Bitcoin’s Q4 History Suggests Strong Finish for 2025

Bitcoin’s historical monthly and quarterly returns show a clear pattern of strength toward the end of the year, suggesting that the final months of 2025 could deliver significant gains if past trends hold.

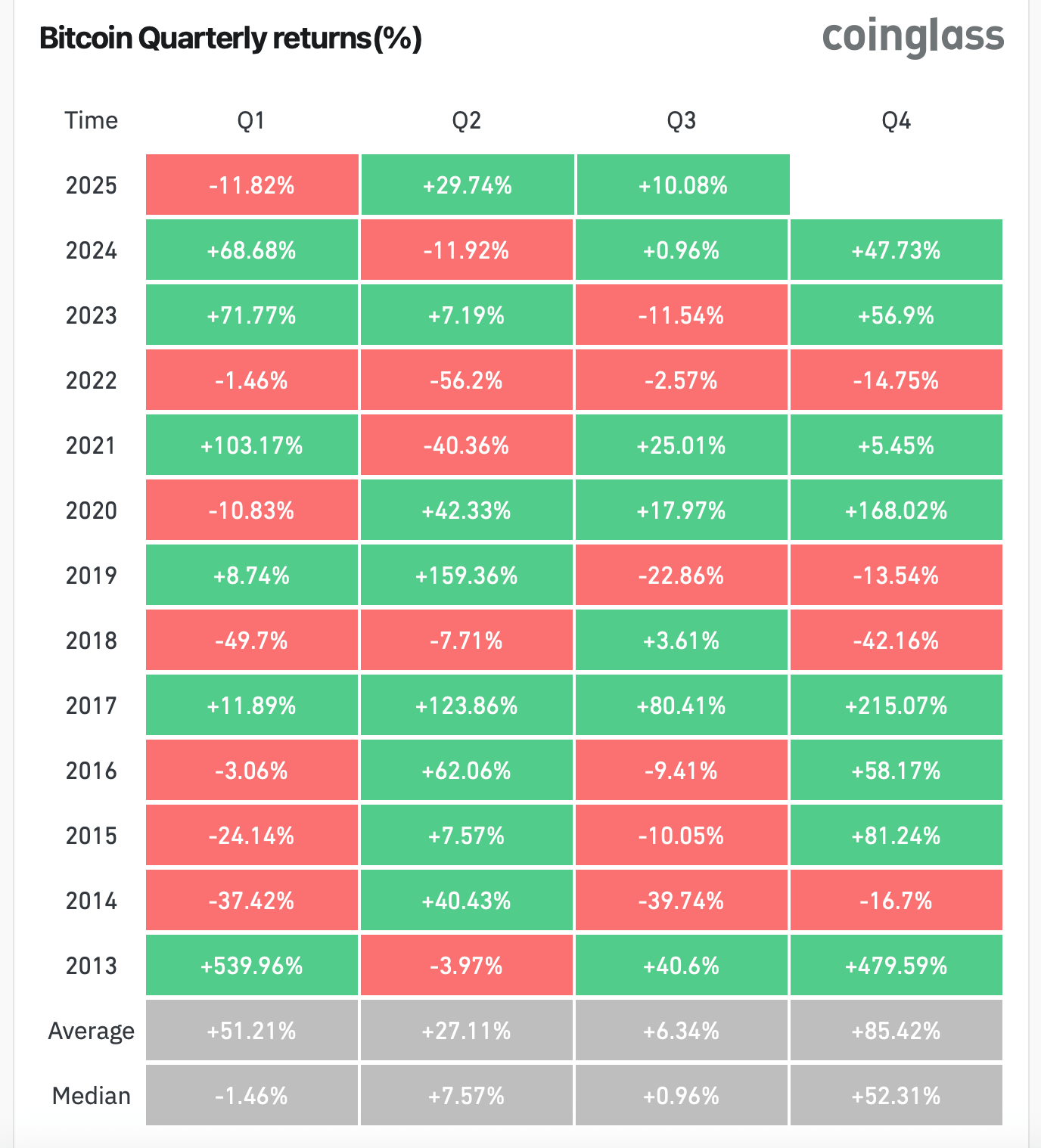

Historical Bitcoin Returns Highlight Seasonal Strength in Q4

So far in 2025, bitcoin ( BTC) has seen mixed performance. January brought a 9.29% gain, followed by a steep 17.39% decline in February. March slid 2.3%, but April’s 14.08% rise and May’s 10.99% rebound helped balance the quarter. June added 2.49%, while July gained 8.13%, according to coinglass.com stats. August, still in progress as of Aug. 17, is up 1.83%, leaving room for further movement before the month’s end.

Source: Coinglass.com

Source: Coinglass.com

Looking at Q3 2025, bitcoin is currently positive by over 10%, with July and August both green and September still to come. Historically, Q3 has been volatile, with losses in six of the last 12 years, but the median return is slightly positive at 0.96%. If September follows its long-term pattern, where half of the past 12 years were negative, bitcoin could close Q3 with modest gains.

Typically though, especially during bull runs, the spotlight is on Q4. Data shows bitcoin has finished the fourth quarter in the green in 8 of the past 12 years, with standout years such as 2017 (+215%), 2020 (+168%), and 2013 (+479%). Even in more muted years, Q4 returns often exceeded earlier quarters. On average, Q4 posts an 85% return, with a median of 52.31%.

Monthly trends also support a strong finish. November and December are historically two of bitcoin’s best months, averaging returns of 46% and 4.7% respectively. November in particular has produced positive gains in 10 of the last 12 years, including sharp rallies in 2020 and 2021.

While past performance is not predictive, the data suggests that bitcoin’s current consolidation may pave the way for a stronger Q4. With August and September still open, the third quarter remains undecided, but history tilts toward the final months carrying bitcoin higher.

You May Also Like

MAGA insiders suddenly embrace 'indispensable' energy they long derided as a 'parasite'

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings