Kraken backs Trump accounts in Wyoming over crypto alignment

Kraken has joined a growing roster of crypto firms aligning with a White House-backed savings concept for American children, signaling how policy-friendly states can shape industry participation. The exchange is the latest to back the Trump Accounts program for children under 18, a pilot initiative that pairs public seed funding with private sector engagement. The move was publicly framed by Wyoming lawmakers as part of the state’s broader effort to cultivate a crypto-friendly climate from its governance to its regulatory environment. Kraken’s leadership said the decision reflects a broader philosophy: that early financial opportunity should be accessible and affordable, a sentiment echoed by Wyoming officials who tout a regulatory framework they deem thoughtful and responsible.

Key takeaways

- Wyoming Senator Cynthia Lummis publicly announced Kraken’s commitment to fund Trump Accounts created for newborns in Wyoming, highlighting the state’s role in the program.

- Kraken’s co-CEO Dave Ripley pointed to Wyoming’s “thoughtful, responsible crypto policy” as a key reason for establishing the firm’s global headquarters there.

- The Wyoming government’s support is linked to Kraken becoming the US’s first Special Purpose Depository Institution (SPDI) and its involvement with Frontier Stable Token.

- Trump Accounts represent a new type of retirement vehicle for minors, with a federal pilot seed of $1,000 per eligible newborn born between 2025 and 2028.

- Traditional banks such as JPMorgan, Bank of America, and Wells Fargo have publicly supported the Trump Accounts program, reflecting broad financial-system engagement beyond crypto-native firms.

Sentiment: Neutral

Market context: The development sits at the intersection of evolving crypto policy, state-level regulatory experimentation, and a broader push from traditional financial institutions to participate in innovative savings tools tied to the digital asset ecosystem. The Trump Accounts program, paired with Wyoming’s SPDI designation and Frontier Stable Token efforts, underscores how policy and geography can influence where crypto-related financial products take root.

Why it matters

The disclosure underscores Wyoming’s continuing appeal as a hub for crypto business. By positioning Kraken’s headquarters in a state that touts a long-running stance toward cryptocurrency policy, the firm signals that regulatory predictability is a meaningful competitive advantage in an industry prone to policy shifts. The combination of SPDI status and Frontier Stable Token development frames Wyoming as more than a duty-bound regulatory sandbox; it’s a launchpad for projects seeking stable, regulated rails for crypto-based savings and custody solutions.

From a consumer perspective, the Trump Accounts program could broaden access to long-term savings for families. If the federal seeds of $1,000 per newborn are distributed through a controlled, retirement-style vehicle, early access and compounding effects could have tangible effects on education and financial security for the next generation. However, the exact scope and funding mechanics of Kraken’s pledges—and how they will be allocated across eligible newborns—remain to be disclosed, leaving room for questions about total funding and administrative overhead.

Beyond crypto-native players, the involvement of major banks in supporting Trump Accounts suggests a broader commitment to integrating innovative savings vehicles into the mainstream financial system. The collaboration between public programs and private institutions could help normalize crypto-adjacent products in everyday financial planning, while also drawing scrutiny over governance, disclosure, and consumer protections. For observers, the evolving narrative raises questions about how such programs will balance public incentives with private sector risk, especially in markets that remain volatile and highly regulated.

The broader ecosystem has already seen crypto-adjacent firms extending benefits back to their home markets. In a related thread, Polymarket opened a free grocery store in New York City and pledged to donate millions of meals across the five boroughs, demonstrating a philanthropic approach to public-facing crypto initiatives. The move followed Kalshi’s fruitfully timed outreach, including a $50 grocery giveaway to residents in Manhattan, illustrating how prediction markets and related platforms are leveraging on-the-ground community support to build familiarity with their products.

Kraken’s blog post emphasizes the state’s role in enabling Silicon Valley–style innovation at a regional scale, with the Frontier Stable Token mentioned as a case study in Wyoming’s effort to expand stable, on-chain financial offerings. The combination of SPDI capabilities and state-backed support signals a model where government policy can align with corporate investment to create a more accessible crypto-enabled financial future, at least for a segment of the population.

