Bitcoin Hyper Presale Raises $10.2M as Bitcoin Reaches New ATHs

Among these Bitcoin holders, Michael Saylor’s Strategy has a considerable lead with 629,376 $BTC. Next is MARA Holdings Inc with 50,639 $BTC. Others, like US President Donald Trump’s Trump Media and Elon Musk’s Tesla, also hold their fair share.

Source: bitcointreasuries.net.

Recently, the coin has witnessed a flurry of activity, driven by interest from institutional investors and the US’ friendlier stance towards cryptocurrencies. This helped drive Bitcoin’s price towards its recent ATH of $124K.

The Problem with the Bitcoin Network

But despite Bitcoin’s status as the premier cryptocurrency, it has several drawbacks, particularly on the technical side. First, we need to talk about its speed.

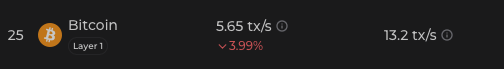

The Bitcoin blockchain can only handle an average of 5.65 transactions per second (TPS). In contrast, newer chains like Ethereum ($ETH) and Solana ($SOL) have an average TPS of 16.83 and 982.9, respectively.

Because of its relatively low TPS, Bitcoin needs anywhere between hours and days to confirm transactions. This makes it ill-suited for fast payments.

Then there’s Bitcoin’s inherently limited flexibility. Its script is simplified, which helps keep its network secure.

But this has its downside, as it prevents the Bitcoin blockchain from supporting more advanced smart contracts, dApps, DeFi protocols, and NFTs, unlike Solana or Ethereum.

Bitcoin Hyper: Bringing Bitcoin to the Modern Age

Improving Bitcoin by upgrading it for faster transactions and greater utility seems straightforward, but the truth is more complicated.

Simply put, reworking the blockchain’s foundation to make it faster and flexible would come at the cost of its security. And it’s fair to assume that no one would want this kind of trade-off.

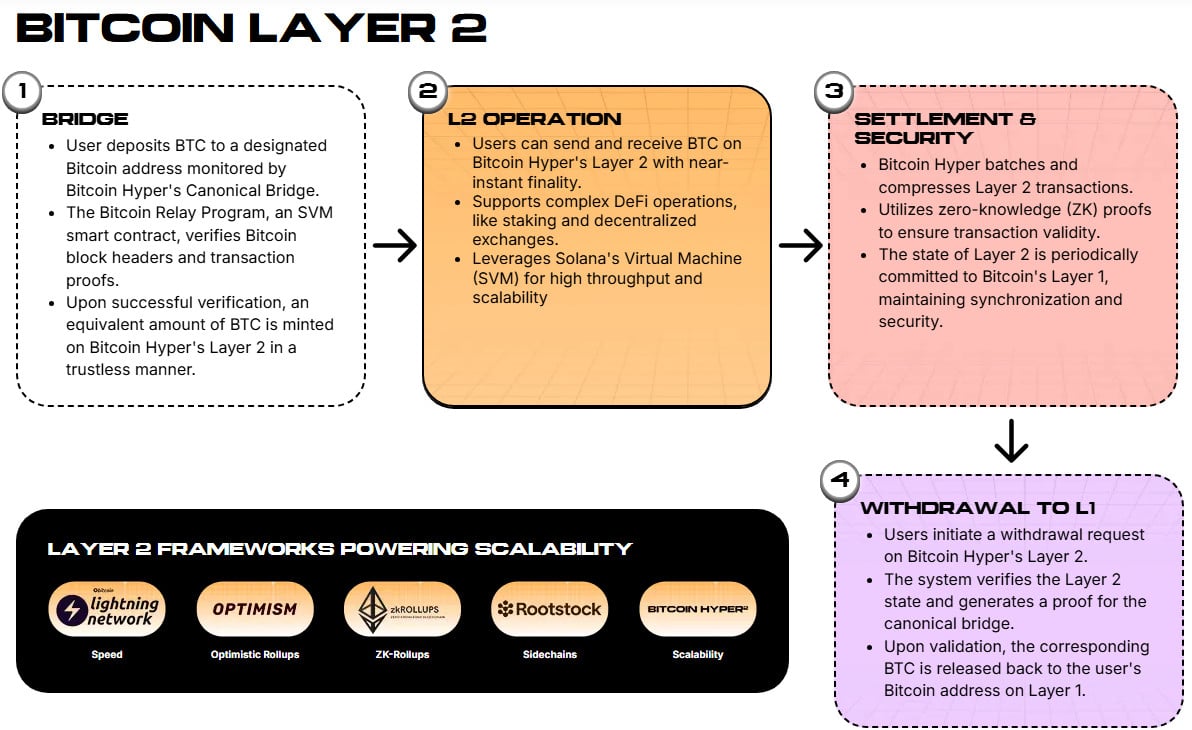

This is where Layer 2 comes in.

