Margex Review: Is This Crypto Exchange Legit to Trade Cryptos in 2025?

Margex is a crypto derivative exchange that was founded in 2019. The exchange was designed to provide an easy-to-use and secure experience for both beginners and experienced traders interested in derivatives products. Besides the comprehensive interface for trading perpetual contracts, the trading platform offers low fixed transaction fees and allows users to start trading without identity verification.

Margex Exchange offers daily rewards to traders holding Bitcoin, Ethereum, and their crypto assets in their wallets. Additionally, the exchange has an extensive and standalone copy trading platform that allows beginners and busy traders to replicate the strategies of successful traders and make profits even with little time or experience.

But there’s more, this Margex review provides an overview of the exchange, highlighting its key features, Margex fees, and offers a step-by-step guide on how to start trading on Margex.

| Rating | 4.6/5  |

| Security | 8.5/10 |

| Available Cryptocurrencies | 8/10 |

| Customer Service | 8.0/10 |

| User Experience | 9.0/10 |

| Is Margex Safe? | Yes |

Margex Review – What Is It? A Comprehensive Look

Margex is a cryptocurrency platform specializing in leveraged trading, offering up to 100x leverage on derivative trading pairs. The exchange supports margin trading on over 50 major digital assets, including Bitcoin, Ethereum, and others. Margex also features multicollateral wallets that let users deposit various cryptocurrencies and trade almost any pair without owning the underlying asset.

Margex Exchange offers a user-friendly interface and robust security measures, including cold storage of funds and advanced encryption, comprehensive market data from multiple liquidity providers to prevent price manipulation, a copy trading feature, and a zero-fee converter for swapping cryptocurrencies.

While Margex offers multiple features for derivative traders and copy traders, it does cater to traders who want to buy or sell crypto on the spot market. The exchange also lacks some features available on other exchanges, like automated trading bots, extensive passive income opportunities, a web3 ecosystem, and a wide crypto selection. These unavailable products might make it unsuitable for traders who have interacted with such services or prefer to do more in one place.

That said, the table below highlights some basic information about the Margex Exchange.

| Exchange | Margex |

| Founded | 2019 |

| Headquarters | Seychelles |

| Margex Key Features | Derivatives trading, multicollateral wallets, fixed low fees, no KYC requirement, copy trading, crypto staking, and live demo. |

| Native Token | No |

| Supported Cryptocurrencies | 50+ |

| KYC Requirements | Optional |

| Security | Cold wallet storage, advanced encryption, two-factor authentication (2FA), an access segregation system, and withdrawal address whitelisting. |

| Leveraged Trading | Yes, up to 100x. |

| Spot Trading | No |

| Futures Trading | Yes |

| Copy Trading | Yes |

| Automated Bot Trading | No |

| Live Demo | Yes |

| Earn Products | Sign-up bonus, trading commissions through the referral program, and staking rewards. |

| Margex Fees | Maker: 0.019%

Taker: 0.060% |

| Payment Methods (Deposit and Withdrawal) | Crypto and third-party payment providers. |

| Customer Support | 24/7 support via Live Chat. |

| Available in the US | No |

Start your trading journey on Margex today and receive a $10,000 welcome bonus.

What Are the Pros and Cons of Trading on Margex?

The pros of Margex Exchange are listed below:

- Copy Trading Feature: Margex offers a user-friendly platform where users can replicate the strategies of successful traders. This means you can automatically copy the entry, exit, and risk management strategies of more experienced participants without performing your technical analysis or monitoring the market constantly.

- Staking Opportunities: The exchange also offers staking programs where users can lock up their digital assets and earn up to 5% annual percentage yield (APY). Margex boosts these staking rewards with built-in protections against price manipulation through its MP-Shield system. The system aggregates price data from multiple sources to ensure fair and accurate asset valuations.

- Low Trading Fees: The exchange offers reasonably low fees for makers and takers, and no fees for crypto deposits or conversions. The maker fees are as low as 0.019%, and taker fees around 0.06%, for perpetual contracts.

- No Mandatory KYC: Margex offers optional KYC, allowing traders to invest without disclosing personal information. Additionally, this optional KYC makes account creation and usage quick and easy.

- High Leverage: Margex allows traders to amplify their exposure by up to 100x on perpetual futures contracts, which can dramatically boost gains (and losses).

