Monero (XMR) Price Boosted by Report on Darknet Usage and Network Trends

- Monero recorded a sharp rise to hit an intra-day high of $344 after a report by TRM Labs broke down its resilience in the face of exchange delistings.

- The report also revealed that the network’s share of the darknet market has shot up, with half of all new markets now supporting XMR only.

Monero surged 8.9% earlier today to hit an intra-day high of $343.88 as market sentiment around its XMR privacy coin improved following a recent report by TRM Labs.

At press time, XMR trades at $332.5, with its market cap at $6.13 billion. Trading volume dropped 12% to $66 million. Despite recent gains, the token has shed 44% of its value since mid-January.

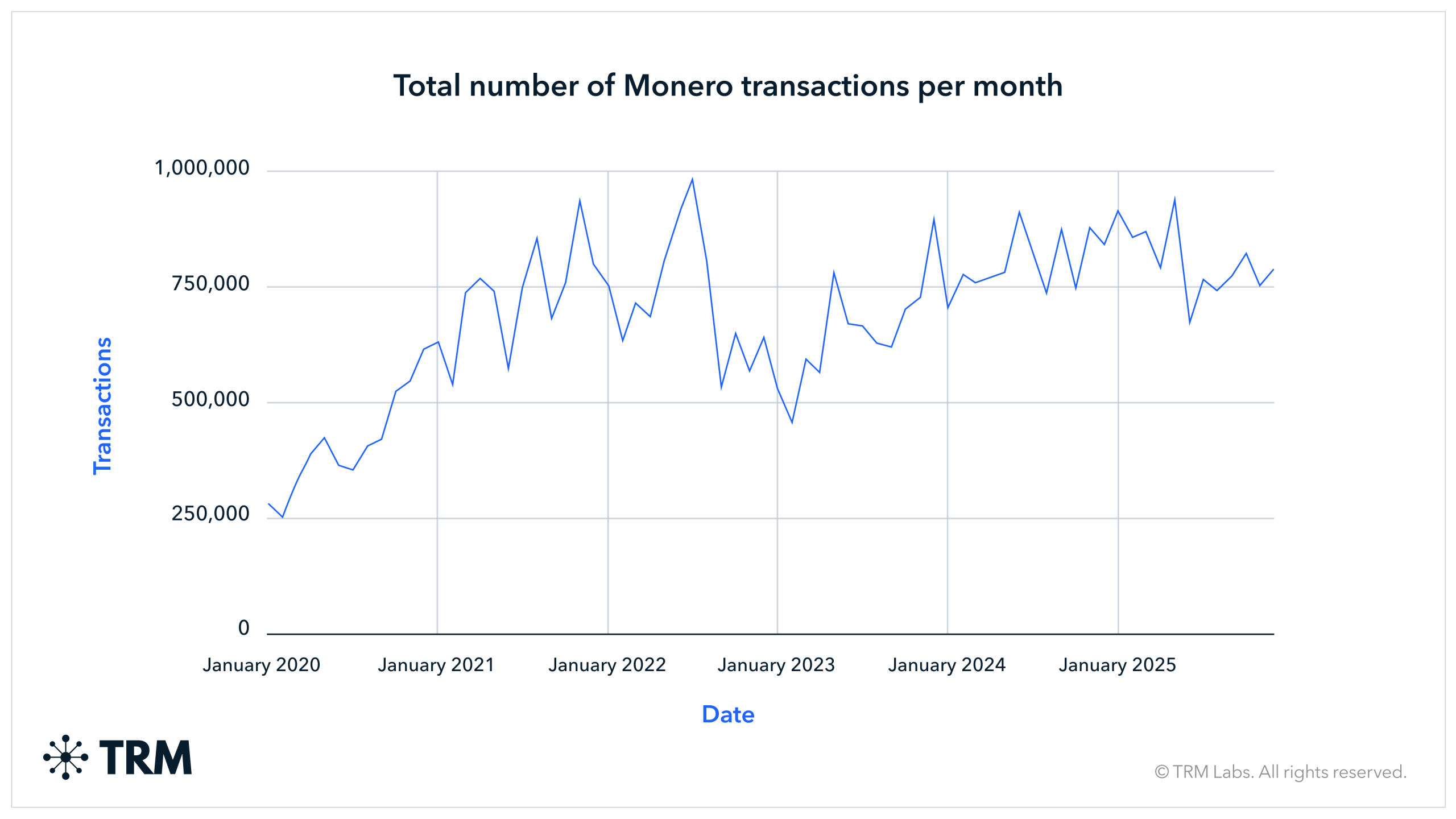

The TRM Labs report revealed that Monero’s transaction activity has remained stable in recent months, despite widespread delistings as regulators clamp down on privacy-focused coins. The transactions have held steadily above the pre-2022 levels, TRM says.

Image courtesy of TRM Labs.

Image courtesy of TRM Labs.

The report attributes this resilience to a growing need for privacy even as regulators infiltrate crypto networks with the latest surveillance tools. The steady numbers “suggest sustained demand and regular use rather than episodic or speculative spikes.”

The consistent usage comes despite a coordinated XMR delisting from dozens of major exchanges, including Binance, OKX, HTX, Kraken and Coinbase. Some reports claimed that at least 70 exchanges delisted the token last year.

Monero’s Darknet and Ransomware Supremacy

Monero continues to shine in the darkweb markets. Last year, nearly half of all new darknet marketplaces said the only crypto they would support was XMR, with prior leaders USDT and BTC losing favor as privacy becomes vital. Ransomware actors have also expressed a strong preference for XMR, but BTC still has a stranglehold over the actual real-world ransom payments.

“While Monero represents a smaller share of overall cryptocurrency transaction activity compared to major transparent networks, its transaction volumes remain substantial and persistent given its specialized role,” the report notes, adding:

The network’s privacy features will be further enhanced with the implementation of the Full-Chain Membership Proofs (FCMP++). As CNF reported last month, the Monero team said there has been massive progress in their development. FCMP++ will replace the existing ring signature model, enhancing the anonymity of the transactions.

But while FCMP++ will boost privacy, the TRM Labs report noted that there has been infrastructure concentration on the network in recent years where a small number of hosting environments accounted for an outsized share of peers. This could allow such nodes to decipher the transaction origination or relay paths, reducing the anonymity that the network is renowned for.

]]>You May Also Like

NVIDIA Partners With India’s Top Manufacturers in $134B AI Factory Push

Tesla's brand has gone negative, says investor who wants Rivian to buy the EV business