Asset-Backed Securities Industry Statistics 2026: Shocking Growth Trends

In the world of finance, asset-backed securities (ABS) have become a cornerstone, enabling investors to access revenue streams from diverse asset classes like auto loans, mortgages, and student loans. ABS provides a unique opportunity to bundle these assets into marketable securities, giving investors exposure to cash flow-generating assets while offering businesses access to liquidity.

Today, the ABS market is poised to grow even further, thanks to a combination of financial innovation, investor interest, and regulatory adaptations. This article delves into the latest market statistics, key trends, and significant developments that shape the ABS landscape today.

Editor’s Choice

- Auto loan ABS volumes are poised to rise in 2026 amid strong origination pipelines and investor demand.

- Student loan ABS issuance expected to increase in 2026, driven by robust pipelines despite credit normalization.

- Credit card ABS issuance is projected to contract in 2026 due to tighter underwriting and credit caution.

- European ABS issuance forecasted at €95-100 billion in 2026, matching or surpassing 2025 levels.

- MBS demand strengthens in 2026 with GSEs purchasing $200 billion in mortgage bonds.

- ABS market ratings stability to persist into 2026, with upgrades outnumbering downgrades 4.8 to 1.

Recent Developments

- Green ABS issuance projected to exceed $75 billion globally, fueled by ESG mandates and EV leasing securitizations.

- SOFR underpins 100% of new US ABS deals, boosting transparency with 98% rating stability across sectors.

- Tokenized ABS transactions forecasted to reach $60 billion, led by private credit at 45-50% market share.

- CRR III and STS revisions enable lower capital charges for STS-compliant ABS, driving European issuance growth.

- Synthetic ABS volumes are anticipated to grow 25% amid Basel IV, enhancing bank capital efficiency.

- AI platforms reduce ABS structuring times by 35%, accelerating risk scoring and investor reporting.

- China auto ABS issuance set to rebound 15%, while India consumer ABS expands with fintech assets.

- Emerging markets ABS growth projected at 14%, supported by consumer credit and infrastructure pools.

Asset-Backed Securities Market Size & Growth Outlook

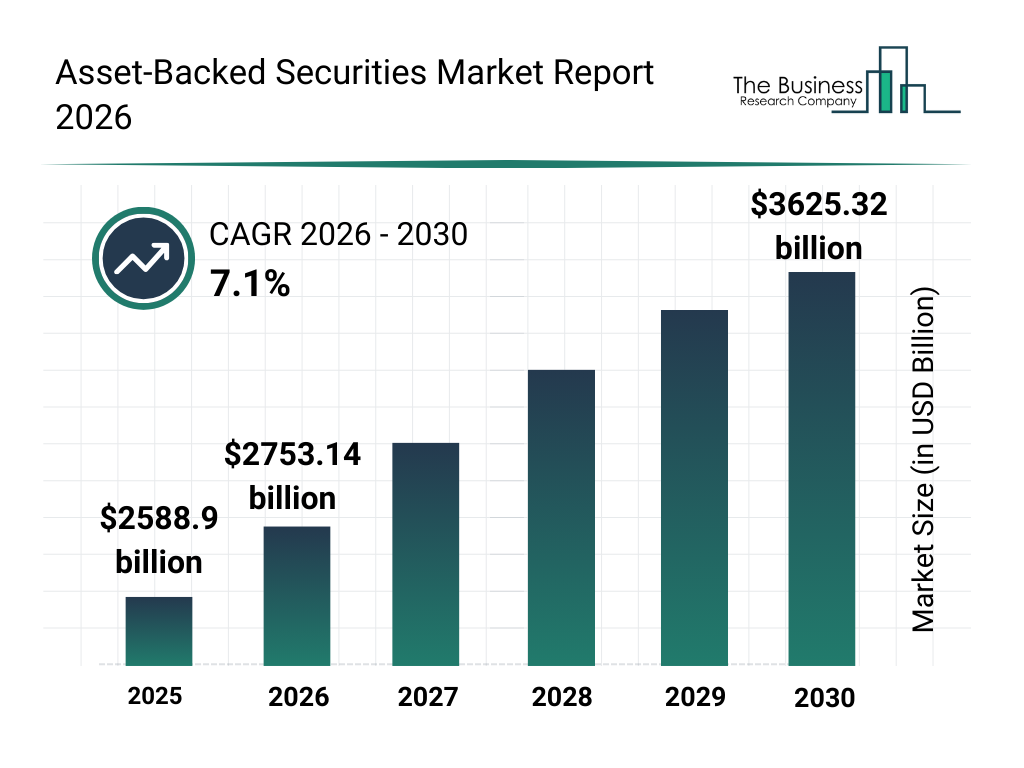

- The global Asset-Backed Securities (ABS) market was valued at $2,588.9 billion in 2025.

- Market size increased to $2,753.14 billion in 2026, reflecting strong year-over-year expansion.

- The ABS market is projected to reach $3,625.32 billion by 2030, highlighting sustained long-term growth.

