Bitcoin News: Whales Accumulated BTC as Market Stress Deepened

Key Insights

- Bitcoin news showed whale accumulation during forced selling.

- Bitcoin news reflected ETF inflows despite weak sentiment.

- Bitcoin news signaled risk remained elevated short term.

Bitcoin news showed large holders accumulated Bitcoin during extreme market stress on Feb. 6. On-chain data confirmed aggressive buying as retail investors and miners sold into losses. The move followed a sharp drawdown that weakened confidence across spot and derivatives markets.

Bitcoin news captured a late-cycle pattern where capital rotated from weaker hands to long-term holders. The broader crypto market declined early this year as leverage unwound and liquidity thinned. That backdrop framed whale accumulation as positioning rather than confirmation of a reversal.

Bitcoin News Covering Market Reaction and Capital Flows

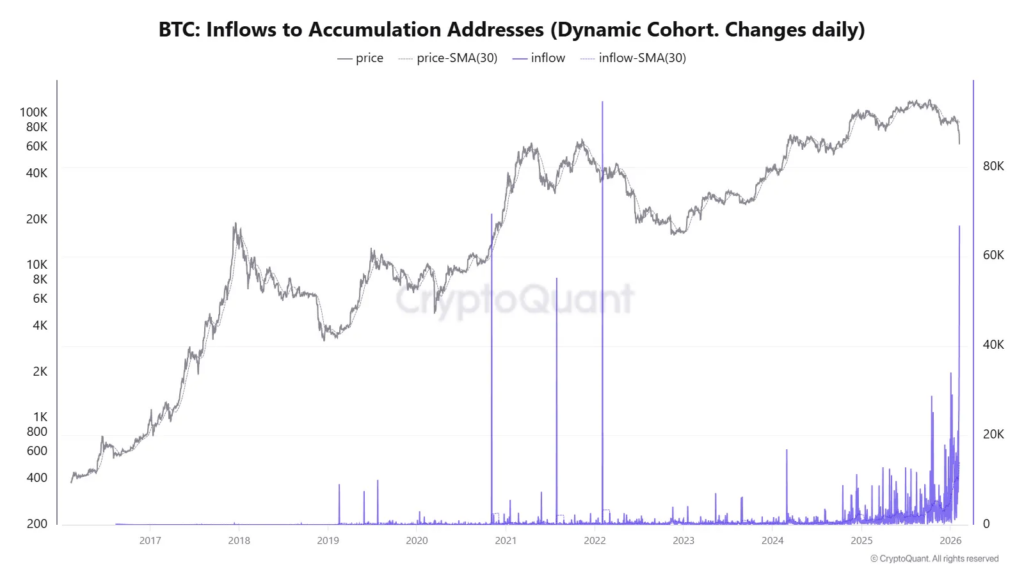

CryptoQuant data showed whales accumulated 66,940 Bitcoin into accumulation addresses on Feb. 6. That inflow marked the largest single-day movement into such wallets since 2022. This shift occurred because forced sellers dominated order books during liquidation-driven volatility.

Bitcoin Inflows to Accumulation Addresses | Source: CryptoQuant

Bitcoin Inflows to Accumulation Addresses | Source: CryptoQuant

CoinMarketCap data showed Bitcoin rebounded from $60,074 to $71,681 within 24 hours when writing. The move followed short covering after intense downside pressure earlier that session. BTC price action remained reactive rather than driven by sustained spot demand.

SoSoValue data showed that spot U.S. Bitcoin exchange-traded funds (ETFs) recorded net inflows of $371.15 million that day. BlackRock’s iShares Bitcoin Trust led activity with 231.62 million dollars. Flows into other funds suggested selective institutional risk appetite rather than broad conviction.

