SharpLink Gaming (SBET) Stock: Analysts Predict $40 Target as ETH Reserves Pass 800K

TLDR

- SharpLink Gaming purchased $252 million in Ethereum last week, bringing total holdings to 797,704 ETH worth $3.7 billion

- The company has $200 million remaining for additional ETH purchases and earned 1,799 ETH in staking rewards since June

- Board approved a $1.5 billion stock buyback program to enhance shareholder value while continuing crypto strategy

- Stock has surged 150% this year but closed Monday at $0.96, down 6.8% for the day

- Analysts suggest the stock could potentially reach $40 if Ethereum climbs to $6,000-$7,000 levels

SharpLink Gaming made a massive move last week with a $252 million Ethereum purchase. The Minneapolis-based company now holds 797,704 ETH tokens worth approximately $3.7 billion.

The gaming company acquired 56,533 ETH at an average price of $4,462 per token. This latest purchase shows the firm’s commitment to its cryptocurrency treasury strategy launched in June.

SharpLink raised $360.9 million through its at-the-market equity program to fund the purchase. The company maintains $200 million in cash reserves for future ETH acquisitions.

Co-CEO Joseph Chalom said the execution shows “the strength of our vision.” He emphasized the company’s focus on building long-term shareholder value while supporting the Ethereum ecosystem.

The company has rapidly scaled its ETH holdings since June. Over four weeks, SharpLink increased its position from 438,000 ETH to nearly 800,000 ETH.

This makes SharpLink one of the largest corporate holders of Ethereum globally. The rapid accumulation puts the company in a unique position in the crypto space.

Treasury Strategy Generates Returns

SharpLink has earned 1,799 ETH in staking rewards since launching its treasury strategy. The passive income adds to the company’s growing crypto portfolio.

The firm introduced a new metric called “ETH Concentration.” This measures ETH holdings per 1,000 assumed diluted shares outstanding.

That figure now stands above 4.0, more than doubling since June. The metric helps investors track the company’s crypto exposure relative to share count.

The staking rewards provide additional income beyond price appreciation. This creates multiple revenue streams from the ETH treasury holdings.

Board Approves Major Stock Buyback

SharpLink’s board approved a $1.5 billion stock buyback program. The plan aims to enhance shareholder value while the company continues its crypto deployment.

The buyback provides a dual approach to returning value. Shareholders benefit from both Ethereum price appreciation and share count reduction.

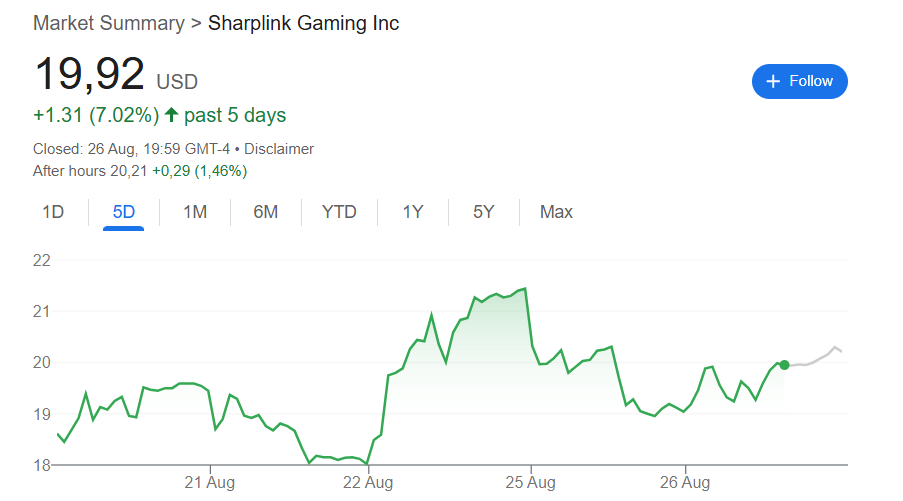

Source: Google Finance

Source: Google Finance

SBET stock closed Monday at $0.96, down 6.8% for the day. After-hours trading showed slight recovery following the ETH purchase announcement.

The stock has gained 150% year-to-date despite recent volatility. Traditional valuation metrics don’t apply as SharpLink operates as a leveraged Ethereum play.

Some analysts believe the stock could reach $40 if market conditions align. This would require Ethereum to climb to $6,000-$7,000 levels consistent with previous bull runs.

SharpLink offers regulated exposure to Ethereum for institutional buyers. Pension funds and insurers seeking crypto exposure face limited options through traditional exchanges.

The company benefits from unique positioning in the crypto space. Chairman Joseph Lubin’s connection to Ethereum’s founding team provides strategic advantages.

Risk factors remain substantial for SBET investors. Sharp crypto market declines would immediately impact the investment thesis.

Government policy changes pose regulatory risks. New corporate crypto taxes or tighter rules could create major headwinds.

SharpLink currently holds $200 million in cash for additional ETH purchases while maintaining its $1.5 billion buyback authorization.

The post SharpLink Gaming (SBET) Stock: Analysts Predict $40 Target as ETH Reserves Pass 800K appeared first on CoinCentral.

You May Also Like

CME Group to launch options on XRP and SOL futures

Adam Wainwright Takes The Mound Again Honor Darryl Kile