- Strong Security Measures: Margex employs multi-layer security including SSL encryption, 2FA, cold storage with multi-signature wallets, DDoS protection, access segregation, and an AI-based MP-Shield system for fraud detection.

- Live Demo: Demo trading on Margex is a feature that allows users to explore the crypto derivatives market without risking real money. The simulation resembles the actual Margex interface. Therefore, both beginners and experienced traders can use this environment and the available virtual funds to test new strategies under real market conditions without incurring actual financial risk.

The cons of the Margex crypto exchange are listed below:

- Advanced Features Lacking: Margex currently supports only a small selection of perpetual futures pairs, which restricts the trading strategies users can employ. In addition, it does not offer spot trading, meaning users can’t buy or sell actual crypto assets, only speculate on their price movements through derivatives. These make Margex less suitable for advanced traders seeking a comprehensive trading ecosystem.

- Unregulated and No Audit Transparency: Margex is not authorized to provide investment services in the UK or other countries and is not regulated by the Financial Conduct Authority (FCA). It operates without formal licensing or independent security audits, meaning funds are not protected by insurance or verified reserve proofs. Additionally, traders are solely responsible for ensuring they comply with the laws and regulations of their own jurisdiction.

- Separate Mobile Apps: The crypto exchange has distinct apps for trading crypto derivatives and a separate app for copy trading. While this app provides traders with a dedicated environment to replicate or create their own strategies, it may be inconvenient, especially for those who have used platforms with an in-app copy trading feature.

- Mixed User Experiences & Complaints: There are many reports of blocked withdrawals, account freezes, forced KYC requests, delayed customer support, and withheld profits. Example: “Margex is complete garbage… customer service is the most disgusting experience… I got liquidated because trades wouldn’t close.” However, some users report successful support outcomes too.

Is Margex Legit and Safe for Crypto Traders?

Yes, Margex is legit and safe for crypto traders. The exchange is legitimate and moderately secure, despite no successful hacks being reported. The platform employs strong security measures, including cold storage and two-factor authentication (2FA), but lacks some regulatory security layers found on top exchanges.

Although Margex is legit and employs robust security measures, the exchange is largely unregulated. The lack of regulatory oversight can leave traders vulnerable since they have limited legal recourse if they fall victim to fraud or disputes. Additionally, exchanges close for many reasons; if Margex shuts down or disappears without warning, users could lose their funds.

What Are Margex Supported and Restricted Countries?

Margex is supported in 153 countries, including Germany, Spain, the United Kingdom, Australia, Sweden, Romania, Portugal, Switzerland, Nigeria, France, South Africa, India, Kenya, Vietnam, Thailand, Greece, Ireland, Italy, the Netherlands, Poland, Austria, Belgium, Bulgaria, Denmark, and Seychelles.

Meanwhile, Margex restricted countries include the United States of America (including Puerto Rico and the U.S. Virgin Islands), Canada, Hong Kong, the Republic of Seychelles, Bermuda, Cuba, Crimea and Sevastopol, Iraq, Qatar, Kuwait, Oman, Iran, Syria, North Korea, Sudan, Lebanon, Libya, Afghanistan, and jurisdictions wherein Cryptocurrencies and leveraged trading on exchanges are prohibited.

Can You Use Margex in the U.S?

No, you cannot use Margex in the US. Due to regulatory restrictions, the exchange does not provide its services to traders based in the United States. While traders in some countries may have limited access to certain tools, all the features on Margex are completely unavailable to US investors.

What Features Make Margex Stand Out Among Crypto Exchanges?

Margex’s key features are derivatives trading, multicollateral wallets, fixed low fees, no KYC requirement, and copy trading. These features make Margex Exchange stand out among crypto exchanges.

Derivatives Trading

Margex supports only crypto derivatives for trading, offering perpetual futures contracts with leverage of up to 100x. This allows traders to speculate on price movements both up and down without owning the underlying asset. Derivatives trading is perfect for experienced traders as it gives them the potential to amplify profits on relatively small price changes, even though the risks are equally amplified with higher leverage.

In addition, Margex provides risk management tools such as stop-loss and take-profit orders for traders to help them limit their losses and amplify gains. While Margex’s focus on derivatives sets them apart from futures and spot platforms, this could be a limitation for new traders who want to start safe with spot pairs or professional traders who are looking to explore more trading options.

