Ethereum Holds $2,050 as Whales Accumulate During Consolidation

Key Insights

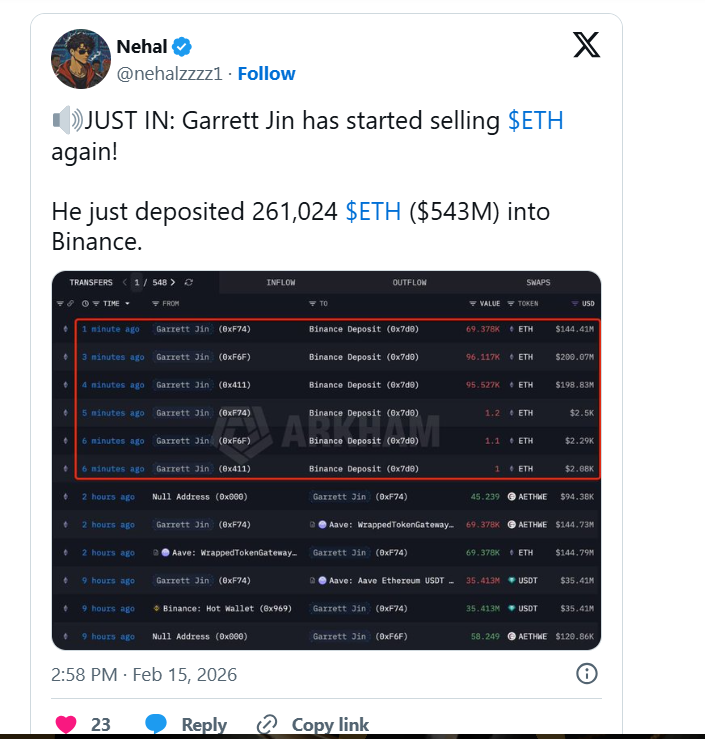

- Ethereum whale Garrett Jin transferred 261,024 ETH worth $543M to Binance, indicating a possible selling pressure.

- The large institutional investors, such as Ark Invest and BlackRock, keep loading the Ethereum exposure at the bottom.

- Bullish divergence and on-chain accumulation indicate a potential bottom in the Ethereum price around $1,900.

Ethereum has stabilized near $2,050 as major whale wallets increase holdings. On-chain data reveals large transfers and strategic accumulation despite market weakness.

The early investors, such as an Ethereum ICO participant, are still actively shaping the price action years after remaining silent. This merge comes as ETH trades below $2,000, and technical indicators suggest a trend reversal.

Ethereum Whale Transfers $543M ETH to Binance

Data shows that the well-known Ethereum whale, Garrett Jin, transferred about 261,024 ETH to Binance in three transactions. These transfers are approximately 543 million at current prices. Large-scale deposits to centralized exchanges often precede selling activity, creating short-term liquidity pressure.

Source. X

Source. X

Garrett Jin has been active since the 2011 Bitcoin era. Wallets tied to the name still hold over 800,000 ETH. The recent transfers represent a significant portion of past holdings. Earlier in February, Vitalik Buterin also sold ETH during a sharp dip. Those sales weakened sentiment further.

Wall Street interest persists despite the dip. BlackRock increased its BitMine stake by 166% to $246 million by late 2025. Cathie Wood’s Ark Invest added over 200,000 shares across three Ethereum-related ETFs last week. Institutions keep building exposure even as price lingers below all-time highs.

Fundstrat’s Tom Lee sees signs of a bottom. He cited extreme pessimism and weak price action. Lee used Tom DeMark indicators, suggesting Ethereum might find support around $1,890. Current levels sit just above that zone.

On-Chain and Technical Signals Suggest Ethereum May Stabilize

The 4-hour chart displays bullish divergence. Price made lower lows from February 10 to 14. The Relative Strength Index formed higher lows over the same period. This pattern often precedes reversals. The MACD histogram is flattening, suggesting a possible shift in momentum toward upward movement.

ETH/USD 4-hour price chart | Source: TradingView

ETH/USD 4-hour price chart | Source: TradingView

Large-volume nodes in the $2,020-$2,080 range around areas of equilibrium offer a foundation for buyers. The nearest resistance lies at $2,150, and a breakout above this level will likely trigger short covering and a further rise.

Moreover, one of the significant Ethereum ICO wallets attempted to deposit 1 ETH to Gemini after 10.6 years. This was because the transaction failed due to low gas prices. This wallet initially placed money in the form of 443 and was given 1,430 ETH, which is currently worth $2.81 million – a 6,335x bet.

The increased ETH inflows into accumulation are a sign that whales have no qualms. Long-term holders get a chance as retail investors are giving up.

Ethereum is still 60% below its all-time high. On-chain indicators indicate that support is accumulating around the current level, and another possible bullish move can be observed if the key resistance is broken.

The post Ethereum Holds $2,050 as Whales Accumulate During Consolidation appeared first on The Coin Republic.

You May Also Like

Nevada’s Legal Clash with Financial Prediction Platform Intensifies

XRP Price Faces Big Risk — But Smart Money Bets on 30% Rally