XRP price could fall below $1 if Bitcoin reaches certain level

Cryptocurrency analyst TARA has forecast that XRP could decline below the $1 psychological support level, citing the altcoin’s correlation to Bitcoin’s price movements, according to a social media post.

- Analyst TARA warns XRP could drop below $1 if Bitcoin experiences a near-term correction, citing correlation with Bitcoin and key Fibonacci support levels.

- Another analyst, CasiTrades, sees XRP in a Wave 4 relief bounce, with potential lower targets if key retracement levels fail to hold, but notes these levels may offer long-term buying opportunities.

- Despite short-term downside risks, both analysts maintain a positive long-term view on XRP, with major lows potentially reached and macro targets still in the single-digit range.

The analyst stated on X.com that a significant Bitcoin decline would push XRP to a deeper support level, which corresponds to certain Fibonacci extensions and a gap left by a prior liquidation event, according to the post.

XRP had reached a textbook resistance level, while the waves on Bitcoin appear incomplete, the observer noted. The token could experience another short-term decline, with Bitcoin likely to correct before it advances to mid-resistance.

The projected Bitcoin correction could bring XRP down to short-term support, with another wave up expected toward mid resistance, according to the analyst’s forecast.

Despite the near-term outlook, TARA maintains a long-term positive view on XRP, with macro targets remaining in the single-digit range, the post stated. The analyst noted that XRP could have bottomed around the current range, but Bitcoin continues to largely drive price action for the altcoin and the broader cryptocurrency market.

Another analyst, CasiTrades, stated that XRP appears to be in a Wave 4 relief that could send it toward a critical retracement level. CasiTrades warned that if XRP fails to convert that level into support, it would establish a final wave down targeting significantly lower levels.

The current relief bounce has reset momentum indicators sufficiently that a move down would likely produce a bullish divergence, making those levels attractive long-term buy zones, according to CasiTrades. Alternatively, if XRP reclaims the key level, the analyst advised waiting for confirmation of a back-test of support before using that as an entry point.

CasiTrades told investors that major lows have been reached, and that there is a possibility the final wave down fails, according to the post.

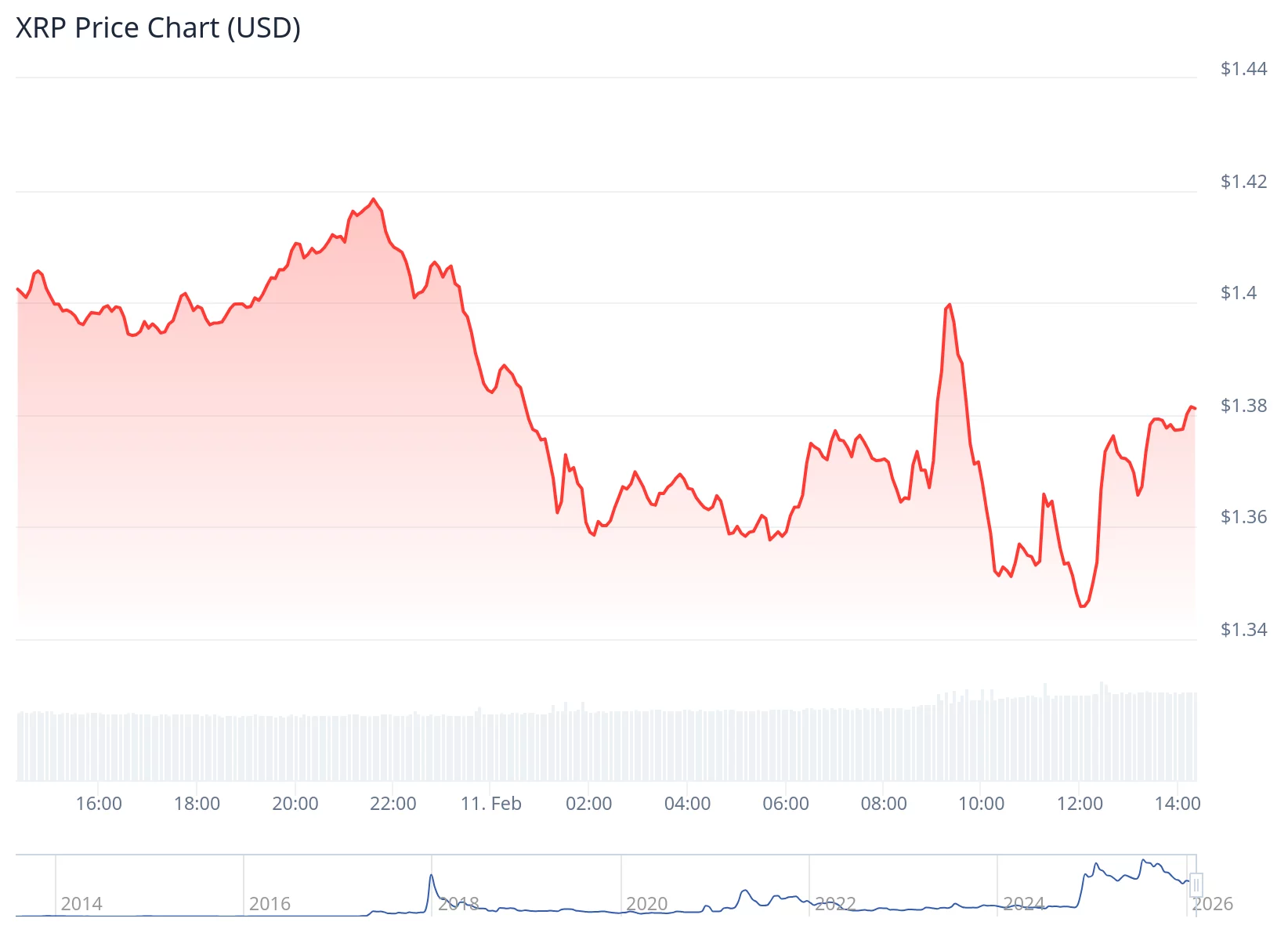

At the time of reporting, XRP was trading lower on the day.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

BlueDot Meetings Enters the Video Meeting Market with Focus on Security and Seamless AI-Powered Language Translation, taking on Zoom and Microsoft Teams