XRP Price Prediction Today: How CPI Data Could Trigger the Next Major Move

![XRP Community Day [Live] Updates](https://image.coinpedia.org/wp-content/uploads/2026/01/22154144/XRP-Price-Rebounds-as-Sentiment-Shifts-Is-a-2026-Rally-in-Play-1-1024x536.webp)

The post XRP Price Prediction Today: How CPI Data Could Trigger the Next Major Move appeared first on Coinpedia Fintech News

Crypto markets are entering a high-impact session as U.S. CPI data looms, and XRP price is positioning right at a structural decision zone. With inflation expectations shaping Federal Reserve policy outlook, today’s data is not just a macro event, it is a liquidity trigger. XRP is holding near the $1.35–$1.40 band, but the real move may only begin once CPI resets short-term sentiment. The question is not whether volatility will come, it is which direction it will expand.

CPI Data Expectations and XRP Price Outlook

Over the past six CPI releases, crypto markets have reacted with an average intraday volatility swing of 5-8% in major assets. XRP, due to its liquidity profile and retail participation, has historically amplified these moves.

If CPI prints below expectations particularly if core inflation cools below 3.7% year-over-year, markets may price in higher probability of rate cuts later in the year. That scenario typically weakens the dollar index and supports risk assets. Conversely, a CPI reading above consensus could pressure liquidity conditions, triggering renewed downside in speculative assets. XRP’s current structure suggests it is coiling within a tight $1.30–$1.45 range, making it highly reactive to macro catalysts.

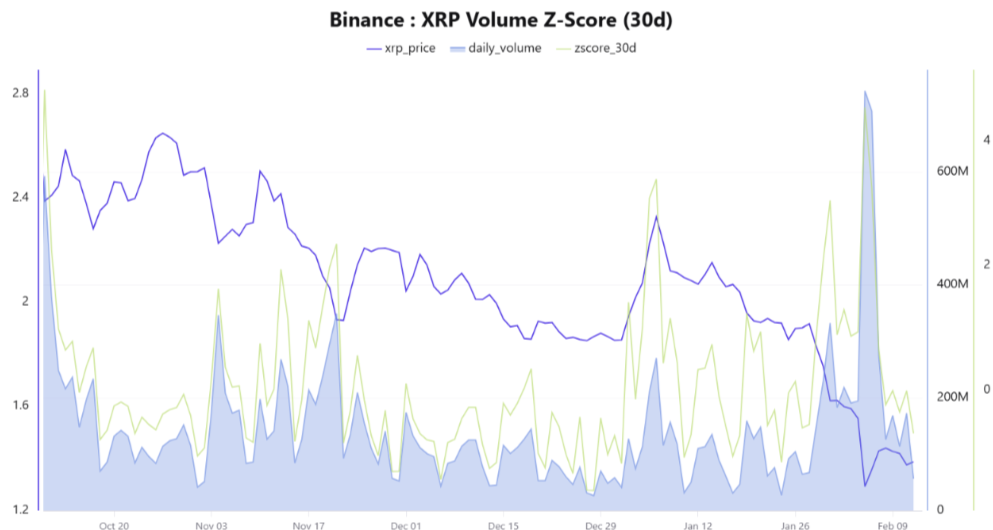

On-Chain Metrics: Volume Z-Score Signals Expansion Phase

Beyond macro expectations, exchange-level data adds an important layer. XRP’s Binance Volume Z-Score, which measures current trading volume relative to its 30-day average, is hovering close to the neutral zone. That means participation is neither overheated nor drying up. This type of equilibrium phase often precedes directional expansion. In prior cycles, sharp spikes in the Volume Z-Score above +2 have coincided with strong upside impulses. Likewise, deep negative readings have aligned with panic flushes.

Right now, the market is balanced, not exhausted. That balance implies XRP is structurally coiled rather than trending aggressively in either direction. Once CPI provides directional clarity, volume expansion could follow quickly.

XRP Price Prediction: Decision Zone Between $1.20-$1.40

XRP price is hovering above a well-defined demand cluster between $1.30 and $1.35. This zone has historically absorbed downside pressure and acted as a reaction base.

If CPI comes in softer than expected and risk appetite improves, XRP could attempt a breakout above $1.45, targeting the $1.50–$1.60 region in the near term. If inflation surprises to the upside, downside liquidity below $1.30 becomes vulnerable, with $1.20 as the next test level. If CPI prints in line with expectations, XRP may remain range-bound temporarily, but compression phases rarely last long.

Immediate resistance sits near $1.40–$1.45, followed by a stronger supply region around $1.60. A clean break above $1.45 on expanding volume would likely open room toward $1.55–$1.60 in the short term. On the downside, failure to hold $1.30 would expose $1.20 as the next liquidity pocket. Below that, structural weakness accelerates.

Market Outlook

XRP price is not collapsing, nor is it aggressively trending. It is stabilizing ahead of a macro event that could reset short-term direction. On-chain volume data suggests the market is preparing for expansion rather than fading momentum. CPI data will determine which side of the range breaks first. Until then, XRP remains in decision mode, and the next move could define the tone for the rest of the week.

You May Also Like

WLFI Expands Into Forex With World Swap Launch

BUZZ HPC Closes Acquisition of 7.2 MW Toronto Site to Build Data Centre for Sovereign AI Infrastructure

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more