Bitcoin Cash (BCH) Holds Support as Analysts Eye Breakout to $950

On Friday, February 13, Bitcoin Cash (BCH) is trading at $533.21, having gained 3.91% in the past 24 hours, according to CoinMarketCap data. The trading volume has increased by 6.82%, and it is currently at $443.8 million. The BCH coin price has risen by 6.53% over the last week.

Source: CoinMarketCap

Analysts stated that BCH continues to hold the mid-range support of its weekly descending channel, a level that has shaped its trend for several months. This support is being defended by buyers, and this increases the chances of BCH testing its upper boundary.

BCH Eyes Breakout From Descending Channel

Analyst Crypto Woodyz highlighted that BCH is still trading within its long-term descending structure. He noted that a clear breakout of the resistance of the channel may lead to an acceleration of the bullish momentum.

The price targets that analysts have for BCH are $735.9, $859.5, and $950, but only if the current structure is maintained. He also noted that these are speculative price targets.

Source: X

However, another analyst, CW, mentioned that BCH has already cleared a major sell wall, which had been an issue for the past sessions.

The move has not left any notable resistance level until a price of $640, which has garnered much attention from short-term traders monitoring how the token is performing around that level.

Source: X

Also Read: Cardano (ADA) $100M Whale Redistribution Could Spark Bullish Momentum

Volume and Open Interest Rise Sharply

CoinGlass data shows a rise in participation in derivatives markets. The trading volume increased by 15.01%, reaching $630.87 million. In addition, open interests rose by 7.51% to $710.80 million.

The OI-weighted funding rate stands at 0.0051%. This implies a slightly positive bias from leveraged traders as the token struggles to maintain stability above local support.

Source: CoinGlass

EMA Trend Weakness Signals Ongoing Bearish Pressure

The Exponential Moving Average (EMA) shows weakness in the trend. The EMA 20 is at $535.89 and acts as the nearest resistance. This level shows sellers still control the short-term direction.

The medium and long EMAs remain above the chart. The EMA 50 is at $558.28, and the EMA 100 sits at $560.88. The EMA 200 stands at $543.68 and signals strong long-term resistance.

The Moving Average Convergence Divergence (MACD) line is at -17.69. The signal line stands at -19.45. The histogram is at 1.76. These levels indicate a decrease in bearish pressure and a rise in early signs of momentum.

Source: TradingView

BCH is in a significant zone as it approaches the upper boundary of its descending channel. Analysts are awaiting a breakout to determine its next trend.

Also Read: Bitcoin Cash (BCH) Tests Resistance as Analysts Warn of $475 Retest

You May Also Like

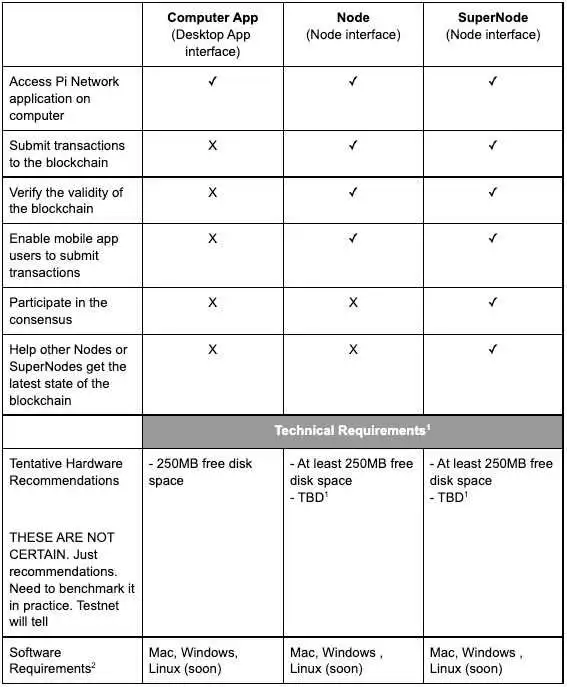

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade