How did edgeX, a derivatives DEX that hasn't even issued a token, achieve revenue exceeding Uniswap?

Most people know that the most profitable business in the cryptocurrency world is contracts.

But can you imagine that a low-profile, dark horse DEX, operating for only a year, surpassed leading public chains like Ethereum and Base in 24-hour revenue? Extending that to a seven-day period, it crushes established DeFi players like Uniswap, Jupiter, AAVE, and Lido. Not only is it one of the few projects in the top 15 daily revenue rankings that hasn't issued a token, it also offers the deepest liquidity for buying BTC and ETH within a 0.01% spread.

This new "monster" of the revenue curve is called edgeX.

Why is the revenue curve so fierce?

Unlike the well-known Hyperliquid, edgeX is a perp dex built on the ZK architecture. Incubated by Amber, its core team includes veterans from Goldman Sachs, Jump Trading, and other institutions with extensive experience in high-frequency trading. In terms of product form, edgeX is more like a "full-stack on-chain financial center": in addition to the perp dex, it also offers two other product lines: eStrategy (treasury) and edgeX Chain.

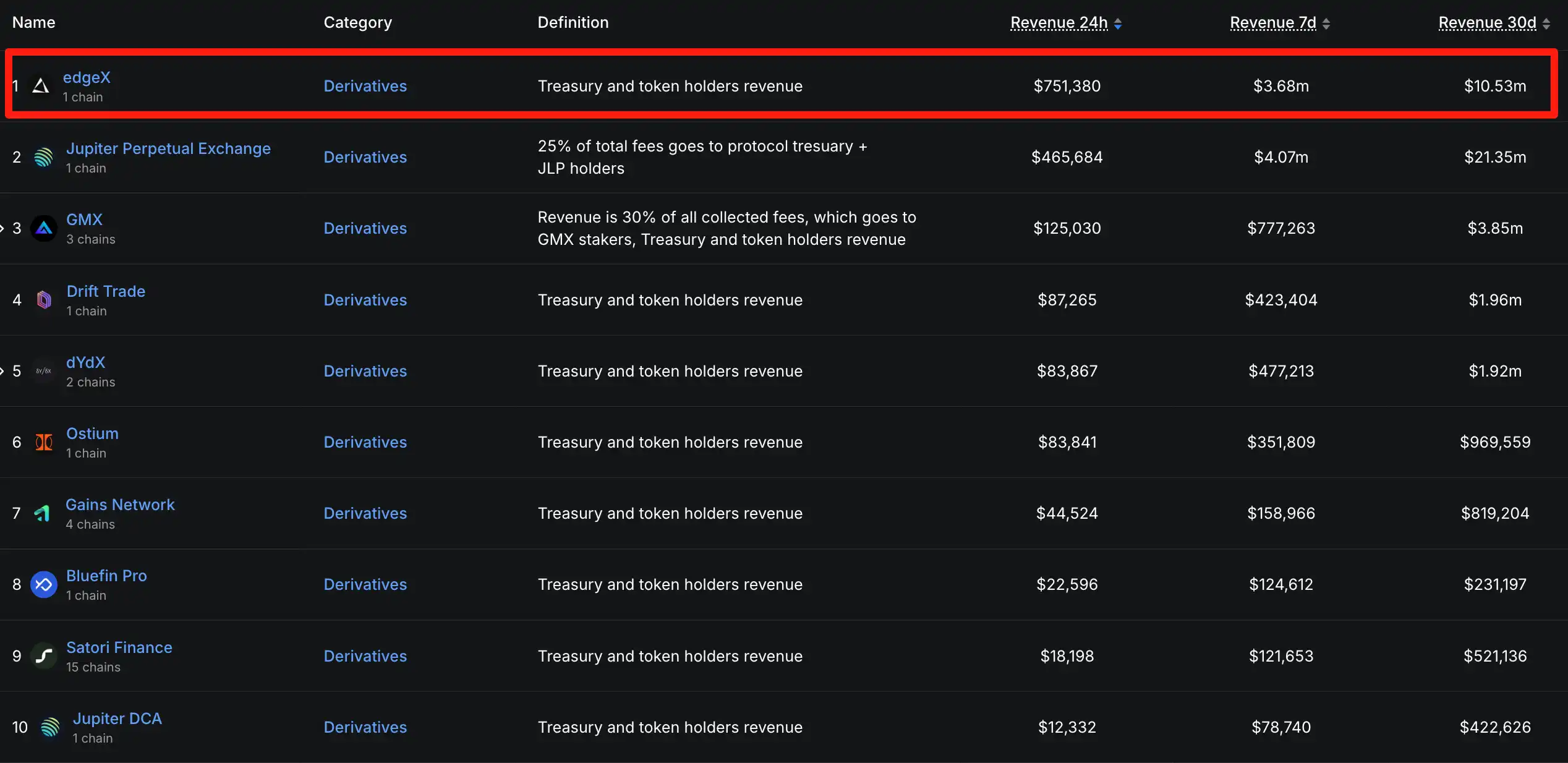

As mentioned at the beginning of the article, the quality of a product is directly reflected in its revenue, so comparing the revenue within the perp dex track can more directly show the ferocity of edgeX.

As a perp dex operating for only a year, edgeX has generated $10.53 million in fees over the past 30 days, far exceeding the $3.85 million earned by established players like GMX and dYdX, which earned $1.92 million. This means that edgeX's revenue is nearly double that of GMX and over five times that of dYdX.

