NVIDIA Stock Forecast as Top UBS Analyst Upgrades Ahead of Earnings

Key Insights

- A top UBS analyst has upgraded the Nvidia stock target to $242.

- The analyst cited strong demand and improving supply chains.

- The company’s revenue and earnings growth is expected to keep growing.

NVIDIA stock price remained in a narrow range at a crucial level as investors waited for the next catalyst ahead of its fourth-quarter earnings. NVDA was trading at $190, down ~10% from its all-time high, indicating it is in a correction. This article explores whether it will rebound after UBS upgraded it ahead of earnings.

UBS Has Upgraded Nvidia Stock Price Ahead of Earnings

Nvidia stock price held steady after Timothy Arcuri, a top UBS analyst, upgraded the stock and his target, noting that it was favorable ahead of its fourth-quarter earnings.

The analyst boosted the target from $235 to $245, implying a 28% upside from the current level. He noted that the company had major tailwinds, including improving supply chain signals, strong management team, and soaring demand for its products. Also, the analyst noted that the company will surpass the gross margin of 75%.

UBS joins other Wall Street firms that are bullish on Nvidia’s stock price. Wolfe Research expects the stock to jump to $275, up by 42% from the current level. Similarly, Mizuho, JPMorgan, Jefferies, and Piper Sandler have maintained a bullish outlook for the stock.

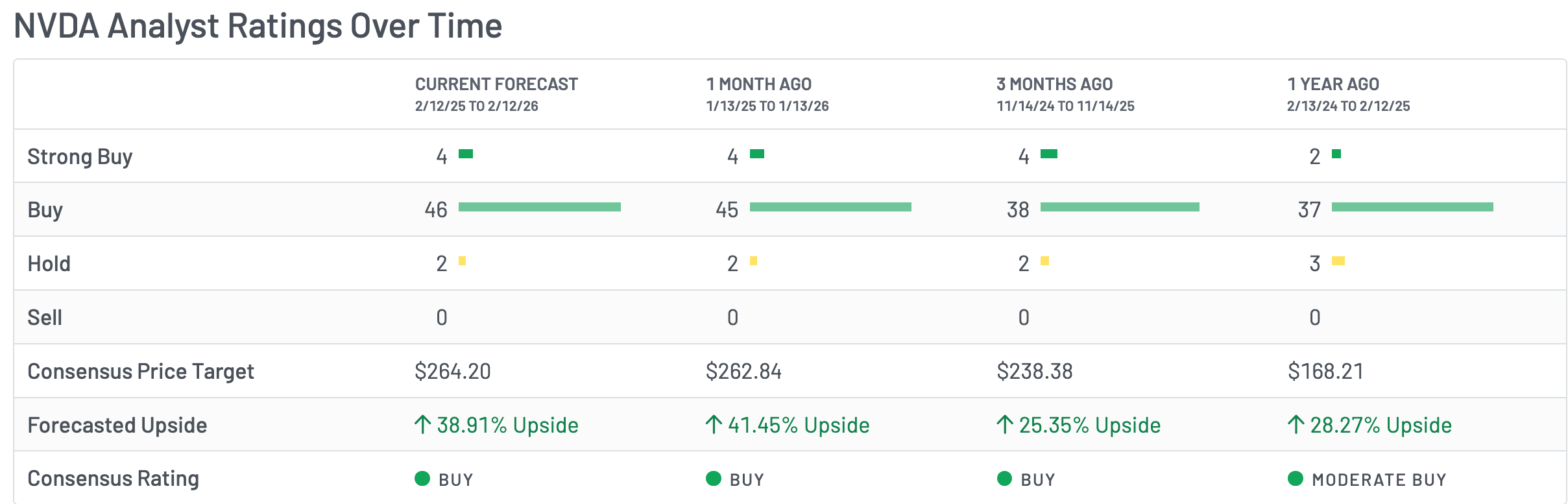

Data compiled by MarketBeat shows that the consensus target for the NVDA stock is $264, up by 38% from the current level. Most analysts tracking the company have a buy rating.

NVDA stock analyst estimates |Source: MarketBeat

NVDA stock analyst estimates |Source: MarketBeat

Early Signs Point to Nvidia Revenue Growth

There are signs that Nvidia’s business is still doing well, a trend that may continue this year. A good example of this is Taiwan Semiconductor (TSMC), which showed that its revenue continued growing in January.

TSMC said that its revenue jumped by 38% in January to over $12.7 billion as the data center chips continued. It also boosted its annual spending to over $56 billion. While TSMC makes chips for other companies like Apple, its revenue growth is a good indicator of Nvidia’s business because it is one of the biggest clients.

Another bullish sign for Nvidia’s stock price is the mammoth spending plans of its biggest clients, such as Microsoft, Google, Amazon, and Meta Platforms.

These companies plan to spend over $660 billion this year, with most of this spending going to data centers. Nvidia will be the top beneficiary of this spending as it is the biggest provider of data center chips.

Other large technology companies, such as Oracle, CoreWeave, Nebius, IREN, and Bitfarms, are also planning to boost their AI spending this year.

At the same time, the company may benefit from new orders from Chinese companies like Alibaba, ByteDance, and Tencent. Jensen Huang believes Nvidia can generate over $54 billion in revenue from China.

The next main catalyst for the NVIDIA stock will be its earnings. Analysts expect the upcoming results will come in at $65 billion, up by 71% YoY. This quarterly revenue will bring its annual figure to over $213 billion.

Analysts also believe that its earnings per share (EPS) will jump to $1.52 from 89 cents. There is a chance the company will report better-than-expected results, as it has always done.

NVDA Stock Price Forecast: Technical Analysis

The daily chart shows that NVDA’s stock price has rebounded over the past few weeks. It has moved above the 23.6% Fibonacci Retracement level and is slightly above the 50-day and 100-day moving averages.

However, the stock has faced substantial resistance at $193, where it has failed to move above several times this year. The stock has formed a head-and-shoulders pattern, a common bearish reversal sign in technical analysis.

NVDA stock chart | Source: TradingView

NVDA stock chart | Source: TradingView

Therefore, the stock will likely remain under pressure as long as it remains below the resistance at $193. The H&S pattern also means that it is at risk of a bearish breakout. If this happens, the next key target to watch will be at $180.

The post NVIDIA Stock Forecast as Top UBS Analyst Upgrades Ahead of Earnings appeared first on The Market Periodical.

You May Also Like

Crucial Fed Rate Cut: Powell’s Bold Risk Management Move Explained

Inference Research Launches in Hong Kong with US$20M Seed Funding