Top 3 cryptocurrencies to watch post US CPI data release

- Bitcoin rebounds above $119,000, reflecting strong sentiment after a moderate increase in US inflation.

- Ethereum breaks above $4,400, reinforcing the bid for a new record high.

- Solana eyes $200 breakout backed by a Golden Cross pattern and an uptrending RSI.

The cryptocurrency market is back in the green on Tuesday following a volatility-driven correction on Monday as investors anticipated the release of the United States (US) Consumer Price Index (CPI) data.

Bitcoin (BTC) price is back above $120,000 and showing signs of a potential breakout past the $122,335 weekly high as Ethereum (ETH) breaks above $4,400, aiming for a fresh all-time high beyond the $4,878 level reached in November 2021.

Solana (SOL), on the other hand, is attempting a breakout toward $200 backed by a robust technical structure.

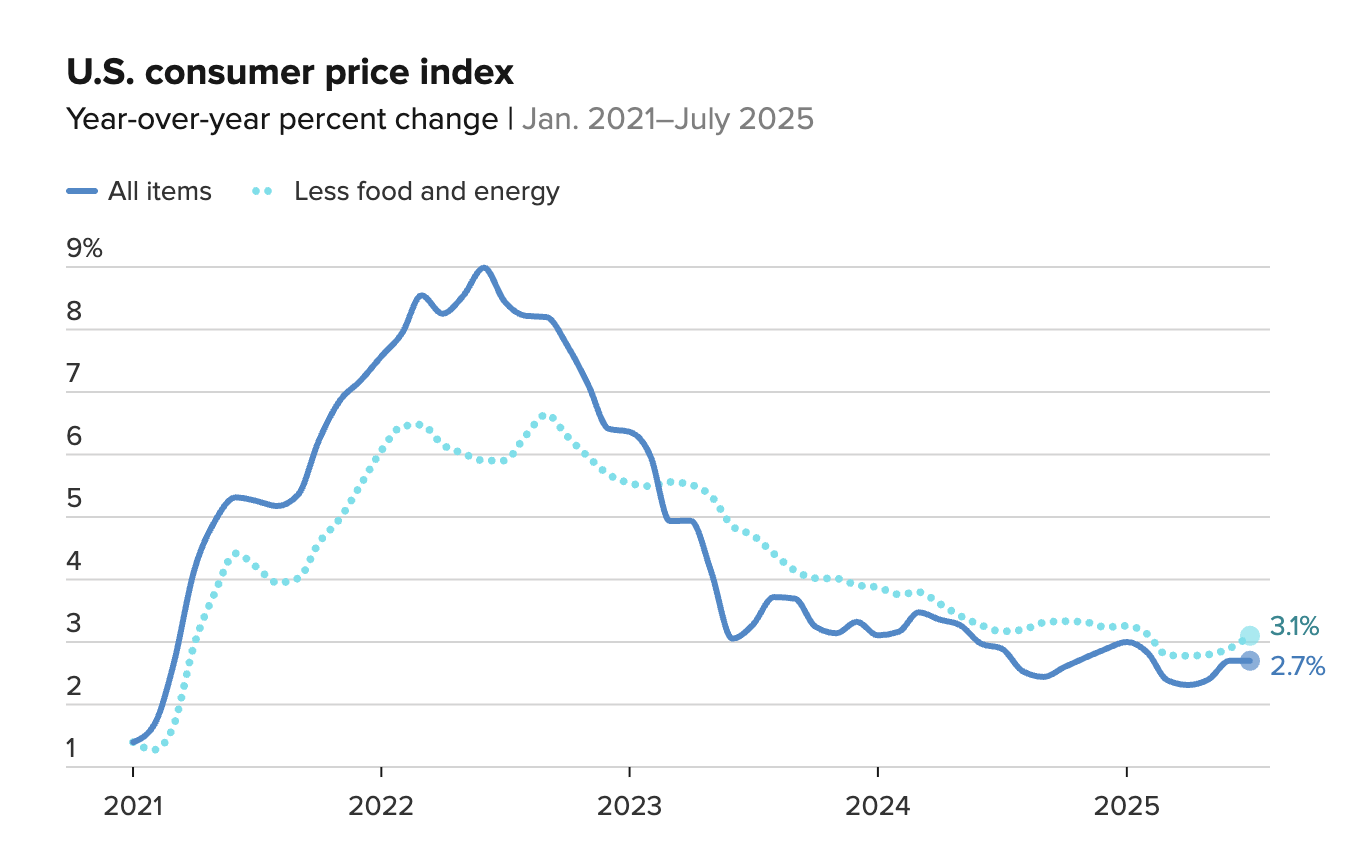

Market overview: US inflation increases moderately in July

The Bureau of Labor Statistics (BLS) Consumer Price Index (CPI) data released on Tuesday showed a moderate 0.2% increase in July and 2.7% on a 12-month basis compared to market expectations of 0.2% and 2.8%, respectively.

The core CPI, which excludes food and energy, increased 0.3% in July and 3.1% annually compared to the market forecast of 0.3% and 3%, respectively. Federal Reserve (Fed) officials focus on core inflation to gauge long-term trends.

US CPI data | Source: LBS

Higher tariffs in the US have been a major concern for market participants and the Fed. President Donald Trump’s reciprocal tariffs took effect earlier this month, with the central bank expected to monitor their impact on consumer goods and services.

President Trump insists Fed Chair Jerome Powell should cut interest rates, while the central bank broadly cites the need to monitor incoming data as the reason for the delay.

Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management, told CNBC that “Inflation is on the rise, but it didn’t increase as much as some people feared. In the short term, markets will likely embrace these numbers because they should allow the Fed to focus on labor-market weakness and keep a September rate cut on the table.”