Data source: DefiLlama

So, how did edgeX break into the top tier of perp dex through its revenue curve? The answer may lie in transaction depth and fees, the two most important and intuitive data for traders.

In terms of liquidity depth, edgeX currently ranks second among all Perp DEXs. Taking the core BTC/USDT pair as an example, within a 0.01% spread, edgeX's order book supports up to $6M in BTC orders, surpassing Hyperliquid ($5M), Aster ($4M), and Lighter ($1M). While still slightly behind Hyperliquid in overall depth, edgeX boasts the deepest Perp DEX outside of Hyperliquid for most currencies. For further details on this topic, see edgeX's Head of Research, Dan, in his latest article, "Understanding DEX Liquidity: A Comparative Look at Trading Efficiency," which provides a more in-depth discussion. I won't elaborate on this here.

EdgeX also offers highly competitive fees for both Makers and Takers: Makers at just 0.015% and Takers at 0.038%, significantly lower than Hyperliquid's 0.045%. Furthermore, users who register through an Ambassador referral link can unlock VIP1 status, further reducing the Taker fee to 0.036%. Becoming an Ambassador also allows users to receive up to 35% commission rebates on transaction fees, saving on transaction costs while continuing to accumulate airdrop points.

With such trading depth and fee advantages, edgeX has naturally formed a competitive advantage, driving revenue growth. Even without a token issuance, edgeX demonstrates its ability to sustain token buybacks and contribute to ecosystem development.