Multicollateral Wallets

Margex’s Multicollateral Wallets enable users to deposit various cryptocurrencies and use them as collateral for trading almost any pair listed on the exchange, without owning the underlying asset. This means you’re not restricted to holding the base currency of a particular market, such as USDT or BTC, to participate in trades.

Instead, settlements are made directly in the collateral you choose, whether that’s Bitcoin, Ethereum, or another supported asset. With multicollateral wallets, traders can avoid swapping between currencies before opening positions, thereby saving on conversion fees. Even when trading pairs that don’t match your deposited asset, you can still execute trades without owning the underlying asset.

Fixed Low Fees

Margex has a transparent, low-fee structure with maker fees around 0.019% and taker fees about 0.06%, regardless of trading volume. Unlike other exchanges that offer trading fees based on a trader’s VIP level, Margex has a fixed cost for trades, and they are not affected by low or high 30-day trading volumes.

There are no hidden charges, and the rates are competitive compared to other crypto trading platforms. This fixed-rate model benefits smaller traders who may not qualify for fee discounts on tiered pricing systems elsewhere, making it easier to predict costs before entering trades.

No KYC Requirement

Unlike many regulated exchanges, Margex does not require mandatory identity verification (KYC) for account creation and trading. Users can sign up with just an email address and password to start trading. The optional KYC requirement makes the sign-up process easy even for complete beginners and maintains privacy for users who prefer to trade anonymously.

However, it’s worth noting that large withdrawals still trigger verification requests. And the lack of regulation implies that you’re entirely on when trading on Margex. If you face legal issues with the exchange, you cannot report to or get help from institutions in your country unless the exchange is regulated there.

Margex Copy Trading

Margex offers a beginner-friendly interface that lets users create and control their own strategies, or automatically mirror the strategies of successful traders on the platform. A Strategy is a fund managed by an experienced trader using their own capital. Followers can join that strategy by allocating their own money to it so that their trades automatically mirror the trader’s actions in real time.

Copy trading on Margex creates a mutually beneficial arrangement for both followers and skilled traders. When a seasoned trader makes a profitable trade, followers will receive a percentage of the profits, based on the amount of their personal equity invested in the Strategy. In contrast, the trader receives a success fee from the profits generated by their followers.

Fortunately, followers can browse the leaderboard of traders, view their performance metrics, allocate funds to follow them, and copy multiple strategies at once to diversify their portfolio.

What Are the Fees When Trading on Margex?

The fees to expect when trading on Margex are maker and taker fees, funding rate, deposit and withdrawal fees, inactivity fee, and liquidation fee. These charges are explained in detail below:

Margex Maker and Taker Fees

Margex uses a standard maker-taker fee model for trades. Maker fee (which is 0.019% on Margex) is charged when you place an order that adds liquidity to the order book. These orders are not matched immediately against another order on the order book. Simply put, market orders are Limit orders that traders place below the current market price for a Buy order or above the current price for a SELL order.

Taker fee (0.06% charge) applies when removing liquidity from the order book by placing an order that is matched immediately against an order already on the order book. These are Market orders or conditional orders that convert to a market order when executed, such as a Stop-Market and Stop Loss.

Register a new account on Margex today and get a 50% discount on trading fees.