- The industry is expected to grow at a 7.1% CAGR from 2026 to 2030, indicating steady expansion over the forecast period.

- Between 2026 and 2030, the market is forecast to add over $872 billion in total value, signaling rising investor demand and securitization activity.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Asset-Backed Securities Market Trends

- Blockchain ABS platforms tokenized $45 billion in assets, boosting settlement speed by 40%.

- Green ABS issuance surges to $80 billion globally, comprising 12% of total ABS volume.

- European NPL ABS hits $42 billion, up 17% amid bank deleveraging efforts.

- Synthetic ABS grows 20% to optimize capital under Basel IV regulations.

- Auto loan ABS issuance climbs 9% to $292 billion with EV financing boom.

- Credit card ABS stabilizes at $95 billion despite volatility, down 3%.

- Hybrid ABS volumes reach $205 billion, rising 18% for diversified exposure.

- Digital securitization platforms process 65% of new deals, cutting costs 28%.

Composition of the Bond Market by Type

- Public sector bonds comprise 78% of total global bond issuance volume.

- Corporate bonds maintain 12% share amid sustained private sector financing.

- Covered bonds account for 8%, backed by prime mortgage collateral pools.

- ABS expands to 2% of the overall bond market, driven by structured credit demand.

Investor-Friendly Features of Securitized Credit

- ABS secondary market trading volume reaches $1.2 trillion, 25% above traditional bonds.

- Investors access 18 distinct ABS asset classes for optimal portfolio diversification.

- 92% of ABS transactions feature multi-layer credit enhancement structures.

- ABS fixed coupons deliver 4.8% average yield with 98.7% payment stability.

- Tranche structures offer risk/return profiles from 2.1% senior to 12.5% equity yields.

- Regulatory compliance achieves 100% Dodd-Frank adherence across rated ABS issuance.

- Green ABS allocations capture 15% of institutional fixed income portfolios.

- ABS liquidity premium narrows to 45 bps over comparable corporate securities.

Major Asset Classes in ABS

- Auto loan ABS issuance surges to $292 billion, up 9%, driven by EV and used car financing.

- RMBS volumes reach $435 billion, fueled by urban housing demand despite high rates.

- Credit card ABS stabilizes at $95 billion, down 3% as BNPL adoption accelerates.

- Student loan ABS climbs to $64 billion, capturing 12% of the total US ABS market.

- CMBS issuances hit $178 billion, led by logistics and warehousing sectors.

- Equipment lease ABS grows to $25.3 billion, rising 12.5% on tech capex boom.

- Esoteric ABS totals $39 billion globally, with solar and royalties leading gains.

Breakdown of Asset-Backed Securities by Type

- Residential mortgage-backed securities comprise 62% of the total ABS market volume.

- Auto ABS captures 14% market share, driven by EV and used vehicle financing.

- Collateralized loan obligations account for 13% of outstanding ABS structures.

- Credit card ABS maintains 7% share despite BNPL competitive pressures.

- Consumer loan ABS rises to 5%, reflecting fintech lending expansion.

- Nonperforming loan ABS grows to 3%, led by European bank deleveraging.

- Equipment leasing ABS reaches 2.5% with corporate capex recovery.

- Esoteric ABS represents 2%, including solar royalties and litigation finance.

Role of Financial Institutions and Major Issuers

- JPMorgan Chase leads with $178 billion ABS issuance, up 10% in auto and RMBS.

- Citibank ABS volumes hit $145 billion, growing 10% in consumer credit.

- Bank of America issues $108 billion, securing 16% US ABS market share.

- Wells Fargo CMBS reaches $62 billion, targeting data centers and logistics.

- Goldman Sachs esoteric ABS climbs to $28 billion, including aircraft leases.

- Deutsche Bank European ABS totals $64 billion, up 20% under STS rules.

- Santander auto ABS issuance surges to $38 billion in subprime financing.

Frequently Asked Questions (FAQs)

Reported ABS issuance through early 2026 was $36.8 billion, a -6.4% year-over-year change.

Market analysts project the ABS market will expand at roughly 6–8% CAGR over the next five years.

The ABS trading ADV in the U.S. was $2,424.0 million, a +20.4% Y/Y increase.

Data center–backed ABS is a growing segment estimated at about 5% of the roughly $1.6 trillion U.S. ABS market.

European securitization issuances, including ABS and related products, could reach about €160 billion in 2026.

Conclusion

The asset-backed securities (ABS) market continues to evolve, driven by innovation, regulatory reforms, and increasing investor interest in sustainable investments. With the rise of green ABS, AI integration, and the expansion of digital securitization platforms, the ABS market is set for robust growth. As both traditional and emerging markets embrace new technologies and ESG criteria, the future of ABS promises both diversity and resilience in the face of economic and environmental challenges.

The post Asset-Backed Securities Industry Statistics 2026: Shocking Growth Trends appeared first on CoinLaw.

You May Also Like

Pompliano Says Bitcoin Volatility Has Shifted Now

SEC to Avoid Unnecessary Roadblocks as Tokenization Advances