Bitcoin, Ethereum, and Solana gain post-US CPI data release

Bitcoin bulls are regaining strength after the CPI data release, indicating strong sentiment in the broader cryptocurrency market. A break above its weekly high of $122,335 is anticipated, backed by a buy signal from the Moving Average Convergence Divergence (MACD) indicator on the 8-hour chart.

Traders will likely increase exposure if the blue MACD line holds above the red signal line. Interest in BTC could increase if the price makes a daily close above the $120,000 level. Other key levels of interest to traders include the record high of $123,218 reached on July 14 and the next milestone at $125,000.

BTC/USDT 8-hour chart

As for Ethereum, its renewed uptrend is approaching the $4,500 level, up over 6% on the day. The largest smart contracts token has the backing of both retail and institutional demand, evidenced by the spot Exchange-Traded Funds (ETFs) in the US recording slightly above $1 billion in inflows on Monday.

Ethereum targets its all-time high of $4,878 reached in November 2021 and a subsequent breakout above the $5,000 milestone. The uptrend in the price of ETH is supported by the MACD indicator buy signal, encouraging traders to maintain or increase their exposure.

ETH/USDT daily chart

On the other hand, XRP shows signs of extending recovery above $3.21 following a 2% increase on the day. The cross-border money remittance token declined retest support at $3.10 after facing rejection under the $3.40 resistance on Friday.

XRP/USDT daily chart

Ripple and the US Securities and Exchange Commission (SEC) filed a joint motion to dismiss appeals last week, effectively ending the five-year lawsuit. This signals renewed interest in XRP, but the uptrend faltered amid low sentiment in the broader market ahead of the US inflation data. If sentiment steadies, XRP could extend recovery toward the record high of $3.66 reached on July 18.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

You May Also Like

This Ethereum Competitor Is the ‘Most Commercially Viable Blockchain’ for Global Markets and Payments, According to Pantera Capital

Willy Woo Warns Liquidity Breakdown Could Cap Bitcoin’s Rally Despite Short-Term Relief