Cardano (ADA) Price Prediction 2026: Why Investors Are Shifting Focus

Cardano (ADA) price prediction 2026 is becoming a major topic of discussion as ADA struggles to regain strong bullish momentum. After facing extended consolidation and increased competition in the altcoin market, investors are reassessing Cardano’s long-term growth potential heading into the next crypto cycle.

In this ADA price analysis, we examine key resistance and support levels, on-chain activity, staking trends, and broader crypto market conditions shaping sentiment. With capital rotating into emerging DeFi and infrastructure projects, many traders are asking whether Cardano can reclaim previous highs in 2026, or if investor focus is beginning to shift elsewhere.

Cardano (ADA)

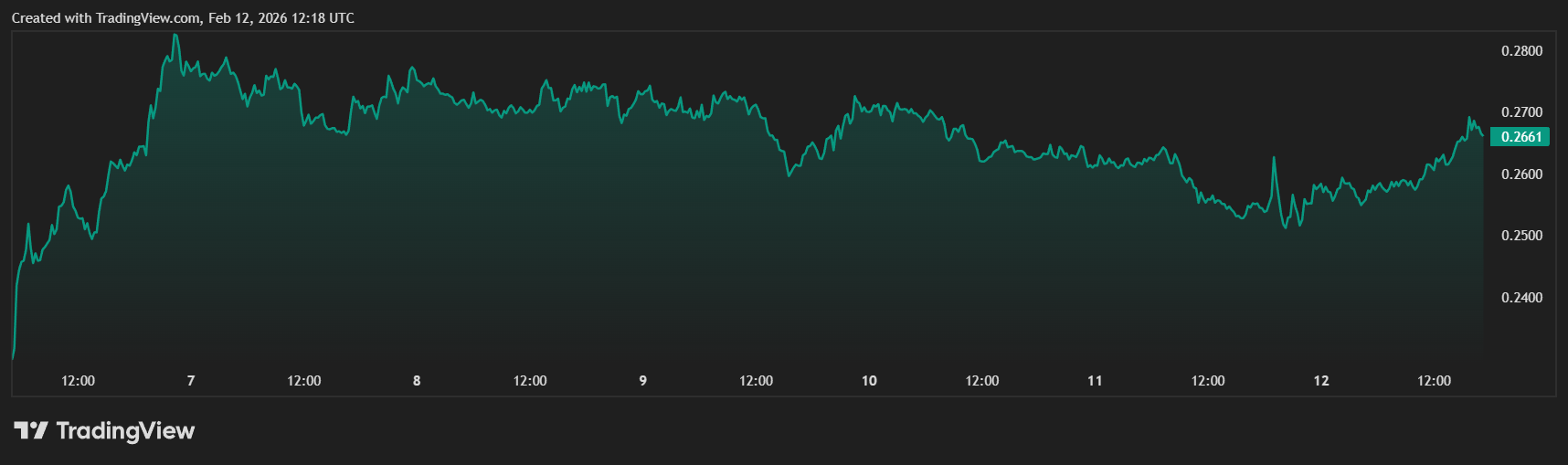

Cardano (ADA) is currently trading around $0.26, with a market capitalization holding steady at approximately $9.6 billion. While it remains a top-ten contender, the network is struggling to find the momentum needed for a true recovery.

Despite constant updates to its scaling solutions and smart contract language, the price action has remained largely sideways for several months. Investors are increasingly concerned that the slow and steady approach is causing the network to lose ground to more aggressive competitors.

From a technical perspective, ADA is trapped beneath heavy resistance zones. The most immediate barrier sits at $0.35, which has rejected multiple recovery attempts. Above that, a much stronger psychological and technical wall exists at $0.43.

Until Cardano can reclaim these levels with significant trading volume, it remains vulnerable to further downside. Support is currently being tested at the $0.20 mark, and a break below this could lead to a retest of multi-year lows.

Mutuum Finance (MUTM)

As Cardano faces a sluggish outlook, Mutuum Finance (MUTM) is emerging as a high-potential alternative. Mutuum Finance is a decentralized lending and borrowing protocol. It aims to solve liquidity challenges by allowing users to lend assets to earn yield or borrow against their holdings without ever selling them. This ensures users can maintain their long-term positions while still accessing usable capital.

The project is currently in Phase 7 of its structured presale, with the MUTM token priced at $0.04. Since starting at just $0.01 in early 2025, the token has already surged by 300%. The project has raised over $20.4 million and attracted a massive community of 19,000 holders. With a confirmed launch price of $0.06, the protocol is offering a clear and structured path to value that stands in sharp contrast to the uncertain movement of legacy coins.

Price Prediction Contrast: ADA vs. MUTM

The price predictions for 2026 show a clear contrast between these two assets. For Cardano, many analysts have issued a bearish outlook. They suggest that without a major surge in decentralized app adoption, ADA could struggle to even reach $0.50 by the end of 2026. The main limitation is its massive supply and slow development cycles, which often fail to excite the retail market. In a worst-case scenario, ADA could stay range-bound between $0.25 and $0.35 for the next two years.

In contrast, analysts are much more bullish on MUTM. Because it is a “new crypto” with a lower market cap, it has a much higher ceiling for growth. Market experts believe that as the protocol moves toward its full mainnet launch, it could see a 10x to 15x increase. This would place the token in the $0.40 to $0.60 range by 2027. This growth is backed by the protocol’s real utility, such as its interest-bearing mtTokens and its plan for a native stablecoin.

Security, Rewards and Whale Interest

Security is a top priority for Mutuum Finance as it prepares for its market debut. The project has completed a full manual audit by Halborn Security and holds a high 90/100 trust score from CertiK.

To ensure long-term safety, the team also maintains a $50,000 bug bounty program. These layers of protection have attracted significant “whale allocations,” with several individual entries exceeding $100,000 recorded in recent weeks.

To keep the community engaged, the platform features a 24-hour board that tracks daily contributions. Every day, the top participant is rewarded with a $500 bonus in MUTM tokens. This constant activity, combined with the fact that 45.5% of the 4 billion total supply is allocated to the community, ensures a fair and decentralized foundation. As the Phase 7 allocation sells out, the shift from legacy coins like ADA into high-utility cheap crypto protocols like MUTM appears to be accelerating.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post Cardano (ADA) Price Prediction 2026: Why Investors Are Shifting Focus appeared first on CaptainAltcoin.

You May Also Like

PayToMe.co and Nixxy Inc. (NASDAQ: NIXX) Advance AI Financial Infrastructure Across Global Telecom Rails

Snowball Money and REI Network Integrate Web3 Identity