FTX Token Jumps 10% After Sam Bankman-Fried Files for New Trial

Key Insights:

- The FTX token price jumped all the way to $0.40 following Sam Bankman-Fried’s new trial plea.

- Bankman-Fried filed a Rule 33 motion in New York federal court alleging due process violations while challenging bankruptcy narrative.

- He also stressed his view that FTX was “always solvent,” disputing the legitimacy of the bankruptcy proceedings.

FTX token (FTT) has surged by a sharp 10% over the last 24 hours despite the broader crypto market consolidations.

This comes as disgraced FTX founder Sam Bankman-Fried (SBF) is seeking a new trial for his 25-year jail term. Bankman claims a bogus “bankruptcy” case filed by the lawyers after taking control of the exchange.

FTX Token Price Jumps As Sam Bankman-Fried Seeks New Trial

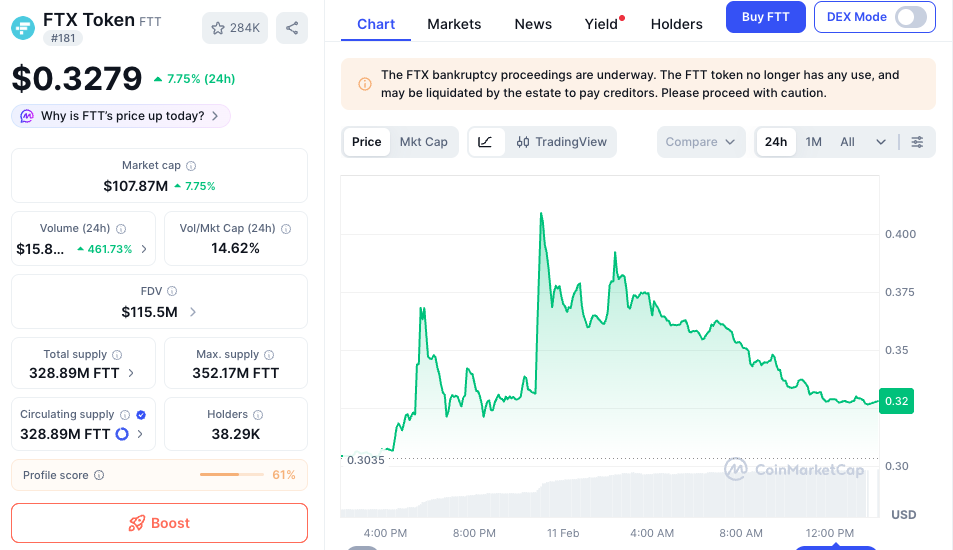

FTT, the native token of crypto exchange FTX, is trading up by 10% as of press time, at $0.3275. Its daily trading volume has shot up by 450% to more than $15.87 million. That showed strong bullish sentiment among traders.

Soon after the news about SBF seeking a new jail trial, the FTX token price jumped over 30% from $0.30 to $0.40. However, it has retraced more than 15% since then. Investors will be waiting on the sidelines before any concrete developments shape up in this regard.

FTX token price pump | Source: CoinMarketCap

FTX token price pump | Source: CoinMarketCap

The FTX token price is already trading 99% down from its all-time high of $84.5. The sharpest phase of the selloff occurred in November 2022, when FTX filed for bankruptcy.

During that period, FTT plunged from around $26 to below $1 within days. This wiped out billions of dollars in market value.

The collapse triggered widespread losses across the digital asset industry, leading to bankruptcies and layoffs. Furthermore, the trust in centralized exchanges was at its lowest point back then.

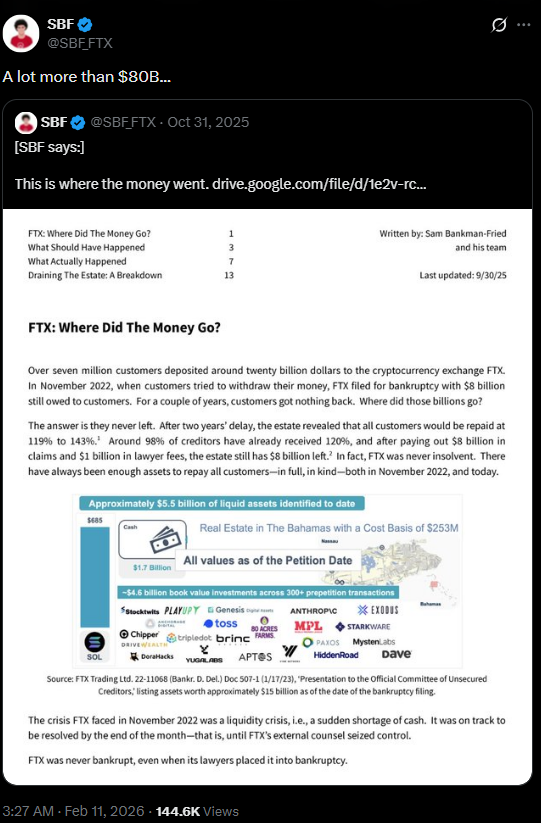

On the other hand, former FTX Chairman Sam Bankman-Fried has been tweeting from prison. In his latest claim, SBF said “FTX was never bankrupt,” sparking major discussion among market players. In his message on the X platform, he wrote:

Sam Bankman-Fried Says FTX Was Never Bankrupt

Sam Bankman-Fried, the jailed founder of FTX, has filed a motion seeking a new trial in his federal fraud case in New York. In the filing, Bankman-Fried argues that his trial violated due process.

It also mentions that the Biden government withheld information that impaired his defense. He also requested that Judge Lewis Kaplan recuse himself from the case.

The motion invokes Rule 33 of the Federal Rules of Criminal Procedure. This permits a court to grant a new trial “if the interest of justice so requires.” Bankman-Fried submitted the request from prison, including a memorandum of law, a declaration, and a cover letter dated February 5, 2026.

President Trump stated that he will not pardon Sam Bankman-Fried. This announcement ends the long-running speculation surrounding the issue. In his latest public defence, Sam Bankman-Fried said that his arrest was politically motivated.

He blamed the Biden government for retaliating after he shifted his support to Republican candidates in 2022. He argued that FTX was always solvent. He claimed the exchange held about $25 billion in assets against $16 billion in liabilities at its collapse.

SBF Lost Over $80 Billion

Sam Bankman-Fried has claimed that assets tied to him and his collapsed crypto empire could have generated tens of billions of dollars in gains.

According to statements attributed to Bankman-Fried, he had committed $500 million to Anthropic. Considering the AI giant’s current valuation, this would be worth around $70 billion as of the date.

He also cited holding $60 million worth of Solana at an average price of $8. To this, he claimed, would have peaked near $2.1 billion at market highs.

Bankman-Fried highlighted a $100 million investment in Mysten Labs. He claimed the stake would now be worth over $800 million. Furthermore, SBF held a 7.5% stake in Robinhood, which would be currently worth about $10 billion.

Source: X

Source: X

SBF stated that this seizure of this asset after the FTX collapse couldn’t let him realize more than $80 billion in profits.

The post FTX Token Jumps 10% After Sam Bankman-Fried Files for New Trial appeared first on The Market Periodical.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

BlueDot Meetings Enters the Video Meeting Market with Focus on Security and Seamless AI-Powered Language Translation, taking on Zoom and Microsoft Teams