Top Altcoins to Watch Today, February 17 – AAVE, ETH, HBAR

Highlights:

- AAVE displays bullish potential with strong support between $90 and $110 and could surge 10x from its current position.

- Ethereum is forming a hidden bullish divergence, signaling a potential 140% price surge.

- Hedera’s price is on the upswing, and the bullish trend is supported by positive technical indicators.

The crypto market displays bullish momentum today, with most of the assets trading in green. Bitcoin is holding above $68K while altcoins such as XRP, ETH, and SOL record modest gains. This latest rally has seen the total market capitalization surge by 0.40% to $2.35 trillion. However, the 24-hour trading volume has declined by 15% to $83 billion, indicating decreased activity in the market. Amidst this mixed sentiment in the market, let’s discuss the top altcoins to watch today, such as AAVE, Ethereum, and Hedera.

Best Altcoins to Watch Today

1. AAVE

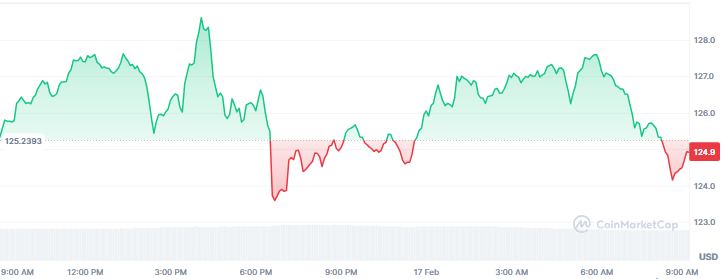

AAVE is down by 0.60% over the last 24 hours to trade at around $124.9. The altcoin has surged by more than 16% on the weekly chart despite the 30-day decline of 26%. Its market capitalization and trading volume stand at $1.94 billion and $420 million, respectively.

Source: CoinMarketCap

Source: CoinMarketCap

AAVE has fallen 86% from its all-time high, touching on a major accumulation zone. AAVE is currently above $120, slightly above a strong support point of $90 and $110. The altcoin has formed a multi-year upward trendline with a clear liquidity sweep and reaction at these crucial levels.

The next breakout seems imminent, and the upside targets lie between $190 and $1,000, making a potential 10x surge from its accumulation zone. Additionally, technical indicators show healthy re-accumulation with a confluence of support at the 0.618 Fibonacci retracement level and an ascending trendline, enhancing the demand area.

2. Ethereum (ETH)

Ethereum is consolidating around the $1,900k region as the bullish momentum prevails. As of this writing, the price is resting around $1,978, with a market capitalization of $240 million. Its trading volume has, however, declined by almost 30% to $18 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Analyst Javon Marks has noted that Ethereum is now shaping a hidden bullish divergence pattern. The oscillator is creating a new low, and the price is exhibiting a higher low, indicating a possible upward trend. This trend indicates a positive movement in ETH’s price.

The Relative Strength Index (RSI) also fits the trend of consistently high lows in the price and further supports the bullish perspective. With this setup, ETH is set to rebound significantly, with the analyst estimating an increase of over 140%, which may even exceed its all-time high of $4,900.

3. Hedera (HBAR)

Hedera has continued its upward journey as the price climbs to $0.100, with a surge of 9.30% over the past 7 days. This latest rally comes on the backdrop of a 14% decline recorded on the monthly chart. Its market capitalization stands at $4.34 billion.

Source: CoinMarketCap

Source: CoinMarketCap

Technical indicators on the daily chart point to a further bullish outlook for the altcoin. The price has formed a series of green candlesticks after bouncing off from the key support around the $0.6900 level. Currently, the price is testing the trendline, which has been acting as a resistance from previous upward rallies.

Source: TradingView

Source: TradingView

Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) suggest that HBAR could continue heading upwards. The MACD is above the signal line, with the histogram printing green bars, indicating a robust bullish momentum. Meanwhile, the RSI is hovering in the neutral region, indicating a long way to go before reaching the overbought region.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

The Italian banking giant held approximately $96 million worth of Bitcoin spot ETFs last December, hedged with Strategy put options.