HBAR Struggles Below $0.25: Key Support at $0.23 in Focus

Technical analysis across multiple timeframes reveals a market at a critical juncture, where support at $0.23 takes center stage as traders seek signals for either a bounce back or a further decline.

The outlook remains uncertain as volume, momentum, and price action suggest a delicate balance between selling pressure and potential recovery.

Price Action Shows Bearish Momentum Amid Low Volume

According to analysis by Fresh ◎, the price of HBAR has declined by over 4% in the last 24 hours to $0.2353. This move reflects growing bearish sentiment as the token trades well below previous support levels ranging from $0.24 to $0.25. Red candlesticks dominate the short-term chart, confirming a downtrend.

Source: X

Volume analysis reveals lower-than-average activity, with selling volume outweighing buying. This reduced participation signals uncertainty, often indicating that the market is waiting for a clear catalyst before deciding on its next direction. The current low volume suggests either continuation of the downtrend or the possibility of a reversal if fresh buying interest emerges near critical levels.

Support at $0.23 remains a vital threshold. Holding this level could spark a bounce, but a breakdown may lead to declines toward $0.22. Resistance is noted near $0.24–$0.25, levels that must be surpassed to signal a potential recovery. Traders should closely watch price action around these key zones for decisive breakout or breakdown signals.

Consolidation Phase Indicates Market Indecision

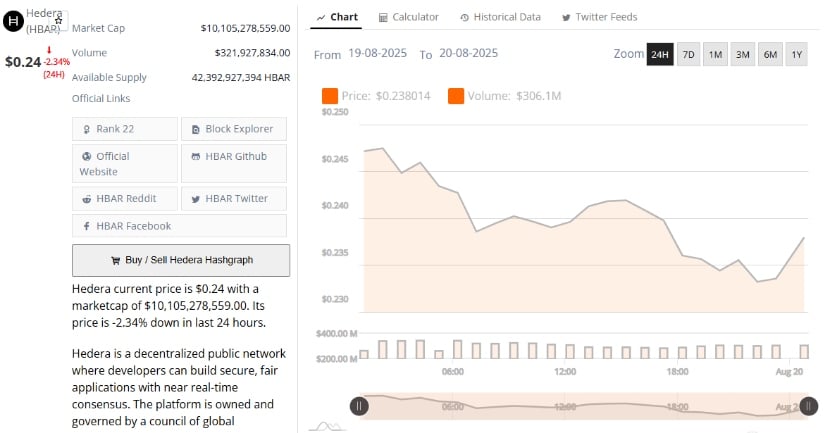

In addition, BraveNewCoin’s 24-hour overview shows HBAR oscillating near $0.24, with a minor 2.34% drop during this period. The price fluctuates within a narrow band, indicating a consolidation phase rather than directional momentum. This sideways movement reflects indecision among market participants as neither bulls nor bears dominate decisively.

Source: BraveNewCoin

Volume during this phase is moderate, balanced between buyers and sellers. Such equilibrium often characterizes markets pausing before larger moves. Without a spike in volume, meaningful breakouts are less likely, leaving the price range-bound.

Should support at $0.24 give way, further downward movement toward $0.22 is possible. Conversely, pushing above the $0.25 resistance could trigger upward momentum, potentially targeting higher resistance levels. Monitoring volume and price near these thresholds will be essential for future trend confirmation.

Momentum Indicators Signal Neutral to Mildly Bearish Stance

At the time of writing, TradingView’s technical indicators show the RSI at 44.63, just below the neutral midpoint of 50. This reading suggests that while sellers have the upper hand, the market is not yet in extreme oversold territory, leaving room for either continued declines or a reversal.

Source: BraveNewCoin

The MACD currently features a bearish crossover with the MACD line below the signal line, signaling short-term downward momentum. However, the narrow histogram bars suggest bearish strength may be weakening, opening the door to potential stabilization or upward movement if momentum shifts.

HBAR is currently testing crucial support and resistance between $0.23 and $0.25. This range will likely dictate near-term price direction, with a break above or below these levels signaling the next significant move.

You May Also Like

The Channel Factories We’ve Been Waiting For

Onyxcoin Price Breakout Coming — Is a 38% Move Next?