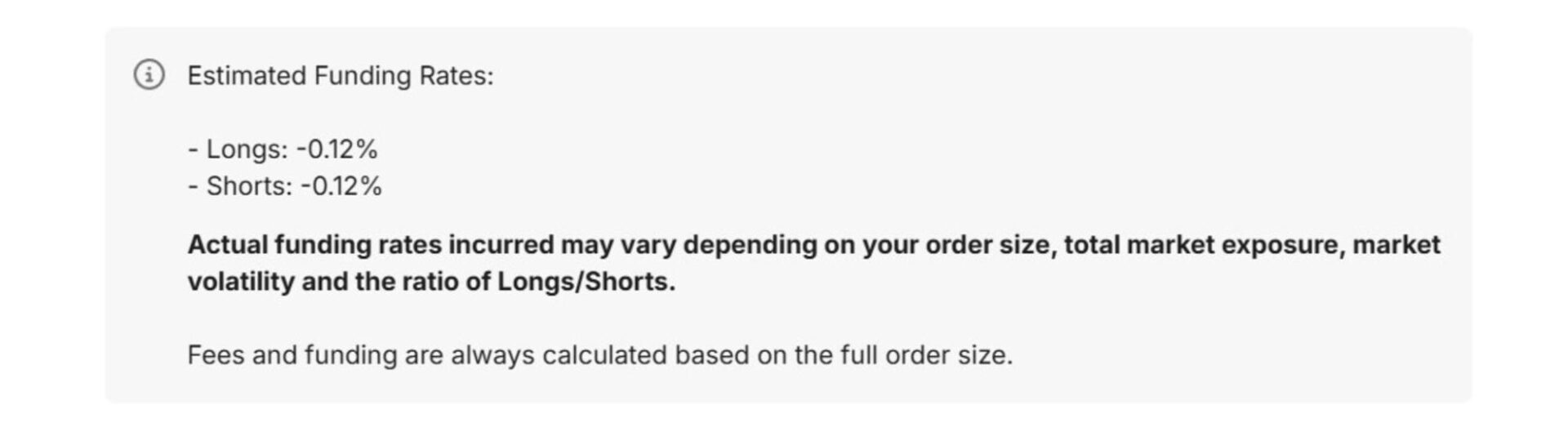

Funding Rate

Since Margex offers perpetual futures (which have no expiration date), it uses a funding rate mechanism to keep contract prices aligned with the underlying spot market. This is a periodic payment between long and short traders. When the funding rate is positive, long position holders pay short position holders, and when the funding rate is negative, short position holders pay long position holders.

The funding fee is calculated every 8 hours and changes over time depending on market conditions and open interest. Hence, the amount you will pay or receive will vary depending on the funding rate at the time and the size of your open position. You can determine the exact funding fee for your trade directly on the trading interface for the perpetual contract you are trading.

Please note: The funding timer is reflected on the Trade page, above the trading chart. Once the countdown timer reaches 00:00, funding will be incurred for any open position, and a new funding period will begin.

Deposit and Withdrawal Fees

Margex doesn’t charge fees for cryptocurrency deposits, although network fees apply when sending from your wallet. For withdrawals, Margex does not charge any additional fees. However, a blockchain miner fee, which is reflected in the withdrawal placement window, will be incurred for any withdrawal on the exchange.

Inactivity Fee

If your account remains inactive (no trading, deposits, or withdrawals) for a year or more, Margex may charge you a maintenance fee. There is no fixed rate; however, the platform decides the amount and how often to apply it on a case-by-case basis. This fee covers the cost of storing your assets in an inactive account.

Liquidation Fee

Liquidation is the forced closing of a trading position, which occurs when the margin to cover a position has run out, meaning the trade has to be settled to cover the losing leveraged position. If your leveraged position falls below the required maintenance margin and gets liquidated, Margex will charge a small percentage as a liquidation fee.

This fee helps cover the costs of closing your position and managing market risk. Liquidation also means losing the margin you put into the trade, which is why crypto leverage trading is more suitable for advanced users and those who are familiar with the market and the risks involved.

To avoid liquidation, closely monitor your trades under the position tab. Alternatively, sync any of the best crypto portfolio tracker apps to your Margex wallet for easy tracking and management of your crypto investments.

How to Start Trading on Margex? (Step-by-Step Guide)

To start trading on Margex, you’ll need to create an account by adding your email and password, deposit funds, select a market, set your trade parameters, and place your first order. Here is a step-by-step guide on how to achieve this:

Register a new account on Margex today to claim up to $10,000 in welcome bonuses.