On-Chain and Risk Metrics

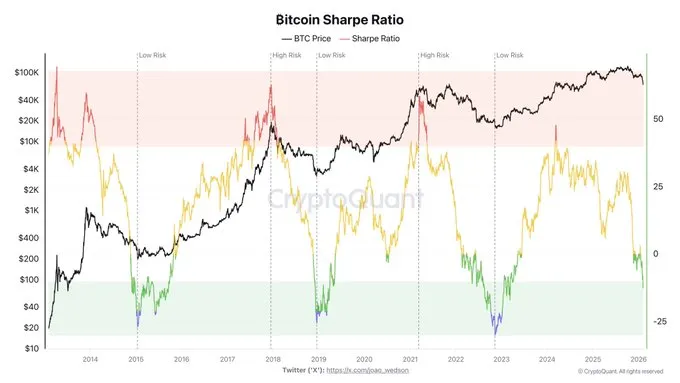

An analyst writing on X said Bitcoin’s Sharpe ratio fell to minus ten, the lowest level since March 2023. The metric measures risk-adjusted returns and typically turns negative during late-stage drawdowns. That behavior historically appeared near inflection zones rather than recoveries.

Bitcoin Sharpe Ratio| Source: CryptoQuant

Bitcoin Sharpe Ratio| Source: CryptoQuant

The analyst said the indicator suggested proximity to a potential turning area, not trend confirmation. Risk remained unattractive as the ratio continued declining despite short-term price stabilization. He warned that such conditions often persisted for months.

This behavior tended to emerge as leverage exited the system and liquidity fragmented. The analyst advised gradual exposure only after risk metrics improved sustainably. That guidance framed accumulation as tactical rather than directional.

Bitcoin News on Structural and Liquidity Signals

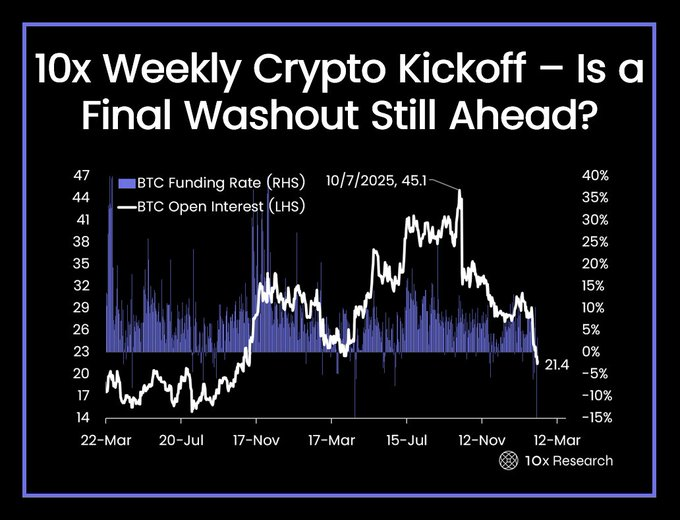

10X Research analysts wrote on X that Bitcoin price approached a key technical zone near 73,000 dollars. That level previously capped price action before the post-election rally accelerated. The BTC price move followed weakening sentiment and reduced follow-through buying.

Leverage Cools as Bitcoin Faces Washout Risk | Source: X

Leverage Cools as Bitcoin Faces Washout Risk | Source: X

The researchers said stablecoin activity reflected off-ramping rather than deployment. Circle data showed nearly ten billion dollars in USD Coin redemptions over recent weeks. That trend pointed to reduced participation from regulated capital pools.

ETF outflows earlier in the month amplified downside pressure across spot markets. Positioning data indicated that traders focused on deleveraging rather than preparing for upside. The report said no immediate catalyst justified aggressive exposure.

Miner Stress Offsets Whale Buying as Bitcoin Tests Key Levels

Network data showed miners contributed to selling pressure during the downturn. Rising operational costs and declining margins forced treasury drawdowns. That supply added stress during peak volatility.

Whale accumulation absorbed part of that excess supply during the decline. Large holders historically accumulated during miner stress events. This pattern reflected balance sheet resilience rather than optimism.

Bitcoin traded at 69,134 dollars at publication after falling 2.5 percent over 24 hours. The next immediate technical area remained near the 73,000 dollar zone flagged by 10X Research. Price behavior around that level may clarify whether accumulation translated into stabilization.

The post Bitcoin News: Whales Accumulated BTC as Market Stress Deepened appeared first on The Coin Republic.

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

Upexi Posts $179M Q4 Loss as Solana Slides Near $78