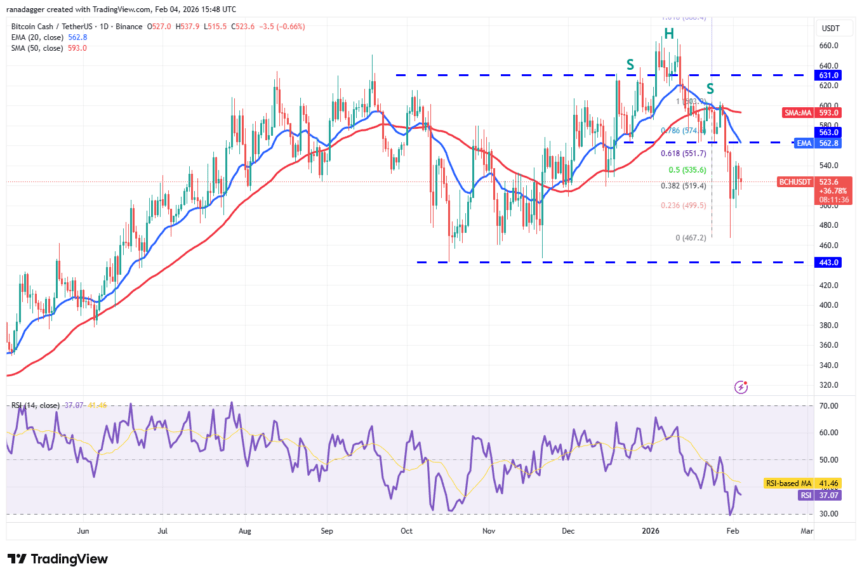

Bitcoin Cash (BCH) has mounted a stubborn resistance near the 50% retracement around $535, keeping the path to higher levels contested. If bears push BCH below $497, the downside could accelerate toward $467 and then $443. Conversely, a sustained move above $544 could draw buyers toward the 20-day EMA around $562, with a test of the $604 level possible if momentum shifts decisively in favor of bulls.

BCH/USDT daily chart. Source: TradingView

BCH/USDT daily chart. Source: TradingView

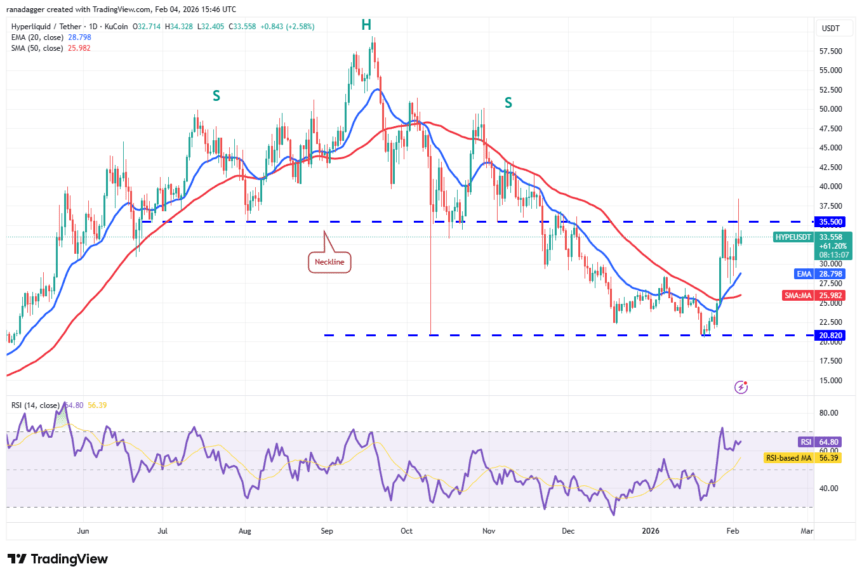

Hyperliquid (HYPE) breached the $35.50 resistance on Tuesday, but a long wick on the candlestick suggests selling at higher levels remains a headwind. If buyers partner with the current setup, a break above $35.50 could push HYPE toward $44, hinting that the corrective phase may be ending. However, a swift move below the 20-day EMA near $28.79 could keep the pair oscillating between $35.50 and $20.82 for an extended period.

