Millions of Investors Could Feel Unintended Consequences of Upcoming SEC Reporting Rules

WASHINGTON, Feb. 13, 2026 /PRNewswire/ — The Investment Company Institute released the following viewpoint:

Less than 10 years ago, the SEC adopted fund reporting requirements on Form N-PORT that provide regulators with monthly portfolio data while giving investors most of that information quarterly. These requirements have been a success, making mutual funds, exchange-traded funds, and closed-end funds among the most transparent financial products available. However, changes adopted by the SEC in 2024 could disrupt this framework and harm investors.

These new rules increase public disclosure of fund holdings and other detailed portfolio information from quarterly to monthly while shortening the filing deadline with the SEC from 60 days after the end of each quarter to 30 days after the end of each month. Taken together, they increase the number of disclosed reports and required filings from four to twelve each year while cutting preparation time in half. These changes, scheduled to take effect in late 2027, risk lowering investor returns, exposing sensitive fund strategies, and imposing immense operational burdens.

Unintended Consequences: How Increased Reporting Frequency Can Affect Investors

More frequent public disclosure gives market participants additional data points about a fund’s trading strategy, allowing them to trade ahead of fund transactions.

- A buy-and-hold fund targets an investment within a favorable price range and plans to build a large position over several months.

- After the fund publicly discloses a new holding, other market participants buy the stock, driving up its price.

- Research shows prices of newly disclosed holdings can rise nearly twice as fast as comparable S&P 500 stocks following disclosure, increasing trading costs for funds still building positions.

Why it matters: Higher trading costs ultimately reduce returns for fund investors.

Public Disclosure: Risks to Investor Costs and Fund Strategies

A fund manager’s investment strategy and current holdings are valuable intellectual property, often developed through extensive research and analysis. Excessive disclosure provides competitors with additional data points to easily reverse engineer proprietary fund strategies. Advances in artificial intelligence and machine learning further enable high-speed traders to analyze fund portfolios, identify trading patterns, and engage in predatory trading tactics, negatively impacting a fund’s performance and investment decisions.

Impact on Performance

When predatory traders anticipate a large fund order, they can trade ahead of—or “front run”—it, driving prices up when a fund buys or down when it sells. This increases the fund’s trading costs, which are passed on to investors, resulting in a reduction in overall performance.

Impact on Investment Strategy

To mitigate these risks, fund managers may be forced to alter their successful, long-term investment strategies or avoid asset classes such as high-yield bonds, where positions take time to build or unwind. This would stifle innovation and potentially limit the diversity of investment options available to ordinary investors through highly regulated funds.

Reporting Frequency: Risks to Fund Operations and Investor Understanding

In addition to trading and cost concerns, the operational demands of the new rules present challenges for all funds as reporting timelines are compressed.

Increased Operational Costs

The tighter and more frequent deadlines would pressure fund operations teams to gather, verify, and reconcile vast amounts of complex data, some of which involve manual and time-consuming processes. This is not simply a matter of speed—it is a fundamental shift that requires significant systems upgrades and additional staffing.

Data Integrity Risks

Rushing the reporting process increases the risk of errors and data integrity issues. Inaccurate public filings can confuse investors and regulators alike, undermining the very transparency the rule aims to create.

Disproportionate Burden on Smaller Funds

The cost of implementing systems capable of meeting this monthly deadline disproportionately affects smaller fund complexes, which typically have fewer personnel and operational resources. Fund investors bear these costs, meaning investors in smaller funds are likely to feel the impact more acutely.

A Balanced Solution: Protecting Investors While Preserving Flexibility

Some funds currently choose to provide their holdings more frequently than quarterly based on their strategy, and the SEC should not interfere with these market practices so long as all fund investors receive appropriate information on an equal basis.

The current framework sets a reasonable reporting and disclosure baseline and allows market forces to determine the optimal level of transparency for distinct types of funds and investment styles without imposing a one-size-fits-all mandate.

Next Steps

Historically, the SEC has agreed with the existing approach to disclosure and reporting. Previous Commissions had found that more frequent public disclosure of portfolio holdings information is “neither necessary nor appropriate in the public interest or for the protection of investors.” They highlighted studies showing that increased portfolio holdings disclosure could decrease certain funds’ performance, recognizing that the current quarterly disclosure approach appropriately balances the interest in disclosing fund holdings against the need to protect sensitive fund portfolio management positions and strategies.1

As the SEC revisits the 2024 Form N-PORT amendments, it should carefully weigh the benefits of reporting speed and volume against the tangible risks of market exploitation and greater transaction and compliance costs, especially in the age of advanced AI analysis.

Restoring quarterly public disclosure and extending filing deadlines would protect funds and give them sufficient time to aggregate, review, and file accurate information. A balanced approach informed by market realities and investor needs will better serve fund investors while preserving appropriate transparency.

1 See Investment Company Reporting Modernization, Release No. IC-32314, 81 Fed. Reg. 81870 (Nov. 18, 2016) at 81,909-10; 81,977 and n. 490 (citing to reports showing that increased disclosure leads to both front running and “copycatting,” in which predatory traders reverse engineer and mimic a fund’s investment strategies, and may adversely affect funds and their shareholders), available at https://www.govinfo.gov/content/pkg/FR-2016-11-18/pdf/2016-25349.pdf. See also Shareholder Reports and Quarterly Portfolio Disclosure of Registered Management Investment Companies, Release No. IC-26372, 69 Fed. Reg. 11244 (Mar. 9, 2004) at 11252-53 (determining not to adopt more frequent than quarterly disclosure because “we take seriously concerns that more frequent portfolio holdings disclosure and/or a shorter delay for release of this information may expand the opportunities for predatory trading practices that harm fund shareholders.”), available at https://www.govinfo.gov/content/pkg/FR-2004-03-09/pdf/04-4829.pdf.

Contact us:

media@ici.org

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/millions-of-investors-could-feel-unintended-consequences-of-upcoming-sec-reporting-rules-302687882.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/millions-of-investors-could-feel-unintended-consequences-of-upcoming-sec-reporting-rules-302687882.html

SOURCE Investment Company Institute

You May Also Like

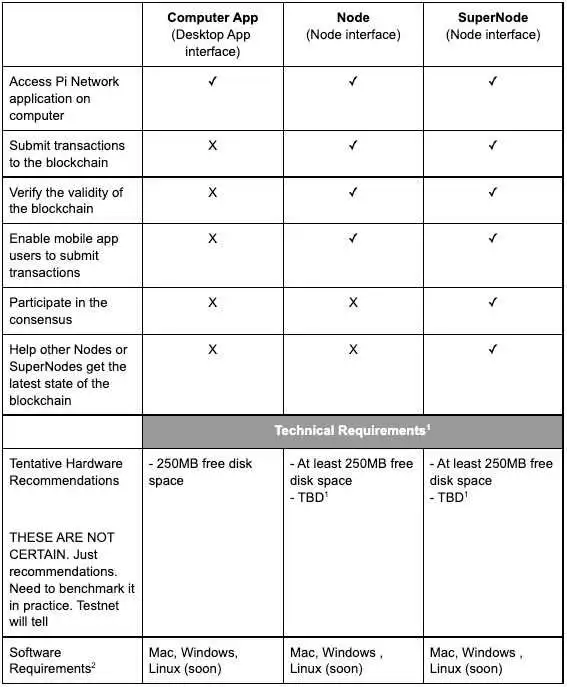

Pi Network Sets Feb 15 Deadline for Mainnet Node Upgrade

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade