Bitcoin Price Plunges Toward $60,000 as $1 Billion in Liquidations Hit in 24 Hours

Bitcoin Magazine

Bitcoin Price Plunges Toward $60,000 as $1 Billion in Liquidations Hit in 24 Hours

Bitcoin price is experiencing one of the most dramatic selloffs in its history Thursday, sliding sharply through key support levels and sparking massive liquidations in the derivatives market.

According to Bitcoin Magazine Pro data, the world’s largest cryptocurrency crashed through critical floors, dipping towards the $62,000 floor, marking the largest raw dollar drawdown ever recorded for BTC.

The October 2025 all-time high above $126,000 now sits roughly $63,000 above current bitcoin price levels, as panicked selling intensified across exchanges.

This drawdown is now 50% from all-time highs and places it alongside some of Bitcoin’s most extreme historical corrections, even greater than the selling that took place around the FTX crash.

Bitcoin price’s sustained downtrend has erased nearly half of its peak value, while broader risk assets have weakened amid global market stress and shifting macro sentiment.

Over $1.1 billion of forced liquidations in the last day

The severity of the move was amplified by leveraged derivatives.

As the bitcoin price collapses, forced liquidations are surging, with over $1 billion in positions wiped out over the past 24 hours, predominantly long bets facing automatic close-outs as BTC broke key levels, according to Coinglass data.

Traders who entered positions on recent strength were hit as support near $70,000 failed to hold earlier today, feeding a feedback loop of deleveraging that pushed price deeper into the $60,000 range.

Bitcoin price support zones

BTC’s breakdown comes after an initial retracement from levels above $90,000 just eight days ago. Bitcoin price is now down nearly 35% over the past 12 months and about 50% below its October peak, according to Bitcoin Magazine Pro data.

Thursday’s plunge also saw the asset breach multiple support zones, with volatility spiking as BTC’s structure shifted decisively bearish. Indicators suggest there are limited stops before the sub-$60,000s.

Crypto-linked stocks were hammered Thursday as Bitcoin’s sharp selloff spilled into equity markets. Shares of major miners such as Riot Platforms and MARA Holdings plunged in double-digit declines as bitcoin.

Crypto-exposed firms like Coinbase and Robinhood also fell into the double digits.The broader market downturn added pressure, with tech and other high-beta assets selling off alongside digital assets.

The iShares Bitcoin Trust (IBIT), a spot Bitcoin ETF managed by BlackRock that lets investors gain exposure to Bitcoin without holding the crypto directly, just crushed its daily volume record with about $10 billion worth of shares traded — even as its price plunged 13%, marking the second‑worst one‑day drop since the fund’s launch.

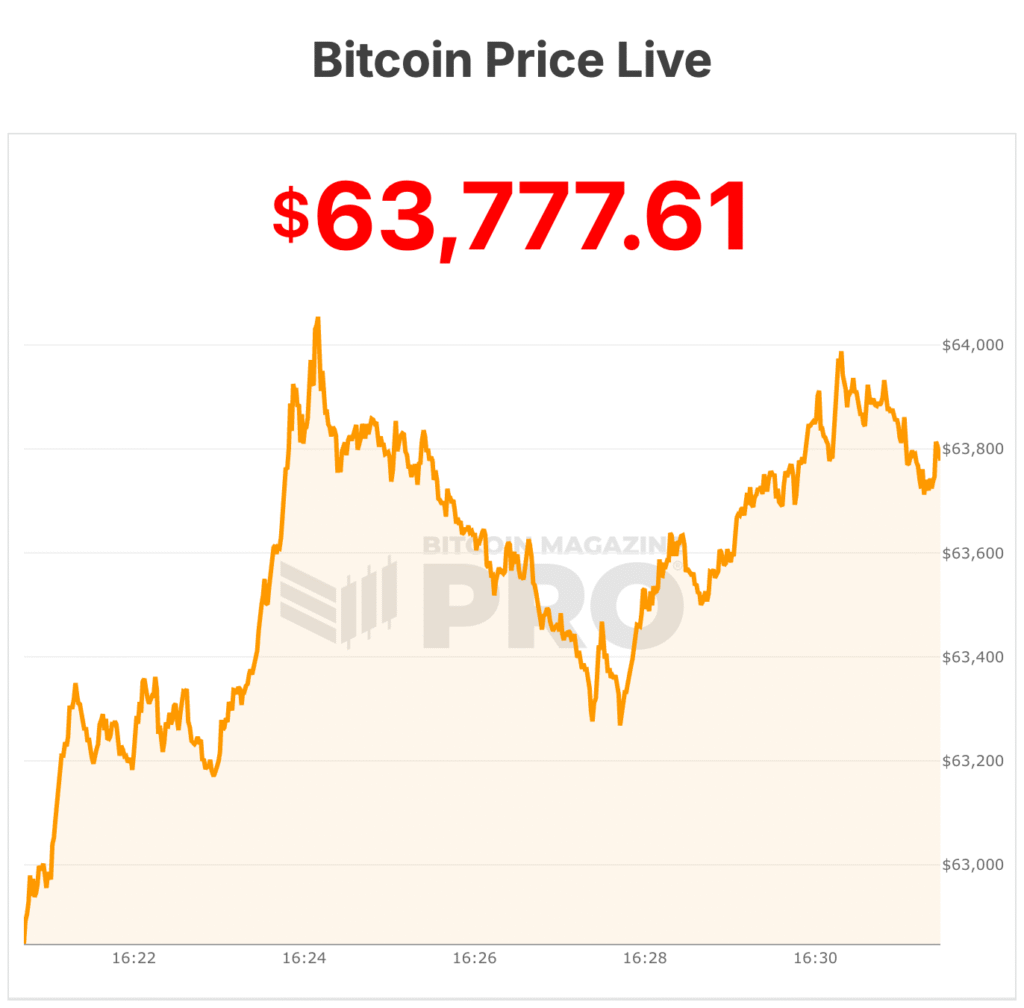

Shares of Strategy ($MSTR) are down over 15% today, with earnings coming later tonight. At the time of writing, bitcoin is trading right below $64,000.

This post Bitcoin Price Plunges Toward $60,000 as $1 Billion in Liquidations Hit in 24 Hours first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Silver Price Crash Is Over “For Real This Time,” Analyst Predicts a Surge Back Above $90