XRP Panic Sell-Off Backfires: Whales Bought the Dip in Record Size

The last few days have been some of the roughest the crypto market has seen in months.

Bitcoin, Ethereum, and XRP all suffered brutal drawdowns, with major assets shedding around 15% of their value in a single day as panic swept across exchanges. The sell-off triggered widespread liquidations, extreme fear, and a wave of traders rushing for the exits.

But XRP is now doing something that’s catching the market off guard.

According to a new report shared by Santiment, XRP’s sharp drop below key psychological levels may have been the exact moment whales were waiting for.

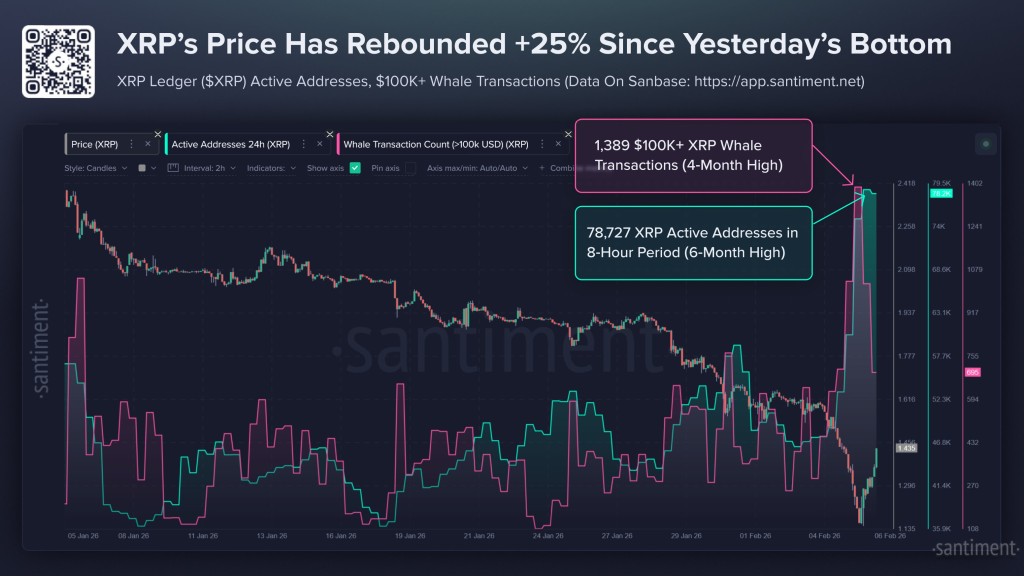

Instead of collapsing further, XRP has staged a massive rebound as it climbed roughly 25% from yesterday’s bottom, one of the strongest recoveries among large-cap cryptocurrencies.

And the on-chain data suggests this move was not random.

Santiment: XRP Just Rebounded 25% From the Lows

Santiment highlighted that the XRP price bottomed out below $1.15 less than a day ago, during peak market panic.

At the time, sentiment around XRP was breaking down rapidly, with traders openly questioning whether the coin could fall below $1.00.

But within just 18 hours, XRP surged back above $1.50, marking a sharp reversal that forced many panic sellers to watch the price bounce without them.

Santiment described XRP’s rebound as “a particularly huge tear,” pointing out that this recovery stands out even in a broader market rebound.

The key takeaway is simple:

The sell-off may have been driven by fear… but whales were treating it as an opportunity.

Whale Accumulation Spiked to a 4-Month High

One of the most important signals in Santiment’s chart is the sudden explosion in whale activity.

Source: X/@santimentfeed

Source: X/@santimentfeed

During the dip, the XRP Ledger recorded:

1,389 separate transactions worth $100,000 or more

That is the highest whale transaction count in four months, and it occurred precisely when retail traders were selling in panic.

This is the classic footprint of smart-money positioning.

Large holders tend to accumulate during moments of maximum fear, when liquidity is abundant and weaker hands are exiting.

Santiment’s data strongly suggests that the XRP dip was also aggressive accumulation happening underneath the surface.

XRP Active Addresses Suddenly Hit a 6-Month Record

Even more striking than whale transfers was the explosion in network activity.

Santiment reported that unique active addresses on the XRP Ledger ballooned to:

78,727 active addresses in a single 8-hour candle

That marks the highest activity spike in six months.

In the chart, this appears as a sharp vertical surge, signaling that participation on the network accelerated dramatically during the sell-off.

This kind of address growth usually reflects one of two things:

- Massive speculative interest during a volatility event

- Large-scale accumulation and repositioning as traders rotate back in

Either way, the data confirms that XRP’s dip was heavily traded and heavily watched.

Read also: XRP Has 300+ Bank Partners… So Why Is Billion-Dollar Volume Still Missing?

Panic Selling vs Smart Money Behavior

Santiment’s commentary makes the market dynamic clear.

Retail traders were focused on fear:

- “Is XRP going below $1?”

- “Is the crash getting worse?”

- “Should I exit before the next leg down?”

Meanwhile, whales were doing the opposite.

The highest whale activity in months occurred during the exact window when panic was peaking.

That contrast is what makes this rebound so notable.

Historically, strong reversals often begin when:

- Retail capitulates

- On-chain activity spikes

- Large holders step in aggressively

- Price rebounds sharply off the lows

XRP may have just checked every box.

What This Could Signal Going Forward

Santiment emphasized that both whale accumulation and active address surges are “major signals of a price reversal for any asset.”

That doesn’t guarantee XRP moves straight up from here, but it does suggest the market may have reached an important inflection point.

After one of the harshest multi-day drawdowns in recent memory, XRP’s bounce is now being backed by on-chain confirmation, not just price action.

If whale demand continues and broader market conditions stabilize, XRP could be entering a new recovery phase faster than many expected.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post XRP Panic Sell-Off Backfires: Whales Bought the Dip in Record Size appeared first on CaptainAltcoin.

You May Also Like

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident

CME pushes Solana, XRP into derivatives spotlight with new options