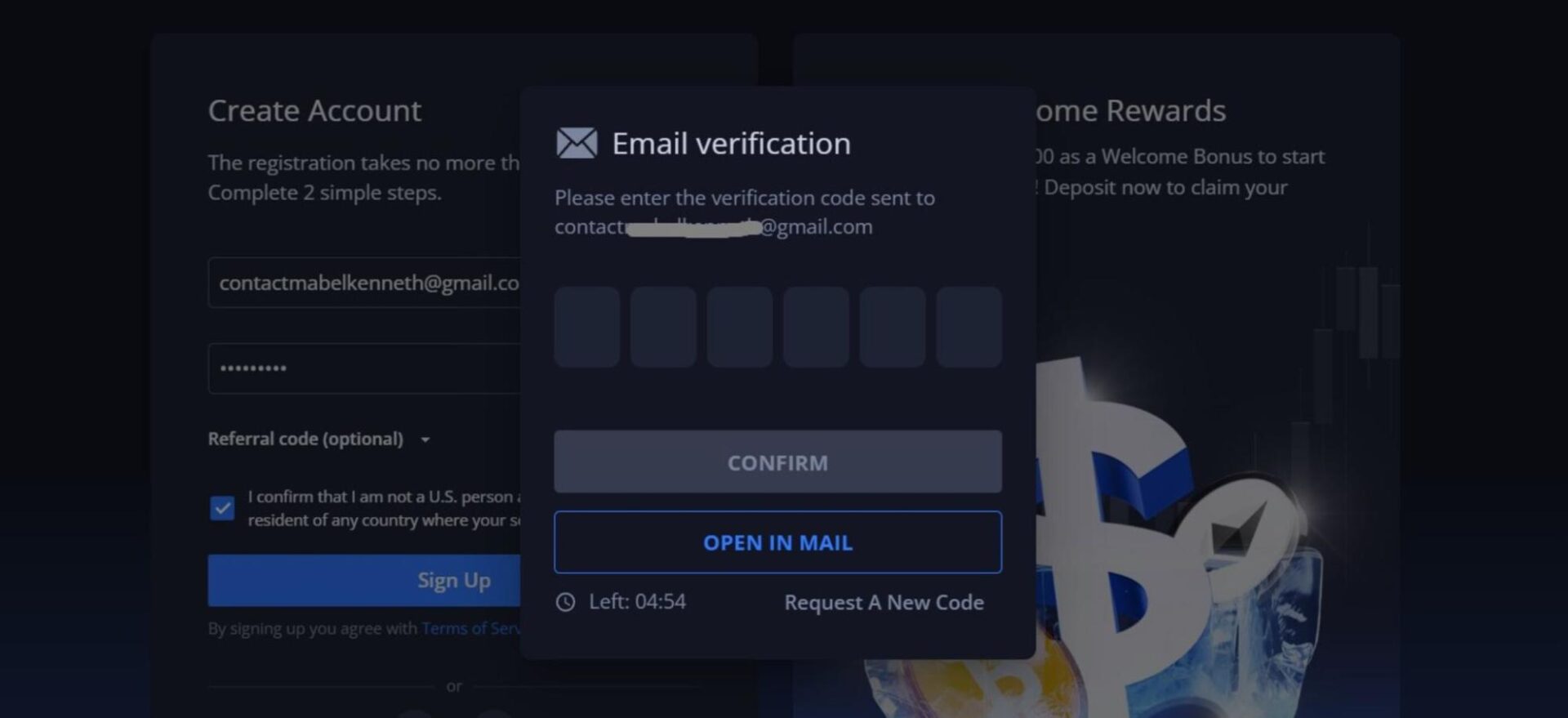

Step 1: Visit the Margex Official Website to Create Your Account

Visit the Margex website or download the mobile app, then click Sign Up. Enter your email address, create a strong password, check the box to confirm you are not a US person or a resident of a restricted country, then click “Sign Up.”

Margex will send you a verification code via email to confirm your registration. Add the code and click “Confirm” to complete your account setup. No mandatory KYC is required to start trading, so you can complete your registration in less than 3 minutes.