As the sector weighs these developments, observers will be watching how the Trump Accounts pilot unfolds in practice, including how much funding is ultimately allocated by Kraken and other participants, how custodial arrangements are handled, and what guardrails are put in place to protect minors’ savings. The stakes extend beyond Wyoming’s borders: the outcome could influence how other states approach crypto policy, how Wall Street and fintechs collaborate on new savings vehicles, and how regulators assess the balance between innovation and consumer protection in youth-focused financial instruments.

Moreover, the narrative around corporate giving is evolving alongside regulatory signaling. The Trump Accounts initiative, backed by high-profile financial names, frames a broader movement where the private sector collaborates with federal and state programs to seed opportunities for younger generations. In this environment, Wyoming’s policy environment and Kraken’s leadership may serve as a proving ground for what a coordinated public-private approach to crypto savings can look like in the United States.

What to watch next

- Disclosure of Kraken’s per-child funding commitments and total pledged amount for Trump Accounts in Wyoming.

- Clarification of how Trump Accounts will be seeded by the federal program (Jan 1, 2025 to Dec 31, 2028 window) and the mechanics of ongoing contributions.

- Progress updates on Frontier Stable Token, including regulatory milestones and adoption by Wyoming residents or institutions.

- Additional corporate participants revealing commitments to Trump Accounts or similar state-led crypto savings initiatives.

- Regulatory developments in Wyoming and other states that could influence SPDI operations, crypto custody, and youth-focused financial products.

Sources & verification

- Kraken blog post Sponsoring Wyoming Trump Accounts detailing SPDI status and Frontier Stable Token context.

- Senator Cynthia Lummis X status announcing Kraken’s funding for newborn Trump Accounts in Wyoming.

- Dave Ripley’s X status confirming Kraken’s Wyoming HQ rationale and policy stance.

- Polymarket X status announces a free grocery store in New York City and a plan to donate 3 million meals across the five boroughs.

Kraken backs Trump Accounts in Wyoming as state-friendly policy draws crypto firms

Kraken has become the latest crypto company to align with a Trump administration initiative aimed at expanding savings opportunities for American children. The exchange joined a growing list of supporters after Wyoming’s senator Cynthia Lummis first flagged the development, stating that Kraken would fund all Trump Accounts created for Wyoming newborns as part of the pilot program. The public note from Lummis highlighted the state’s commitment to fostering a robust, future-oriented financial landscape for the next generation.

Kraken’s leadership framed the move within a broader strategic preference for Wyoming, emphasizing the state’s regulatory climate as the primary driver behind establishing the firm’s global headquarters there. Co-CEO Dave Ripley underscored that Wyoming’s policies are deliberate and responsible, aligning the company’s long-term ambitions with a governance framework designed to support innovation while protecting consumers. “We picked Wyoming as our global HQ because it leads with thoughtful, responsible crypto policy. We want to keep investing back in the community we call home. Starting early matters, and innovation should make long-term financial opportunity more accessible and affordable,” Ripley said in a post attributed to him on X.

Kraken’s published remarks also drew attention to the state’s role in enabling institutional frameworks such as the Special Purpose Depository Institution (SPDI) charter and the Frontier Stable Token. In a separate blog post, the exchange credited Wyoming officials with enabling its SPDI status and praised the state for helping advance frontier initiatives that blend traditional financial rails with digital assets. This alignment with SPDI and Frontier Stable Token signals a broader strategy to anchor crypto services in a jurisdiction perceived as stable and policy-forward.

Under the Trump Accounts framework, these vehicles are a novel form of retirement account designed for minors, financed in part by a federal seed of $1,000 for each child born between January 1, 2025, and December 31, 2028. The idea seeks to pair public funding with private-sector participation to create a foundation for long-term, tax-advantaged savings. While Kraken did not disclose the amount it intends to contribute per eligible newborn, the company confirmed its commitment to participate and noted that discussions with policymakers and state authorities are ongoing.

The broader financial ecosystem has shown varied enthusiasm for Trump Accounts. Prominent banks, including JPMorgan Chase, Bank of America, and Wells Fargo, have publicly supported the initiative to a degree, signaling a warming relationship between traditional finance and crypto-enabled savings products. The convergence of these players around a program meant to seed children’s savings illustrates a cross-industry willingness to experiment with governance structures, while raising questions about oversight, transparency, and the long-term performance of such accounts.

