Bitcoin could see increased profit-taking ahead of Powell's speech at Jackson Hole

- Bitcoin could see more profit-taking amid uncertainty ahead of Fed Chair Powell's speech at Jackson Hole.

- QCP analysts highlight that the sustained weakness in Bitcoin's implied volatility reflects reduced expectations for a breakout.

- The prediction comes as Strategy acquired 430 BTC for $51.4 million, marking a second consecutive week of low purchases from the firm.

Bitcoin (BTC) declined 1% on Monday as QCP analysts predicted continued profit-taking following uncertainty surrounding the Federal Reserve (Fed) Chair Jerome Powell's upcoming speech at the annual Jackson Hole Economic Symposium.

Bitcoin investors could continue profit-taking as Fed's annual conference draws closer

Bitcoin could see increased profit-taking as traders await Fed Chair Powell's speech at the annual Jackson Hole Economic Symposium, QCP analysts said in a Monday note to investors.

The conference, widely viewed as the year's most important policy gathering, often sets the tone for the Fed's interest rate decisions.

QCP analysts stated that the stronger-than-expected Producer Price Index (PPI) data released on Thursday has "complicated the Fed's policy framework." They added that market participants are watching for "hints" about the central bank's possible stance ahead of its September meeting.

Bitcoin's current pullback is also attributed to traders "de-risking" in anticipation of the Fed's decision. With markets still unsure of the event's outcome, QCP analysts predict more profit-taking activity over the next few days.

"With spot still in the middle of the range, we could potentially see more profit‑taking at these levels before the event," QCP analysts wrote in a note.

BTC declined 1% on Monday, retracing towards $116,000 despite hitting an all-time high last week. QCP noted that the decline was no surprise, as funding rates had signaled weakness ahead of the drop. Funding rates on Deribit, which stayed above 20% last week, turned negative on Saturday, despite prices attempting a weekend comeback before a slight decline.

The analysts also highlighted that persistent weakness in Bitcoin's implied volatility over the past weeks signals little expectation of a major breakout.

"Sideways trade seems likely, with dips near 112k attracting buyers and rallies toward 120k meeting supply, at least until Friday when Fed Chair Jerome Powell takes the stage," QCP added.

Despite the uncertainty surrounding Bitcoin's price, treasury companies continue to increase their holdings.

Business intelligence firm Strategy (MSTR) purchased 430 BTC for $51.4 million last week, according to a Securities & Exchange Commission (SEC) filing on Monday. The acquisition came at an average price of $119,666 per person BTC, boosting Strategy's Bitcoin holdings to 629,376 BTC. This marks Strategy's second week of reduced buying pressure.

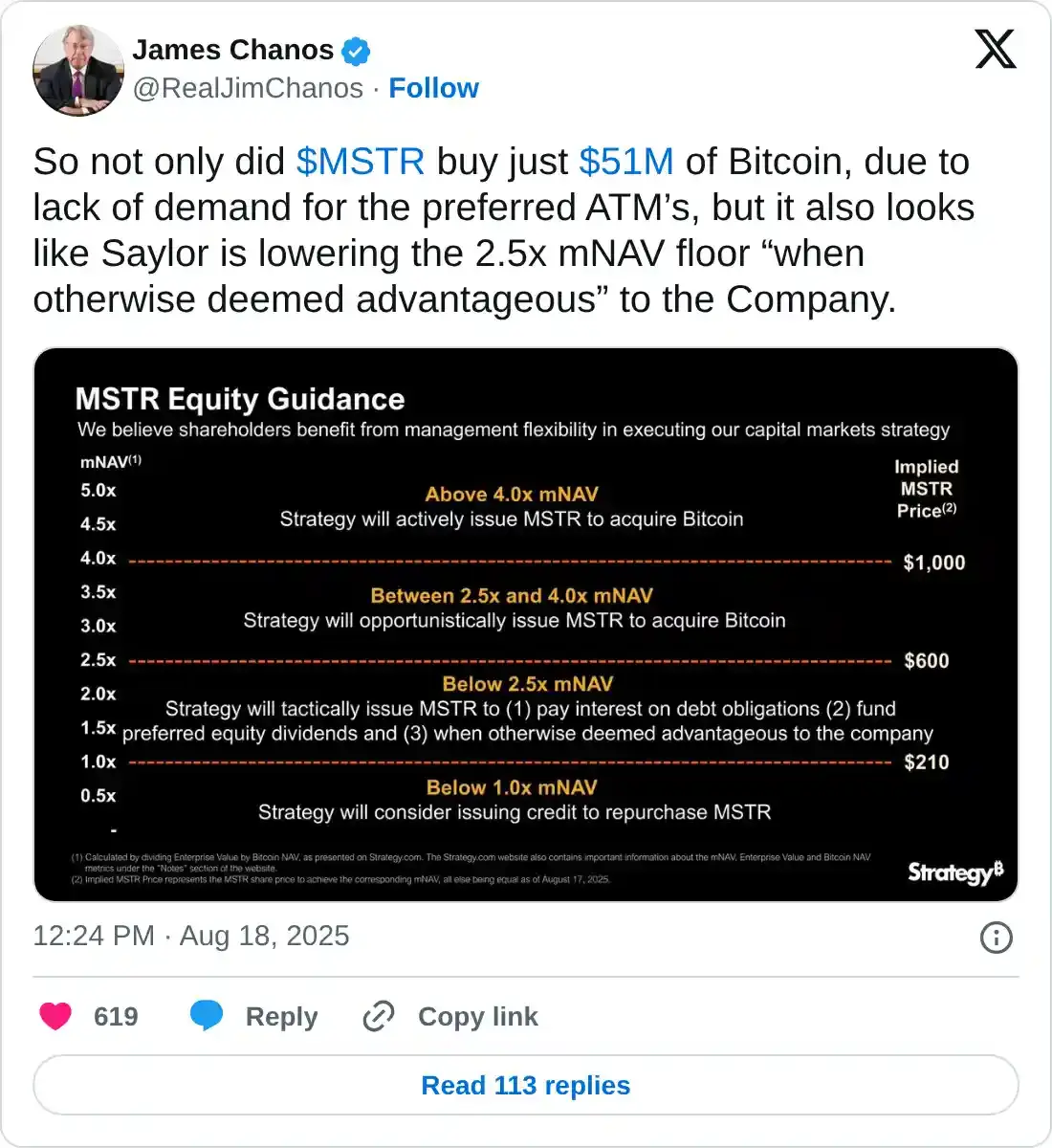

Strategy also announced changes to its MSTR Equity ATM Guidance to "provide greater flexibility in executing [its] capital markets strategy." However, short trader James Chanos criticized the company for its low purchase in an X post on Monday.

Strategy's share price closed the day at $363 on Monday, marking a 0.74% decline.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

Modernizing Legacy E-Commerce Platforms: From Oracle ATG To Cloud-Native Architectures