‘Nothing Left to Use’ — Monero Reorg and Samourai Takedown Spark Privacy Doomsday Talk

Amid the storm over the Qubic/Monero clash, some warn that privacy’s slow fade is picking up speed — first with the fall of Tornado Cash, then the loss of Samourai Wallet, and now, Monero’s latest setback.

The Great Privacy Purge

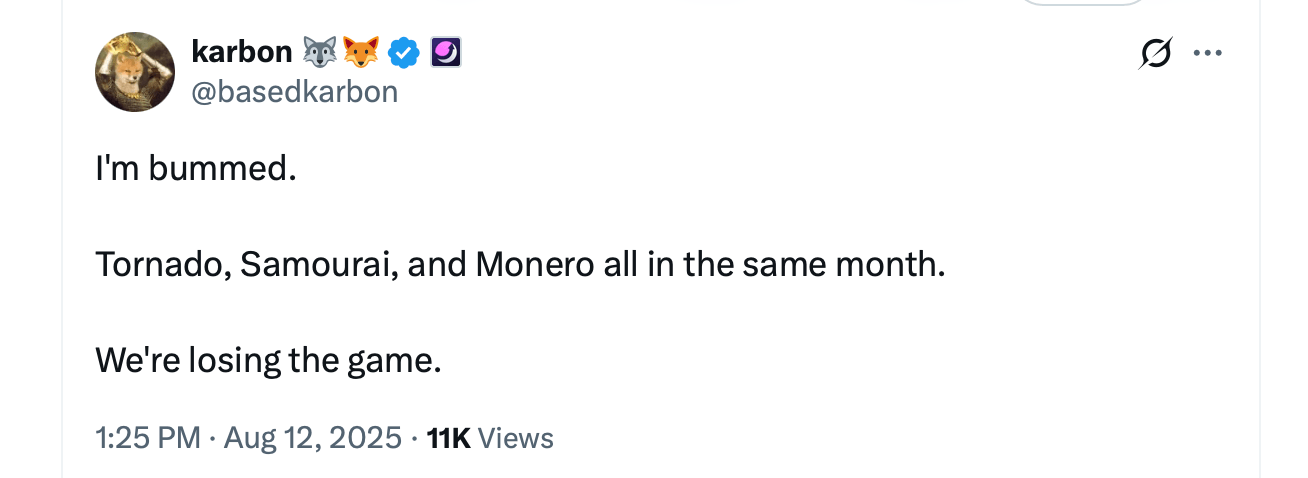

On social media, X user Karbon told their 86,900 followers that recent blows to Monero and other projects have gutted crypto privacy. “Tornado cash – gone, Samourai – gone, Monero – in the middle of a 51% attack,” Karbon wrote. “There’s nothing left to use if you want privacy. Great job team. Yay number go up.”

Karbon was pointing to a string of recent hits to crypto privacy: Tornado Cash was sanctioned and effectively blacklisted, Samourai Wallet was hit with legal action and lost its infrastructure, and now Monero is facing a pool that managed to reorganize several blocks. Privacy coins have endured years of exchange delistings, and privacy-focused crypto projects now appear so heavily suppressed that using them has become increasingly difficult.

Karbon’s X post drew nearly 200,000 views and sparked a flood of reactions. “Everyone being more worried about Fartcoin price action than a Monero 51% attack pretty much sums up the state crypto,” Zack Voell wrote. One user asked Karbon whether the Monero 51% attack was simply about mining, noting that those carrying it out might have a vested interest in keeping the network running as it is.

“Do you feel safe using it rn, knowing they just had a reorg and can censor txs?” Karbon asked the person. “What’s the max amount you’d risk moving around under those conditions?” Others agreed that the erosion of privacy has only deepened with each passing year. “Blockchain will end up supercharging the surveillance state and cash will be the only way to preserve privacy—The irony,” another person replied on the thread.

The discussion highlights a growing divide between those focused on asset prices and the bull market, and those alarmed by the shrinking space for privacy in crypto. As a great deal of people celebrate today’s crypto gains, others warn that without accessible, censorship-resistant tools, the industry risks undermining one of its core promises: empowering individuals to transact without constant oversight or control.

The broader concern is whether crypto’s future will favor convenience and compliance over the principles that once defined it. If privacy becomes an afterthought, the technology’s transformative potential could narrow to little more than a speculative asset class, leaving its original vision sidelined in favor of a system far closer to traditional finance than its pioneers imagined.

You May Also Like

This Ethereum Competitor Is the ‘Most Commercially Viable Blockchain’ for Global Markets and Payments, According to Pantera Capital

Willy Woo Warns Liquidity Breakdown Could Cap Bitcoin’s Rally Despite Short-Term Relief