XRP price prediction: Will XRP Community Day trigger a rally?

XRP Community Day has put Ripple’s token back in focus as traders look for catalysts amid a fragile market structure.

- XRP Community Day has refocused attention on the XRP Ledger’s ecosystem, highlighting developer activity and community engagement rather than delivering a single market-moving announcement.

- XRP is consolidating near the $1.37–$1.38 support zone, with narrowing Bollinger Bands and a recovering CMF suggesting selling pressure is easing, though upside remains capped below $1.45–$1.50.

- Declining XRP exchange reserves on Binance point to reduced immediate sell-side supply, offering a supportive backdrop if renewed community-driven interest translates into demand.

The community-led event highlights ecosystem updates, developer activity, and ongoing engagement around the XRP (XRP) Ledger. This could help refocus attention on fundamentals after weeks of price weakness.

While XRP Community Day is not tied to a single market-moving announcement, it often serves as a sentiment booster, particularly during consolidation phases.

Increased visibility, renewed social engagement, and discussion around XRPL use cases can act as short-term momentum drivers if broader market conditions cooperate.

XRP price action steadies near key support

XRP is trading near the $1.37–$1.38 zone at press time, attempting to stabilize after a steady pullback from highs above $1.60 earlier this month.

The price is holding near the middle-to-lower portion of the Bollinger Bands on the daily chart. The bands have started to narrow, signaling reduced volatility following the recent sell-off.

While XRP is no longer hugging the lower Bollinger Band, indicating that downside momentum has eased, price has struggled to reclaim the mid-band (20-day moving average). As long as XRP remains below this level, upside attempts are likely to face resistance.

A sustained move above the mid-band would open the door toward the upper band near the $1.45–$1.50 zone.

The Chaikin Money Flow (CMF) remains slightly below the zero line but has turned higher from recent lows, suggesting selling pressure is fading. A move back into positive territory would signal improving capital inflows.

A failure to do so could leave XRP vulnerable to a retest of support around $1.35, followed by $1.28 on a deeper pullback.

Exchange reserve data hints at supply dynamics

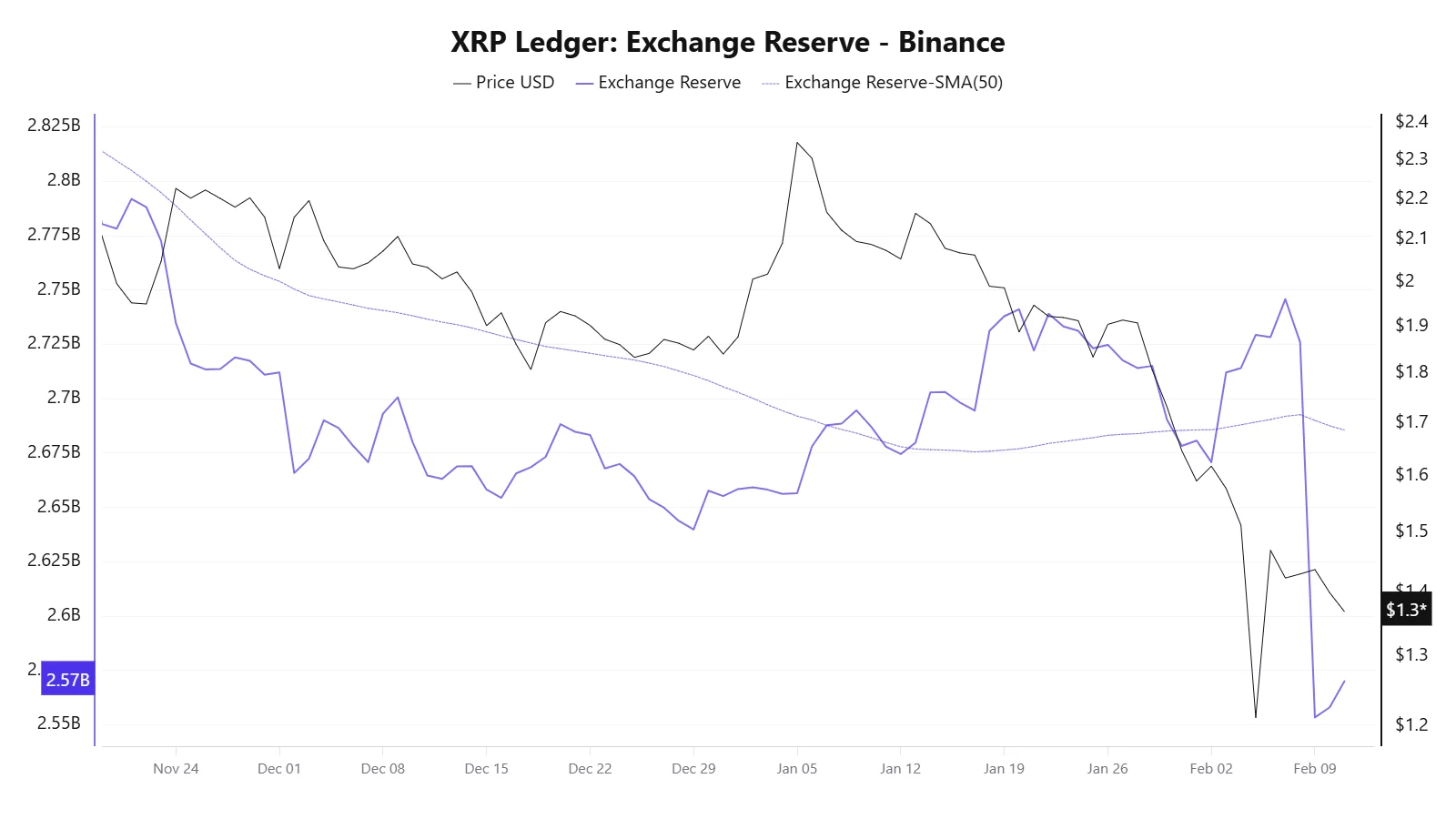

Moreover, CryptoQuant data shows XRP exchange reserves on Binance have declined recently, suggesting fewer tokens are being held on exchanges.

This trend typically points to reduced immediate sell-side pressure, as more XRP moves into private wallets rather than remaining available for spot selling.

While falling exchange reserves alone do not guarantee a rally, they can provide a supportive backdrop if demand picks up. Combined with community-driven attention from XRP Community Day, the supply-side dynamics could help limit downside risk in the near term.

Overall, XRP remains in a consolidation phase, with Community Day acting as a sentiment catalyst rather than a guaranteed breakout trigger. Traders will be watching whether XRP can defend the $1.35 support zone and reclaim resistance near $1.45 to signal a shift toward recovery.

You May Also Like

Rheem® and ecobee partner to launch the ecobee Smart Thermostat Lite | Works with EcoNet® Technology

Serrala Acquires e-invoicing and Accounts Payable Specialist Cevinio