SUI Price: Alibaba Partnership Launches as Analysts Eye $4 Target

TLDR

- Sui trades at $3.45 with 3.25% daily gains but faces pressure below key technical levels

- Cetus DEX maintains $170.7 million daily volume while smaller DEXs see massive growth

- Technical analysis shows weakness below $3.50 support with potential drop to $3.20

- Sui partners with Alibaba Cloud to launch AI coding assistant for Move developers

- Open interest rises 3.66% to $1.88B while trading volume drops 14.03% to $5.21B

Sui (SUI) is currently trading at $3.45 with a market cap of $8.06 billion. The token posted 3.25% gains over the past 24 hours despite facing technical challenges.

SUI Price

SUI Price

The network’s 24-hour trading volume reached $2.24 billion. However, price action suggests uncertainty ahead as key support levels come under pressure.

From a technical standpoint, SUI has dipped below its 50-day moving average of $3.69. The token also slipped under the pivot point of $3.46, creating downward pressure.

The MACD histogram sits at -0.0293, indicating bearish momentum remains active. This technical setup makes the coming days critical for price direction.

Source: TradingView

Source: TradingView

Traders are watching the $3.50 level closely as a key support zone. A sustained break above this level could target the $3.70 to $4.00 range.

Failure to hold support may send SUI toward the $3.20 area. The next few sessions will determine which direction the token takes.

DEX Activity Shows Mixed Results

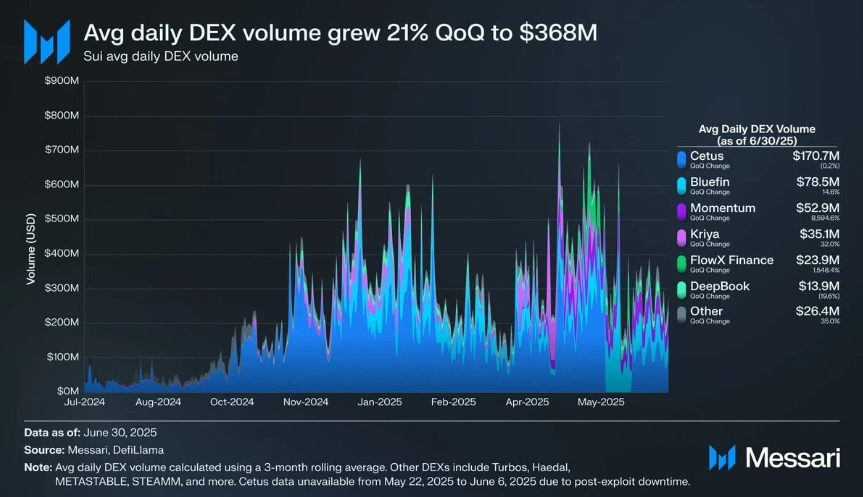

On-chain data reveals uneven growth across Sui’s decentralized exchange ecosystem. Network DEX volume averaged $368 million daily, up 21% quarter-over-quarter.

Source: Messari

Source: Messari

Smaller protocols drove most of this growth. Momentum DEX surged 8,594% while FlowX Finance jumped 1,548%.

Cetus, the largest DEX on Sui, showed no change in volume. The platform maintained its $170.7 million daily volume despite increased competition.

This data suggests users are exploring newer exchanges while established platforms consolidate their positions. The trend indicates innovation is attracting liquidity to emerging protocols.

SUI Price Prediction

SUI’s derivatives market shows mixed signals for future price action. Trading volume fell 14.03% to $5.21 billion over the recent period.

Open interest moved in the opposite direction, rising 3.66% to $1.88 billion. This divergence suggests reduced short-term activity despite locked-in capital positions.

The OI-Weighted funding rate stands at 0.0089%, showing a slight positive bias. Long positions maintain a marginal edge but the low rate indicates balanced market sentiment.

AI Development Tool Launch

Sui announced a partnership with Alibaba Cloud to launch an AI coding assistant. The tool integrates with ChainIDE to support Move programming language development.

Key features include multi-lingual support and real-time security alerts. The assistant also provides integrated documentation to streamline the development process.

The tool aims to reduce entry barriers for Web3 developers. Both experienced and new builders can benefit from automated code generation and vulnerability scanning.

Move Language Enhancement

The AI assistant strengthens Sui’s Move programming language ecosystem. Move has gained attention for its focus on efficiency and safety in smart contract development.

A more accessible development environment could attract additional teams to build on Sui. This would increase network activity and strengthen Sui’s position in the Web3 space.

The integration reflects broader industry trends combining blockchain technology with artificial intelligence. Other projects have launched similar tools to simplify Web3 development.

The native SUI token gained 1% following the AI tool announcement, reaching $3.44 during publication.

The post SUI Price: Alibaba Partnership Launches as Analysts Eye $4 Target appeared first on CoinCentral.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week