HYPE/USDT daily chart. Source: TradingView

HYPE/USDT daily chart. Source: TradingView

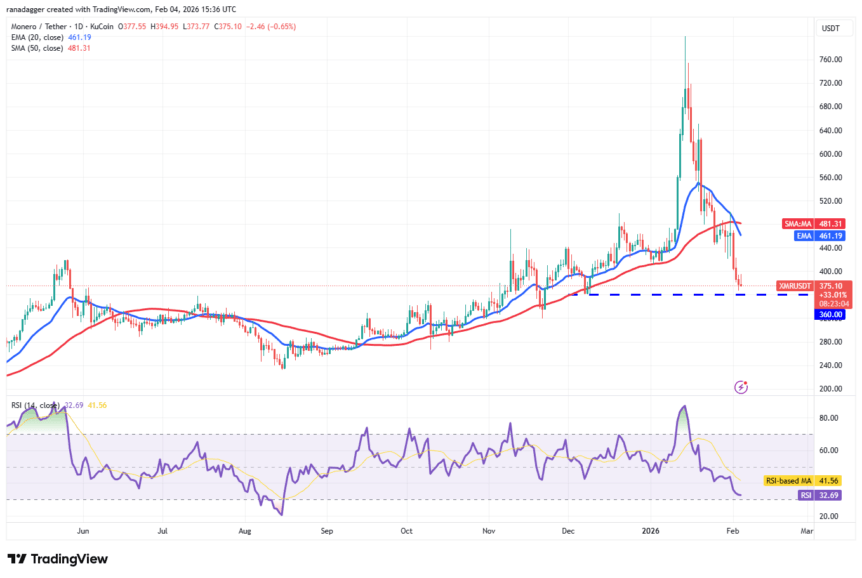

Monero (XMR) is attempting to establish a footing around the $360 level, but relief rallies remain vulnerable to selling at $412 and the 20-day EMA near $461. A move lower would place the next support near $360, while a sustained push above the 20-day EMA could invite a test toward $500, where selling pressure historically intensifies. After sharp declines, price action tends to consolidate before the next directional move, making near-term forecasts highly contingent on how the price behaves around the moving averages.

XMR/USDT daily chart. Source: TradingView

XMR/USDT daily chart. Source: TradingView

Overall, the market landscape remains delicate as traders reassess risk in a period of liquidity constraints and cautious positioning. The key near-term takeaway is that major assets are defending critical levels, but without a clear impulse from buyers, any break below established supports could accelerate the downside and redraw the scope of continued consolidation across the top ranks of the market.

Why it matters

For traders, the confluence of key supports and oversold conditions creates a fragile balance between retracements and renewed downside pressure. The tests of $74,508 and $72,169 for BTC, alongside Ethereum’s $2,111 floor, provide a battleground where micro-entries and risk controls will determine whether a relief rally gains momentum or if selling pressure resumes with renewed force. In this environment, altcoins trading near critical support zones are particularly vulnerable to quick shifts in sentiment, underscoring the importance of disciplined risk management and defined exit strategies.

From a broader market perspective, the situation underscores how macro dynamics and on-chain signals interact with technical thresholds. While some observers expect a rebound as oversold conditions unwind, others warn that the absence of catalysts could keep assets tethered to negative drift until fresh bullish narratives emerge. The tug-of-war between these viewpoints highlights the evolving complexity of crypto markets where liquidity, volatility, and sentiment can swing rapidly in response to both technical patterns and macro cues.

For developers and infrastructure teams building on-chain services, these conditions stress-test risk controls, liquidity provisioning, and the resilience of cross-chain flows. Elevated volatility can impact funding rates, borrow costs, and the timing of protocol upgrades, making robust risk assessment essential for participants across the ecosystem.

What to watch next

- BTC price action around $72,945 and $74,508: a decisive move below or above these levels will set the near-term trajectory.

- ETH at $2,111: a break below could target $1,750; a close above $2,467 and the 20-day EMA near $2,712 would signal bullish re-engagement.

- Relief rally triggers: a sustained move above $79,500 and toward $84,000 would be a meaningful bullish cue for BTC and correlated assets.

- Altcoin next supports: any breach of critical supports for SOL, XRP, ADA, BCH, and XMR could accelerate downside swings or alter the near-term trend.

- Market liquidity and risk tone: keep an eye on macro developments and any shifts in risk sentiment that could influence funding rates and asset correlations.

Sources & verification

- Galaxy Digital note stating BTC could fall to its realized price near $56,000 in coming weeks.

- Bitwise CIO Matt Hougan’s post on X discussing a potential sooner-than-expected market rebound.

- Price levels: BTC below $72,169 and near $74,508 as critical support/resistance points; RSI in oversold territory.

- ETH support at $2,111 and possible targets at $1,750, $2,467, and $2,712 based on chart analysis.

- Channel and moving-average references used to discuss XRP, SOL, DOGE, ADA, BCH, XMR scenarios.

What the story means for readers

The current setup reinforces the importance of monitoring key support zones and momentum indicators in a market that remains sensitive to macro cues and risk appetite. While a relief rally is plausible if price action turns constructive, investors should remain cautious and rely on robust risk controls as the market tests multiple moving averages and defensive levels. For builders and participants in the ecosystem, this environment emphasizes the value of resilient liquidity management and the need to prepare for a range of outcomes, from shallow bounces to deeper corrections, as assets navigate the interplay between chart-based signals and fundamental drivers.

Market context

In a climate where risk assets exhibit episodic volatility, the crypto market continues to move in step with broader liquidity conditions and investor sentiment. Downside pressure at critical levels often precedes cautious bounces, while oversold readings can precede short-lived relief rallies. The balance between technical levels and macro cues will continue to shape price action in the near term, with traders watching for confirmatory moves that could change the current narrative from consolidation to a renewed phase of directional movement.

Why this matters to traders, builders, and investors

For traders, the next few days will test the strength of risk-off sentiment against the potential for a short-covering rally. For builders and users of crypto services, stability around key prices matters for funding rates, liquidity provisioning, and the reliability of on-chain operations during periods of volatility. Investors should differentiate between short-term swings and long-term fundamentals, avoiding over-interpretation of any single move while prioritizing risk controls and diversification in a market that has shown resilience but remains prone to abrupt shifts in direction.

This article was originally published as Bitcoin Dips to 2026 Low as Altcoins Crumble: Is BTC at $56K Next? on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For