Is Bitcoin entering its most bearish period? Bear‑market signals now

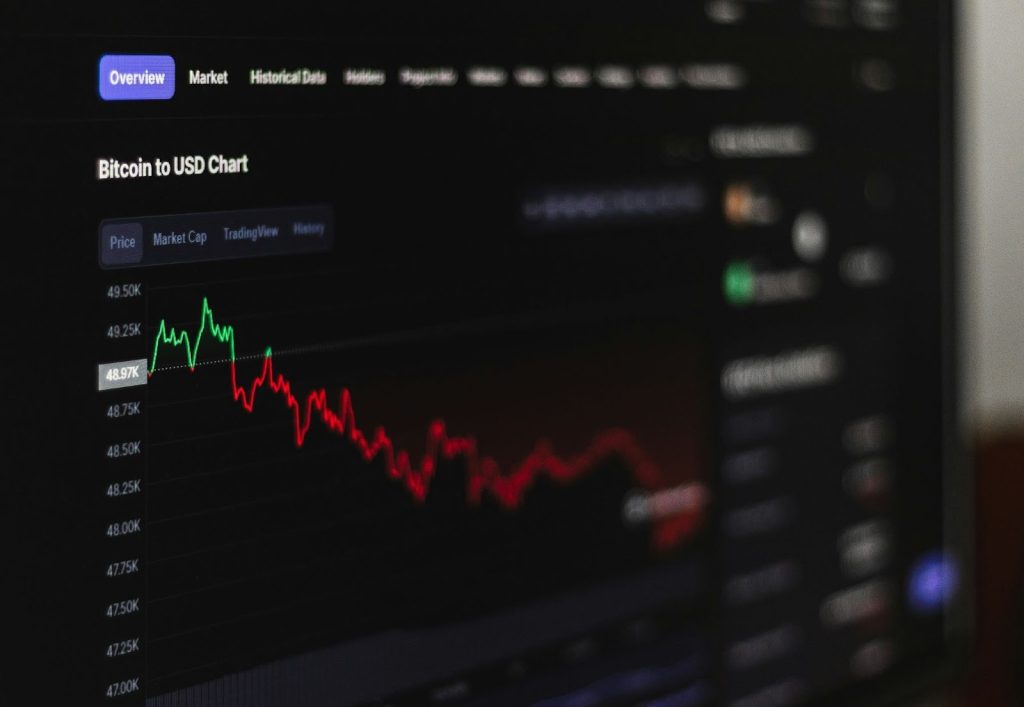

Bitcoin is on track to equal its most bearish period in history, with multiple monthly declines accumulating into early 2026, as reported by CryptoSlate. The outlet notes that a negative February and March would risk tying the longest monthly losing streak since 2018, intensifying debate over whether a Bitcoin bear market is taking hold.

The pattern emerging now blends structural pressures familiar from prior downcycles with newer drivers tied to spot Bitcoin exchange-traded funds. While labels can lag reality, the confluence of flow, macro, and technical stress has pushed “Bitcoin bear market” signals into focus.

Why it matters now: ETF outflows, macro pressure, technical breaks

Macro positioning adds a second headwind alongside ETF flows. According to Bitget’s report on a Bank of America update, investor positioning against the U.S. dollar has reached an extreme, a setup often associated with cross‑asset volatility. In such environments, liquidity can prove pro‑cyclical, and crypto markets have historically been sensitive to abrupt shifts in dollar sentiment.

Technical structure has also weakened. As reported by Yahoo Finance, analysts highlight “death cross” dynamics and failed support retests as evidence that momentum has deteriorated, increasing the risk that rallies fade at resistance. In this context, breakdowns below key trend indicators tend to reinforce a cautious bias until breadth and volume improve.

Against this macro‑technical backdrop, some institutional researchers argue that the market is discounting unusually bleak growth conditions. “Bitcoin is priced for a worse macro outlook than during the COVID crash or the FTX collapse,” said André Dragosch, Head of Research at Bitwise Asset Management. That perspective helps explain why sentiment appears fragile even when headline catalysts are limited.

At the time of this writing, price context underscores the pressure. Finance Magnates reported Bitcoin holding near $68,250, with Ethereum testing $2,000, while XRP traded around $1.49 and Dogecoin near $0.10. Such levels reflect a market that has struggled to reclaim prior highs as risk appetite cools.

Spot Bitcoin ETF outflows: how redemptions pressure spot markets

Spot Bitcoin ETFs have recently posted massive outflows, as reported by Coinpaper, a pattern that typically translates into net selling of underlying BTC when issuers meet redemption requests. The figures indicate that this sell‑to‑redeem pathway can amplify spot‑market pressure during withdrawal waves, particularly when primary‑market redemptions and secondary‑market liquidity interact. In practice, this transmission channel helps explain why persistent ETF redemptions can coincide with weaker price action and more defensive positioning.

| Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial, investment, legal, or trading advice. Cryptocurrency markets are highly volatile and involve risk. Readers should conduct their own research and consult with a qualified professional before making any investment decisions. The publisher is not responsible for any losses incurred as a result of reliance on the information contained herein. |