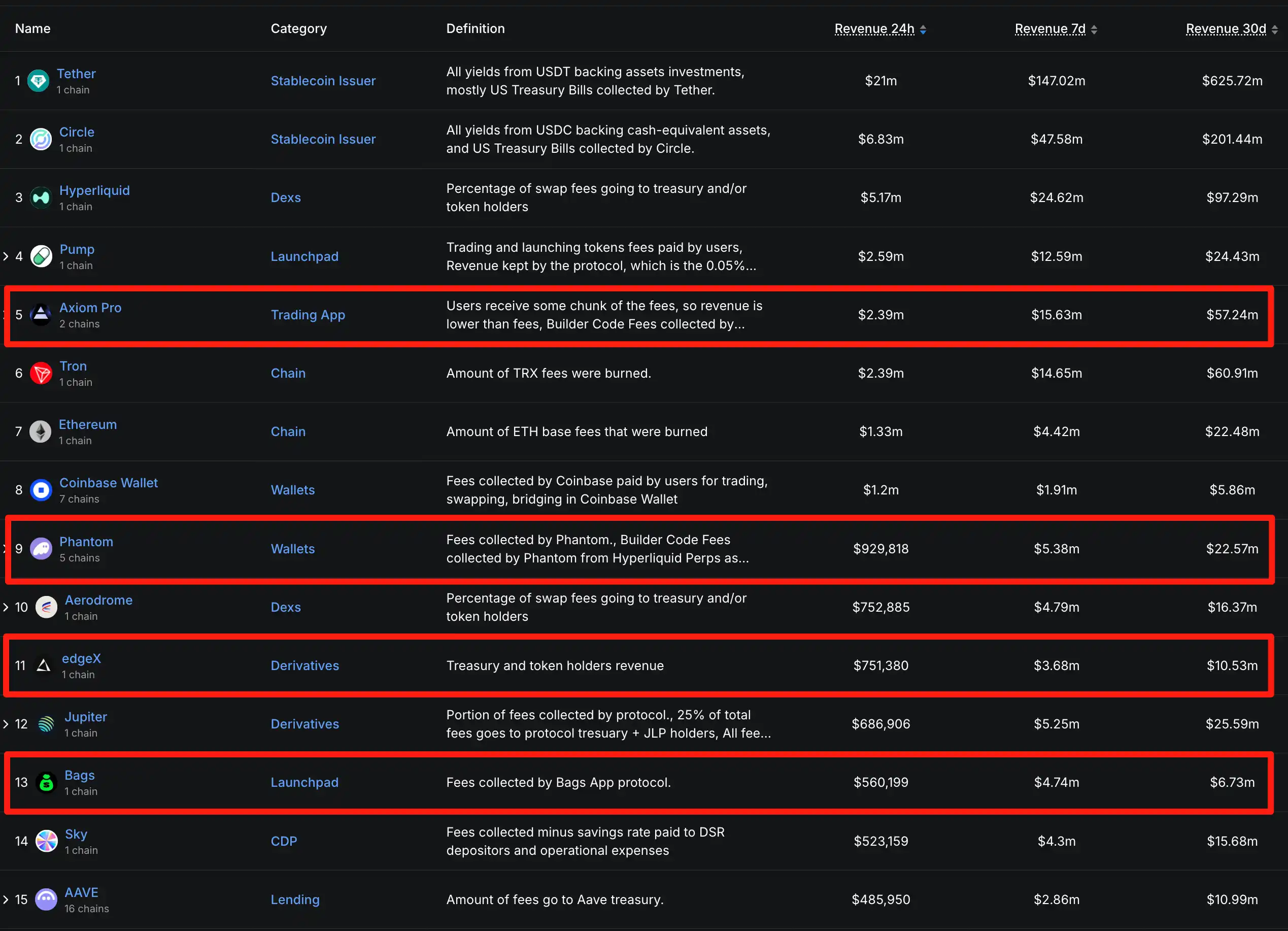

What’s even more intriguing is that, when we look at the revenue rankings of the entire network, among the top 15 protocols (excluding the two stablecoin issuers, USDT and USDC), there are only four that have made it to the top but have yet to issue a coin, and edgeX is one of them.

Data source: DefiLlama

Many friends in the Chinese-speaking world may not have heard of this dark horse, because this perp dex rarely does so-called narrative packaging, and its community audience is more in the Korean and North American communities.

In other words, this is an obviously scarce Alpha with high income, low valuation, and still in the token window period.

Currently, edgeX uses edgeX Points as a contribution measurement and distributes them weekly. 2.4M have been distributed so far. The ways to obtain them include trading volume, holdings, vault participation and invitations, etc. At the same time, edgeX's Messenger Ambassador Program is underway.

Transaction volume can be inflated, but profit revenue is hard to fake. Whether in traditional finance or the web3 industry, only the actual user willingness to pay is the most direct verification of product sustainability.

In less than a year, edgeX has achieved a top-15 industry-leading cash flow. This is a highly predictable growth trajectory, and perhaps also a highly predictable alpha. We can't wait to see what FDV it will launch with in the next phase, and what rewards it will offer to early adopters.

You May Also Like

X encrypted promotions face FCA, DSA limits

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!