Ethereum Price Closes Sub-$2,000 Support As Crypto Rout Intensifies

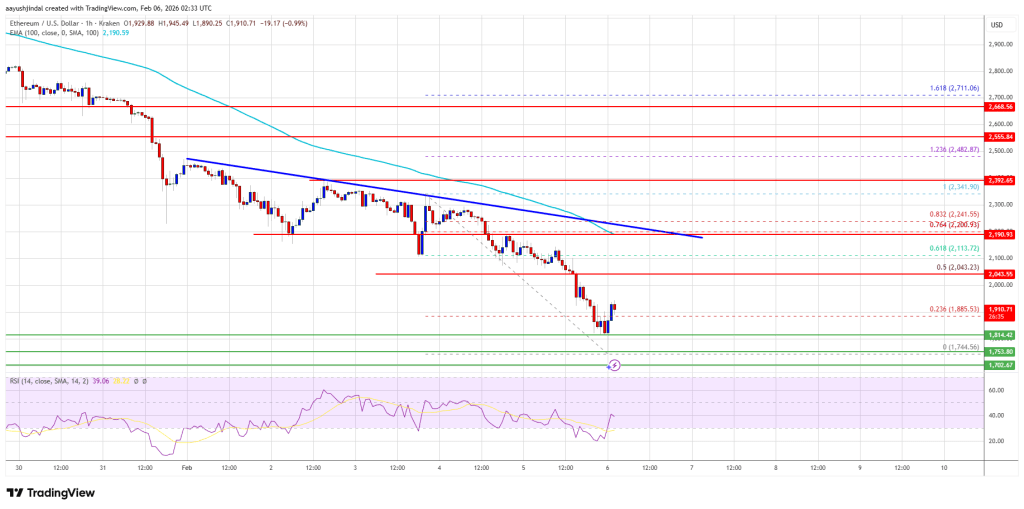

Ethereum price extended its decline below $2,000 and $1,950. ETH is now attempting to recover from $1,750 but faces many hurdles near $2,200.

- Ethereum failed to stay above $2,000 and started a fresh decline.

- The price is trading below $2,000 and the 100-hourly Simple Moving Average.

- There is a major bearish trend line forming with resistance at $2,200 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh decline if it stays below the $2,200 zone.

Ethereum Price Dips Over 15%

Ethereum price failed to remain stable above $2,200 and extended losses, like Bitcoin. ETH price traded below $2,000 to enter a bearish zone.

The bears even pushed the price below $1,880. A low was formed at $1,744 and the price is now attempting to recover. There was a move above $1,850. The price surpassed the 23.6% Fib retracement level of the downward move from the $2,341 swing high to the $1,744 low.

Ethereum price is now trading below $2,000 and the 100-hourly Simple Moving Average. If the bulls remain in action above $1,800, the price could attempt another increase. Immediate resistance is seen near the $1,950 level. The first key resistance is near the $2,050 level and the 50% Fib retracement level of the downward move from the $2,341 swing high to the $1,744 low.

The next major resistance is near the $2,200 level. There is also a major bearish trend line forming with resistance at $2,200 on the hourly chart of ETH/USD. A clear move above the $2,200 resistance might send the price toward the $2,350 resistance. An upside break above the $2,350 region might call for more gains in the coming days. In the stated case, Ether could rise toward the $2,550 resistance zone or even $2,665 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $2,050 resistance, it could start a fresh decline. Initial support on the downside is near the $1,850 level. The first major support sits near the $1,800 zone.

A clear move below the $1,800 support might push the price toward the $1,750 support. Any more losses might send the price toward the $1,720 region. The main support could be $1,680.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,850

Major Resistance Level – $2,200

You May Also Like

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility

Bubblemaps: The top five traders in STBL token trading volume are interconnected and have made profits exceeding $10 million