While there are already several Bitcoin Layer 2s in the market today, none is as promising as Bitcoin Hyper ($HYPER). This project aims to develop an L2 that leverages the Solana Virtual Machine to bring speed, low transaction costs, and flexibility to the Bitcoin ecosystem.

Here’s how it works:

- First, you deposit your $BTC to a Bitcoin address monitored by Bitcoin Hyper’s Canonical Bridge

- Then, a Solana Virtual Machine (SVM) verifies the $BTC

- Once verified, a 1:1 amount of $BTC is minted on the L2

- You’ll then be able to use this wrapped $BTC for things base Bitcoin can’t do, such as staking, trading, or interacting with dApps

- Using the SVM, the L2 will deliver Solana-level transaction speeds

- The state of the L2 is constantly synchronized to the L1 to maintain its integrity and security

- If you want to withdraw your $BTC, just make a request on the L2, after which it is sent back to your Bitcoin address on L1 after verification

Bitcoin Hyper will expand what Bitcoin is capable of, while handling transactions considerably faster and more cost-efficiently than on Bitcoin Layer 1.

Bitcoin Hyper Presale: Help Turn the Layer 2 into Reality

At the moment, the team is raising funds for the project via the Bitcoin Hyper ($HYPER) presale. When the L2 is launched, you’ll be able to use your $HYPER tokens to pay for gas fees and other transactions. Plus, holding the token will unlock exclusive features, dApps, and utilities.

More importantly, you can participate in DAO decisions and community proposals as a token holder. This is crucial if you want to help shape the future of the project.

For now, you can buy $HYPER tokens for $0.012755. To get started, simply connect your crypto wallet to the presale widget, enter the amount you want to buy, and then pay via credit/debit card or crypto. You can also check out our Bitcoin Hyper buying guide for more details.

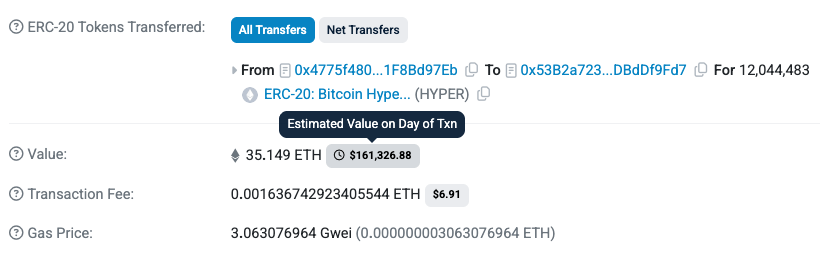

Since launching in May, Bitcoin Hyper has already raised over $10.5M and shows no signs of slowing down. Less than a week ago, a whale bought over $161K worth of $HYPER tokens in the biggest single buy to date. The second-largest purchase happened almost two weeks ago, worth more than $100K.

By all accounts, the Bitcoin Hyper project is just heating up. We can expect the excitement to grow as the presale draws to a close and the Layer 2 is finally launched.

Join the Bitcoin Hyper presale today.

Bitcoin is Here to Stay

We may have expected the likes of Ethereum and Solana, with their sheer speed and flexibility, to have left Bitcoin behind. But, despite its shortcomings, Bitcoin still leads the pack. As the most successful cryptocurrency, investors continue to bet big on its future.

Fortunately, Layer 2 projects like Bitcoin Hyper ($HYPER) could help Bitcoin catch up on the technology level. With its Solana-level speeds, low transaction costs, and expanded flexibility, Bitcoin Hyper is here to bring Bitcoin into the modern age.

You May Also Like

XRP Delivers Impressive ETF Volumes But Digitap ($TAP) is the King of Cross-Border Payments in 2026

Strive Completes Acquisition of Bitcoin Treasury Firm Semler

Wormhole token soars following tokenomics overhaul, W reserve launch

Wormhole’s native token has had a tough time since launch, debuting at $1.66 before dropping significantly despite the general crypto market’s bull cycle. Wormhole, an interoperability protocol facilitating asset transfers between blockchains, announced updated tokenomics to its native Wormhole (W) token, including a token reserve and more yield for stakers. The changes could affect the protocol’s governance, as staked Wormhole tokens allocate voting power to delegates.According to a Wednesday announcement, three main changes are coming to the Wormhole token: a W reserve funded with protocol fees and revenue, a 4% base yield for staking with higher rewards for active ecosystem participants, and a change from bulk unlocks to biweekly unlocks.“The goal of Wormhole Contributors is to significantly expand the asset transfer and messaging volume that Wormhole facilitates over the next 1-2 years,” the protocol said. According to Wormhole, more tokens will be locked as adoption takes place and revenue filters back to the company.Read more