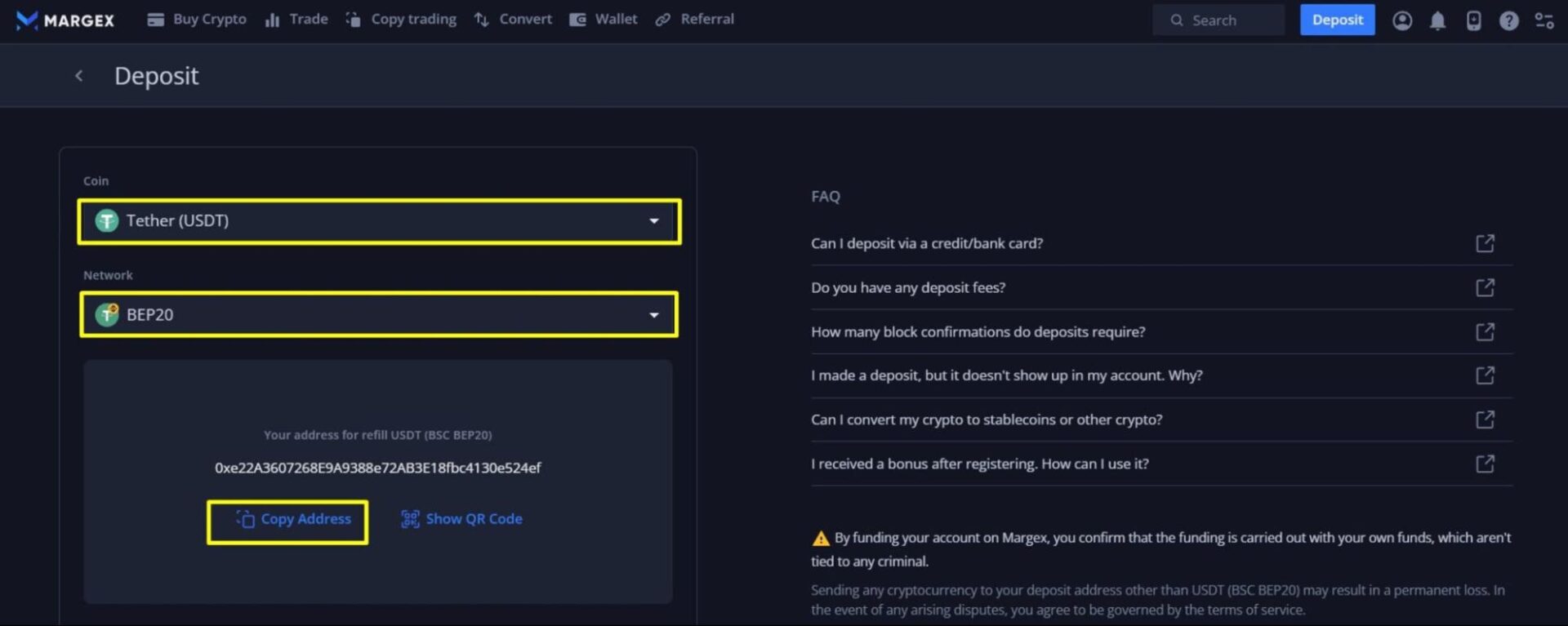

Step 2: Deposit Funds

There are two ways to buy crypto on the Margex Exchange, and they are explained below:

- Deposit Crypto: Go to the Wallet section and select Deposit. Choose your preferred cryptocurrency (e.g., BTC, ETH, USDT) and copy the deposit address. Transfer the crypto asset from your external wallet or another exchange to fund your account.

- Buy With Fiat Currencies: If you don’t have crypto in an external wallet, you can use the “Buy Crypto” service available on Margex to fund your account. On the same page, click “Buy Crypto,” then select the fiat currency, choose the crypto you wish to buy, and pick a supported payment method. Complete the payment through the third-party payment provider, and your crypto will be deposited directly into your Margex wallet.

Step 3: Choose a Trading Pair

Once your crypto has been deposited into your trading account, go to the Trade section and select the crypto pair you want to trade (e.g., ETHUSD). Margex offers multiple perpetual contract pairs, allowing you to go long or short with leverage.

Step 4: Set Your Trade Parameters

Pick your order type (market, limit, or stop order), set your trade size, choose your leverage level, add optional stop-loss/take-profit settings to manage risk, then select the margin mode between cross and isolated margins.

For cross margin, your entire available balance in the selected collateral is shared across positions to maintain margin. This reduces the chance of immediate liquidation on a single position because extra equity from your account can be used to cover losses. Still, it also means losses on that position can eat into your other asset balances.

On the other hand, isolated margin mode allows you to allocate a fixed amount of margin to the position. Liquidation can happen faster here than in cross margin, but losses are limited to that allocated amount, so your other funds are protected if the position is liquidated.

Step 5: Place and Monitor Your Trade

After setting your trading parameters, click Buy/Long if you expect the price of the base asset to rise, or Sell/Short if you expect it to drop. Monitor your open positions in the Positions tab, and close them manually or let them close automatically based on your preset targets.

