Why Bitcoin price could bottom at $65,000 before a major relief rally

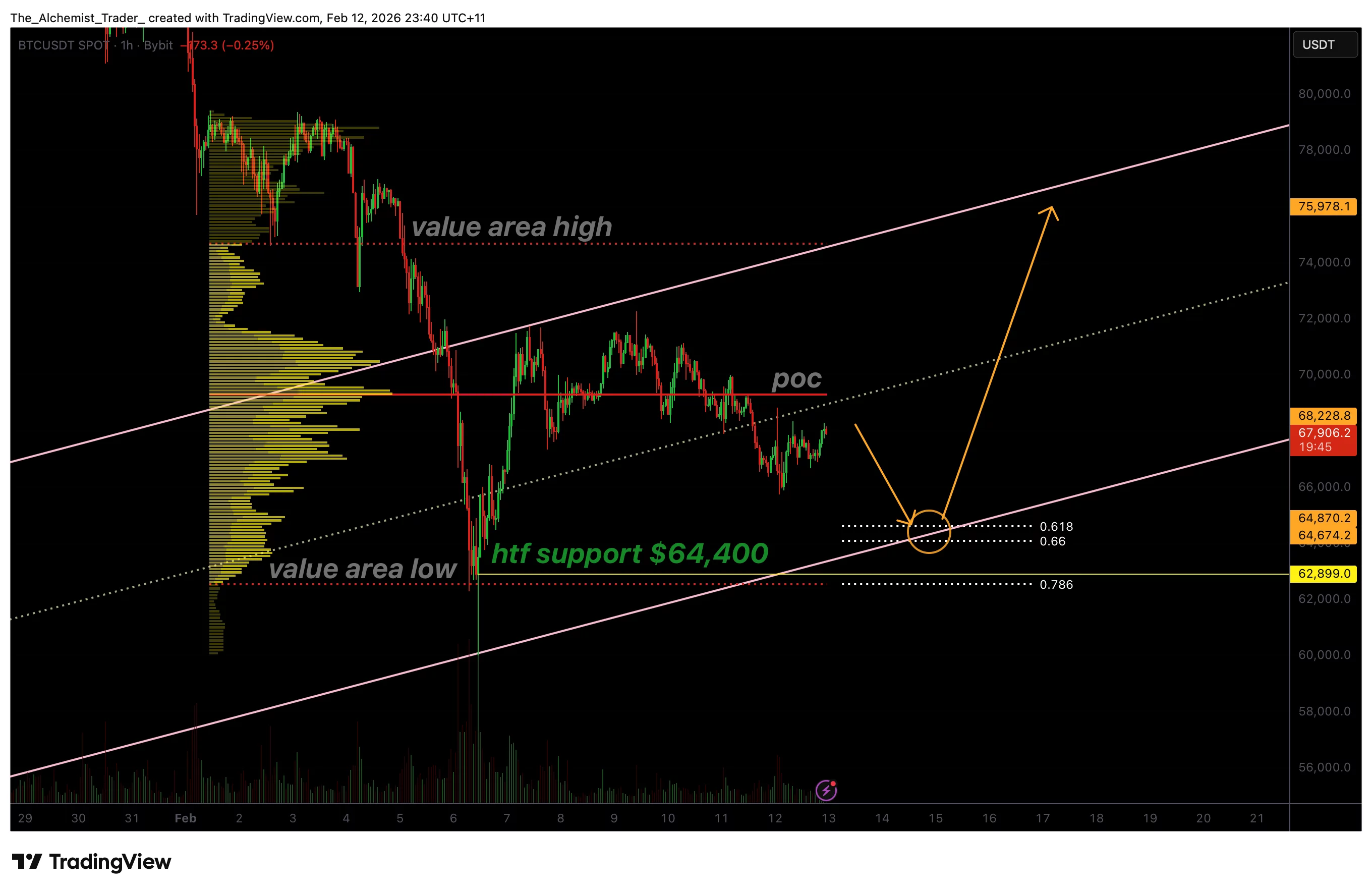

Bitcoin price is approaching a critical $65,000 support zone where Fibonacci and channel confluence suggest a potential local bottom may form before a strong relief rally unfolds.

- Rising channel support and 0.618 Fibonacci converge near the $64,400–$65,000 zone

- Local downtrend likely persists until stronger support is tested

- Bullish volume at support could spark a relief rally toward channel resistance

Bitcoin (BTC) price action remains corrective in the near term, with the market continuing to rotate lower within a broader rising channel. After failing to hold the channel midpoint, BTC has slipped into a weaker internal trend, putting downward pressure on the price as sellers remain in control.

Despite this weakness, the broader structure does not yet signal a macro breakdown. Instead, current conditions suggest Bitcoin may be nearing a high-probability support zone where a temporary bottom could form.

This type of environment often precedes internal rotations within an uptrend, where price revisits deeper support before attempting a recovery. The focus now shifts to whether Bitcoin can find demand near the lower boundary of its rising channel.

Bitcoin price key technical points

- Rising channel structure remains intact, despite the loss of mid-channel support

- 0.618 Fibonacci retracement aligns with channel support near the $64,400–$65,000 zone

- Bullish volume at support is required, to confirm a relief rally and trend continuation

Bitcoin has been trading within a rising channel that has guided price action over recent months. The recent loss of the channel midpoint marked an important shift in short-term momentum, indicating that buyers were unable to maintain control at higher value levels. Once this internal support failed, price began rotating lower toward the stronger structural support at the channel low.

This type of movement is common in trending markets. Rather than immediately reversing, price often seeks deeper liquidity and stronger technical confluence before stabilizing. The current downtrend on lower timeframes reflects this internal rotation rather than a full trend reversal.

Importantly, this move lower has occurred without aggressive expansion in bearish volume, suggesting controlled selling rather than panic-driven capitulation.

$65,000 support zone comes into focus

The next major technical level sits near the $64,400–$65,000 region. This zone represents a strong confluence of technical factors, including the 0.618 Fibonacci retracement of the broader move and the lower boundary of the rising channel. When Fibonacci retracements align with structural channel support, they often act as high-probability reaction zones.

A move into this area would complete the current internal rotation within the channel. As long as price holds this support on a closing basis, the broader bullish structure remains intact. This makes the $65,000 region a key area where buyers may step in to defend trend continuation.

‘No Man’s Land’ consolidation likely before support test

At present, Bitcoin is trading between major support and resistance levels, an area often described as “no man’s land.” In these zones, price action tends to be choppy, with limited follow-through in either direction. Consolidation in this region is typical as the market prepares for its next decisive move.

As long as BTC remains below reclaimed resistance and above major support, further ranging and slow drift lower remain likely. This environment often frustrates both bulls and bears, but it is a necessary phase before larger rotations unfold.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Bitcoin appears to be nearing the latter stages of its current corrective rotation. While short-term downside risk remains, the $64,400–$65,000 region stands out as a potential bottoming zone.

For a meaningful relief rally to begin, Bitcoin will need to show a clear reaction at its support level. This includes strong bullish volume, rejection wicks, and acceptance back above short-term value levels.

If these conditions are met, price could rotate back toward the upper boundary of the rising channel, with the $75,000 region acting as the next major resistance target.

You May Also Like

UAE Launches First Regulated Stablecoin as ADI Trends Higher

The Ultimate Guide to Professional Dog Grooming: Choosing the Right Tools for a Salon-Finish at Home