PDD Holdings (PDD) Stock; Jumps 12% as Q2 Revenue Tops $14.5B

TLDRs:

- PDD Holdings exceeds Q2 revenue estimates with $14.5B, shares surge 12% pre-market.

- Temu and Pinduoduo operator sees adjusted net income fall amid price war pressures.

- Government stimulus aids consumer spending, supporting PDD’s revenue growth this quarter.

- Chinese e-commerce competition squeezes margins despite revenue gains for market leaders.

PDD Holdings, the operator behind China’s Pinduoduo and international platform Temu, reported stronger-than-expected Q2 revenue of 103.98 billion yuan (approximately US$14.5 billion), marking a 7% year-on-year increase.

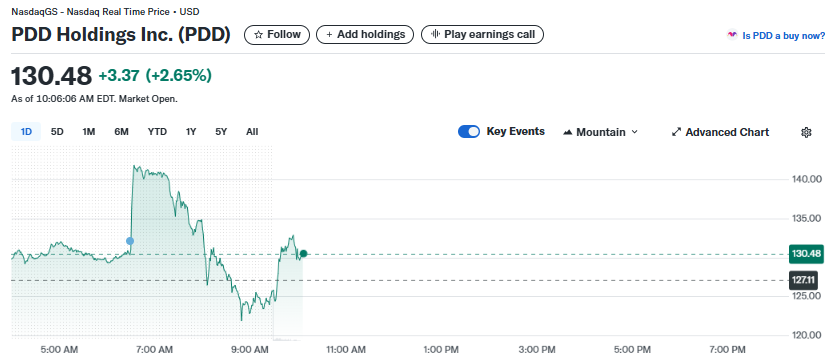

The results exceeded analyst forecasts, driving pre-market trading of PDD shares up nearly 12 % in the United States.

The growth comes as PDD continues to leverage both its domestic and international operations, balancing the rising competition in the Chinese e-commerce sector while expanding its presence overseas through Temu.

PDD Holdings Inc. (PDD)

PDD Holdings Inc. (PDD)

Net Income Declines Amid Price War

Despite the revenue beat, adjusted net income fell to 32.71 billion yuan (US$4.6 billion), down from 34.43 billion yuan (US$4.8 billion) in the same period last year.

Analysts attribute this decline to aggressive pricing strategies employed across the sector, where PDD, JD.com, and Alibaba have increasingly offered steep discounts to attract customers.

JD.com recently announced a 10 billion yuan subsidy program for food delivery, highlighting the widespread impact of price wars on earnings.

Government Stimulus Supports Spending

PDD’s revenue growth also benefited from government efforts to boost domestic consumption amid economic challenges.

China’s retail sales grew 6.4% year-on-year in May 2025, the fastest pace since December 2023, fueled by consumer goods trade-in programs that saw household appliance sales rise 53%.

The Chinese government’s stimulus efforts, including an initial 200 billion RMB program later expanded by an additional 300 billion RMB, have helped sustain consumption momentum. However, analysts caution that these gains remain fragile, as consumer confidence continues to lag and household savings rates remain high.

Market Implications and Outlook

The quarterly results highlight the pressure on margins faced by e-commerce leaders in China. While PDD’s revenue performance is encouraging, the decline in net income underscores the challenges posed by competitive pricing and subsidy-driven customer acquisition.

The extended US-China tariff truce also appears to have stabilized Temu’s international operations, providing a degree of predictability for cross-border growth. Market watchers note that while the short-term revenue boost is positive, longer-term profitability may remain constrained until price competition eases or operational efficiencies improve.

As Chinese e-commerce firms navigate these dynamics, investors will be closely monitoring both revenue growth and margin trends in upcoming quarters. PDD’s ability to balance aggressive expansion with sustainable profitability will likely determine its stock trajectory in the months ahead.

The post PDD Holdings (PDD) Stock; Jumps 12% as Q2 Revenue Tops $14.5B appeared first on CoinCentral.

You May Also Like

Fed rate decision September 2025

GBP/USD rallies as Fed independence threats hammer US Dollar