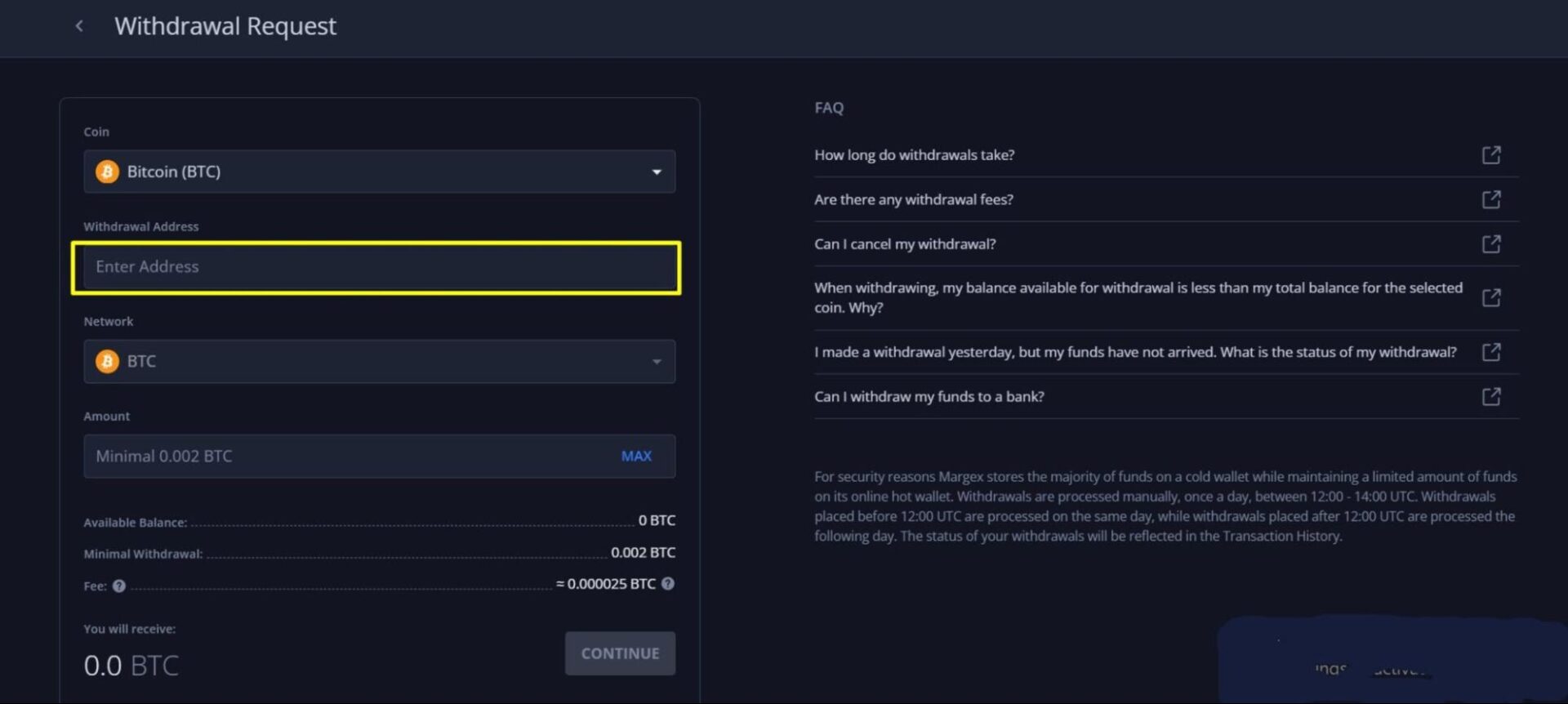

Step 6: Place a Withdrawal Request

Go to the “Wallet” section and click “Withdraw”. From there, select the cryptocurrency you want to withdraw, indicate the network, enter the destination wallet address, and specify the amount you wish to withdraw. Review the information carefully and confirm the request. Margex processes withdrawals once daily at scheduled times, so your funds will be sent in the next processing batch.

Pro Tip: Remember to use the Margex bonus code during registration for a chance to claim up to $10,000 in welcome bonuses. If you are exploring other crypto exchanges and would want to claim new user rewards, get the current Margex referral codes for fee discounts and monetary rewards on some of the best exchanges in this crypto sign up bonus compilation.

The post Margex Review: Is This Crypto Exchange Legit to Trade Cryptos in 2025? appeared first on CryptoNinjas.

You May Also Like

XCN Rallies 116% — Can Price Hold as New Holders Gain?

Worldcoin Price Near $0.65 Faces Pressure as Whales Sell Into the Rally