XRP Quietly Crushes SOL and Now Targets BNB as $354M Floods Into Tokenized Assets

A fresh data point from TheCryptoBasic places XRP at the center of a fast-changing race inside the tokenized real-world asset market. The post explains that XRP moved ahead of Solana after adding $354M in RWA value within 30 days.

Price weakness across the broader crypto market did not stop that expansion. Tokenization activity on the XRP Ledger kept growing even as sentiment across major assets stayed cautious.

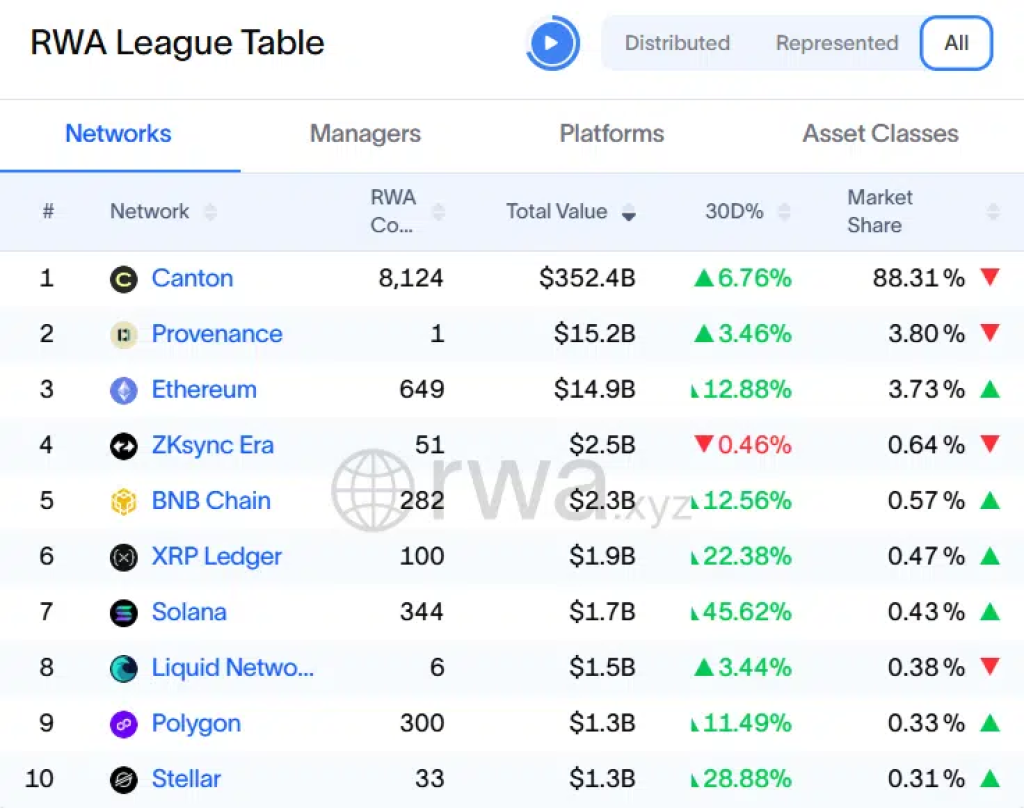

Total RWA value on XRPL now stands near $1.874B, after assets are distributed and counted, with stablecoins excluded. That figure positions XRP as the sixth-largest network in tokenized assets.

BNB Chain ranks fifth with about $2.3B. Solana sits lower with roughly $1.7B. The gap between XRP and BNB now looks narrow enough to watch closely over the coming weeks.

XRP Tokenized Asset Growth Changes The Competitive Order Between Solana SOL And BNB

TheCryptoBasic notes how XRPL climbed past Solana during this recent expansion phase. That move matters because SOL has often been viewed as a strong infrastructure layer for tokenized finance.

@thecryptobasic / X

@thecryptobasic / X

XRP now shows measurable strength in the same category. Growth of $354M within one month signals active usage across token issuance and representation of real-world value on the ledger.

Distance between XRP and BNB remains close to $400M in tokenized assets. Such a margin can close quickly if current activity continues at a similar pace. BNB still controls a larger base today.

XRP now holds visible momentum inside this specific metric. Competition between these networks therefore looks more balanced than before.

The attached chart reinforces this ranking structure through a visual ladder of RWA totals. BNB appears slightly ahead. XRP follows just below. Solana remains behind both networks.

Size of the bars or figures shows how a single month of inflow reshaped the order without requiring a broad market rally. That contrast between weak prices and strong tokenization growth forms the key takeaway from the data shared by TheCryptoBasic.

Ripple Ecosystem Utility Expands Even As XRP Market Price Stays Under Pressure

Ripple’s long focus on real-world financial connections gives context to this development. Tokenized assets align with settlement infrastructure and cross-border finance.

Expansion of RWA value on XRPL, therefore, signals deeper network usage beyond speculative trading. Market price and network utility do not always move together in the short term. Current conditions show that separation clearly.

Read Also: Is Gold a Good Investment? Paper vs Physical Gold Is at an All-Time Extreme

TheCryptoBasic frames the next milestone around the remaining $400M gap between XRP and BNB. Closing that distance would move XRPL into the fifth position among tokenized asset networks. Such progress would strengthen the narrative around Ripple’s infrastructure role inside digital finance.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post XRP Quietly Crushes SOL and Now Targets BNB as $354M Floods Into Tokenized Assets appeared first on CaptainAltcoin.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Strategy's Bitcoin holding cost has fallen for the first time in nearly two and a half years.