Beyond Kraken’s pledge, the broader crypto philanthropy wave has gained visibility in other corners of the market. Polymarket, a blockchain-powered prediction market, opened a temporary free grocery store in New York City, pledging to donate millions of meals across the five boroughs. The restaurant-like store operated for a few days before a coordinated food-donation event on a subsequent Monday, inviting residents to contribute to redistribution efforts. The move, paired with Kalshi’s $50 grocery giveaways to residents in Manhattan, underscores the industry’s willingness to blend community outreach with product education—a strategy aimed at normalizing crypto-enabled services in everyday life.

As Wyoming stands at the center of these developments, Kraken’s public involvement offers a concrete signal to the market: policy clarity, coupled with corporate participation, can accelerate the adoption of crypto-enabled savings tools. The SPDI framework and Frontier Stable Token provide a tangible context for how a state can serve as a testing ground for crypto custody, stability mechanisms, and youth-focused financial products. Investors and participants will be watching not only for the pledged funding totals but for how these initiatives translate into accessible financial opportunities for families across the region and beyond.

https://platform.twitter.com/widgets.js

This article was originally published as Kraken backs Trump accounts in Wyoming over crypto alignment on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

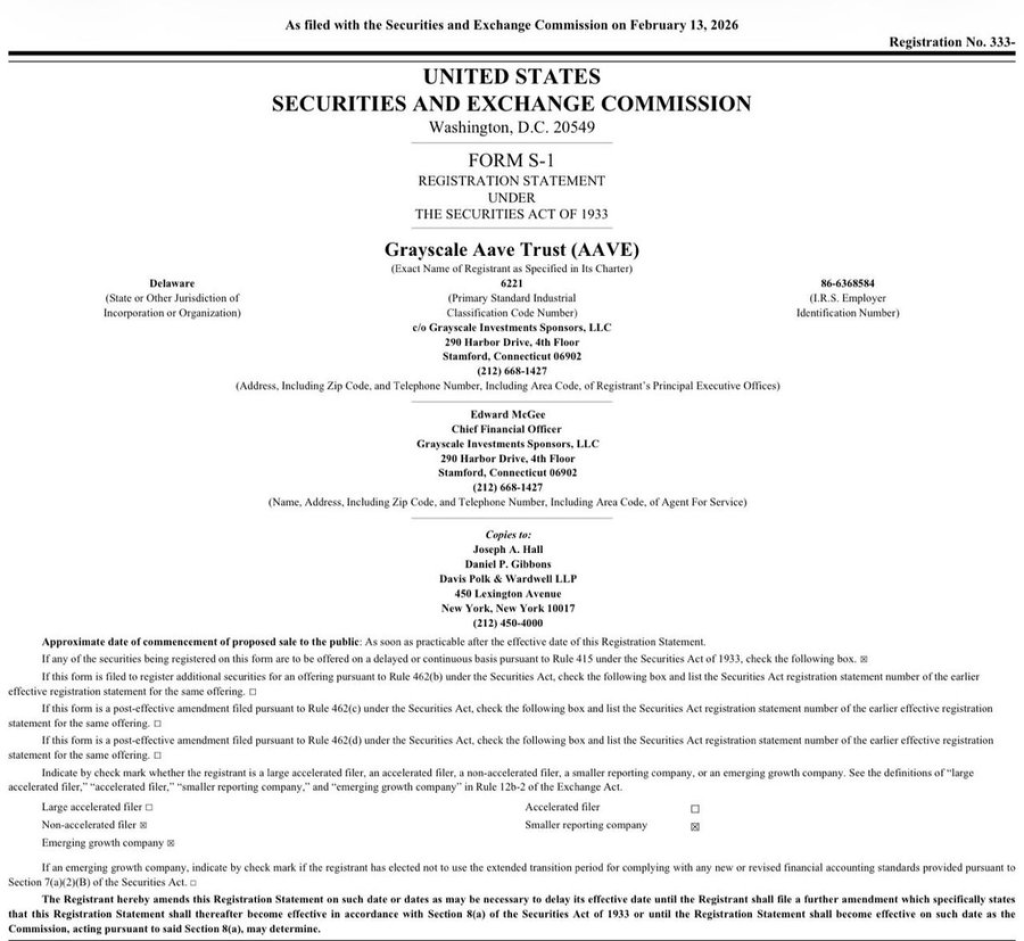

Will SEC Approve the First DeFi ETF? AAVE Filing Sparks Big Question

Wall Street Giants Lead Crypto Hiring Surge: JPMorgan, Citi & More