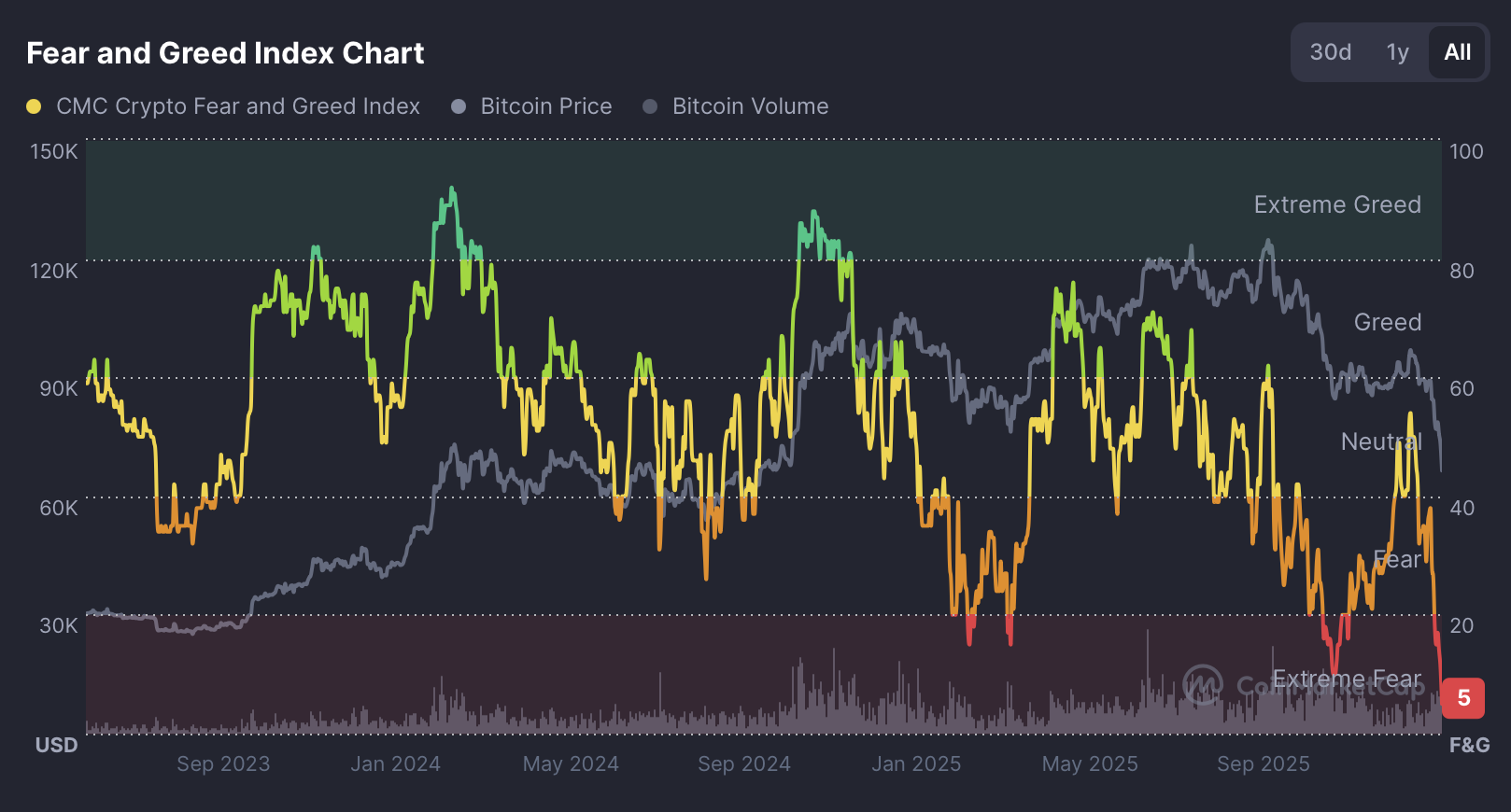

Crypto Fear and Greed Index Hits 5 as Market Enters Extreme Risk-Off Phase

As the broader crypto market retraced, the Fear and Greed Index collapsed to 5, pushing decisively into extreme fear territory and marking its lowest reading since the Luna collapse.

That shift coincides with a clear deterioration in market breadth. Total crypto market capitalization now sits at $2.28 trillion, down 5.2%, while the CMC20 index has fallen to $136.56, reflecting a 6.18% drawdown across large-cap assets. This isn’t isolated weakness, it’s systemic risk aversion.

Short-Term Market Behavior: Fear Takes Control

Sentiment data shows the market moving from caution into outright defensive positioning. A Fear and Greed reading of 5historically aligns with forced deleveraging phases rather than orderly pullbacks. At the same time, the Altcoin Season Index at 23/100 confirms that capital is clustering toward Bitcoin relative to alternative assets, reinforcing a risk-off posture.

Momentum indicators support this view. The Average Crypto RSI at 34.89 places the market firmly in oversold territory, suggesting selling pressure has been persistent and broad-based rather than driven by a single catalyst. Importantly, this oversold condition reflects exhaustion, not confirmation of a reversal.

Momentum indicators support this view. The Average Crypto RSI at 34.89 places the market firmly in oversold territory, suggesting selling pressure has been persistent and broad-based rather than driven by a single catalyst. Importantly, this oversold condition reflects exhaustion, not confirmation of a reversal.

Structural Context: Capitulation Signals Without Confirmation

What makes this reading notable is its rarity. Extreme fear levels this low tend to appear during stress events rather than routine corrections. However, sentiment alone does not define a bottom. Oversold conditions can persist if liquidity continues to thin and confidence fails to stabilize.

From a structural perspective, the alignment of collapsing sentiment, weak breadth, and oversold momentum suggests the market is reacting defensively rather than positioning opportunistically. The absence of any visible recovery signal in sentiment implies participants are still prioritizing capital preservation.

Scenarios and Risk Framing

Stabilization scenario:

If total market capitalization can hold near $2.28 trillion and sentiment stops deteriorating further, the current extreme fear reading may begin functioning as a contrarian signal. That would require acceptance above current levels and a gradual improvement in breadth indicators.

Continuation risk:

A sustained break below current market capitalization levels would reinforce the risk-off regime. Further deterioration in sentiment from already extreme readings would imply ongoing liquidation pressure rather than panic exhaustion.

Professional Takeaway

Current conditions reflect capitulation risk, not confirmed recovery. Extreme fear at this depth signals stress, but without stabilization in market structure or breadth, it remains a warning rather than an opportunity. For now, the market is signaling defense, and any shift toward recovery will require confirmation through acceptance, not sentiment alone.

The post Crypto Fear and Greed Index Hits 5 as Market Enters Extreme Risk-Off Phase appeared first on ETHNews.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

Silver Price Crash Is Over “For Real This Time,” Analyst Predicts a Surge Back Above $90