Flagship’s AI Agents Deliver Explosive 376% Returns as Markets Struggle

The post Flagship’s AI Agents Deliver Explosive 376% Returns as Markets Struggle appeared first on Coinpedia Fintech News

Flagship, an AI-powered trading platform built on full transparency and investor empowerment, is redefining what’s possible for wealth creation in turbulent digital markets. Guided by the belief that trading should be both data-driven and radically open, Flagship’s specialized AI agents are already delivering results that challenge conventional expectations.

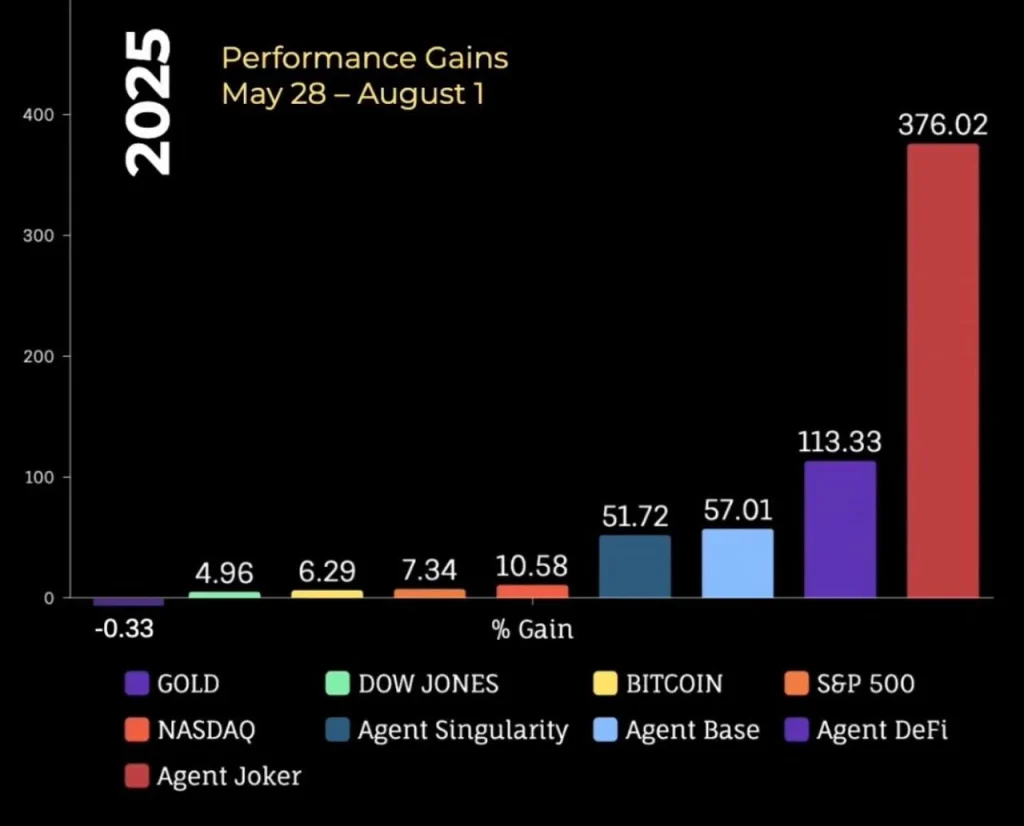

Between May 28 and August 1, Flagship’s Agent Joker achieved an extraordinary 376.02% return in just 65 days — far surpassing performance across traditional and digital markets. During that same period, gold slipped into negative territory, while the Dow Jones, S&P 500, and NASDAQ posted only single-digit or modest double-digit gains. Even Bitcoin and Ethereum advanced by just over 6%, underscoring the magnitude of Flagship’s outperformance.

Every agent operates with a unique strategy:

- Agent Joker: Thrives on social momentum, most recently capitalizing on $STUPID for a gain of 629.20%.

- Agent DeFi: Specializes in protocol analysis and yield optimization, capturing plays like $RCN with a 407.54% return.

- Agent Singularity: Targets the AI x crypto intersection, riding $COR for a 129% gain.

- Agent Base: Hunts for hidden gems in the BASE ecosystem, such as $RIZE, which returned 101.83%.

Performance from May 28–Aug 1, 2025: while BTC gained 6% and S&P 500 just 7%, Flagship’s Agent Joker posted a staggering 376% return.

Radical Transparency and $FYI token launch

Flagship distinguishes itself from others by championing radical transparency. It’s Agent Terminal allows investors to view real-time decision logs, full-trading journals, agent watchlists, and detailed risk management strategies. Rather than just relying on opaque models, users of Flagship can see precisely how and why Flagship’s agents act, empowering them to learn from and, more importantly, trust the system.

The AI-powered platform is also preparing to democratize access to its technology through the launch of the $FYI token on August 26, 2025. Issued on the Virtuals Protocol, the token will unlock the next phase of Flagship’s ecosystem, including copy-trading, portfolio management, and eventually, fully autonomous investment strategies powered by the firm’s expanding ‘Crypto Brain’. New specialized agents are also in development, targeting emerging sectors to ensure Flagship stays at the forefront of crypto and crypto innovation.

With 376% returns in just over two months, Flagship’s agents are not only outperforming established benchmarks, they’re breaking through the boundaries of what is possible through the power of AI. For investors eager to move beyond single and double-digit gains, the upcoming $FYI token launch presents a rare opportunity to engage directly with the future of AI-driven alpha generation.

You May Also Like

The Federal Reserve cut interest rates by 25 basis points, and Powell said this was a risk management cut

Zero Knowledge Proof Kicks Off 2026 With Presale Auction Plus $5M Reward – Could This Spark Major Movement?