Bitcoin Hyper Accelerates Bitcoin’s Development: $HYPER to 100x?

Why don’t more people use Bitcoin?

It’s one of the world’s largest assets, with a market cap of over $2.2 trillion. Bitcoin is divisible – you can spend tiny fractions of it at a time, in even smaller units than traditional dollars and cents. It takes 100 million satoshis to make one Bitcoin.

Since Bitcoin is highly divisible, liquid, and valuable, why isn’t it more commonly used in everyday transactions?That’s just one of the questions Bitcoin developers face. The answers expose some of the problems with Bitcoin’s existing architecture and demonstrate how Bitcoin Hyper ($HYPER) could be the answer.

Bitcoin’s Speed and Scalability Gap

Despite being the largest cryptocurrency by market cap, Bitcoin’s Layer 1 has significant limitations. For example, it can only process around 7 transactions per second (TPS), much lower than Ethereum and Solana’s much higher throughput.

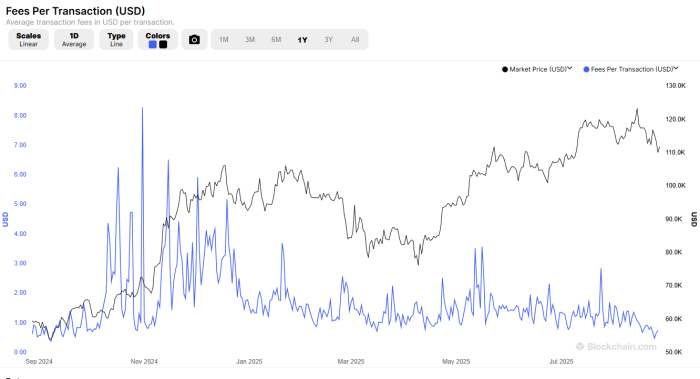

During peak usage, congestion increases, leading to higher fees and longer confirmation times, which makes everyday transactions inefficient.There’s the additional issue that congestion spikes also lead to transaction fees that vary wildly, sometimes spiking dramatically.

Both issues hinder Bitcoin’s adoption as a payment method; nobody wants to pay several dollars in fees for a small transaction.

The lack of programmability also hampers adoption – Bitcoin doesn’t support complex smart contracts, dApps, NFTs, and DeFi natively.

Its simple smart contract design emphasizes security and stability; ideal for a blockchain that focuses on being a ‘store-of-value,’ but less suitable for a more versatile blockchain built with Web3 in mind.

The lack of DeFi, meme-coin ecosystems, and Web3 integrations limits Bitcoin’s role in mainstream crypto innovation. Without the ability to host complex smart contracts or support programmatic financial products, Bitcoin risks being sidelined.

Bitcoin Hyper’s Layer-2 Revolution

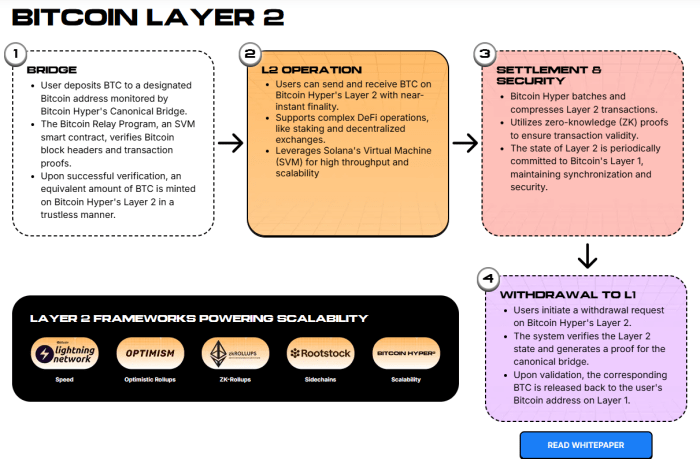

Bitcoin Hyper proposes a Layer-2 solution built atop Bitcoin’s mainnet, but leveraging the power of Solana through the SVM. The new Layer-2 targets transaction speeds of thousands of TPS – a monumental leap from the current 7 TPS average.

Bitcoin Hyper uses zk-rollups and a canonical bridge. It processes bundled transaction batches off-chain before settling them on Bitcoin’s mainnet.

Users transfer BTC into the Layer‑2 ecosystem using Bitcoin Hyper’s Canonical Bridge, wrapping BTC 1:1 to create fungible, fast-moving tokens within Hyper.

And because of the SVM, Bitcoin Hyper integrates true programmability in the form of smart contracts, dApps, NFTs, and DeFi. Learn more about the details of the architecture in the project’s whitepaper.

Ecosystem Token: HYPER

At its core, the $HYPER token drives the ecosystem: used for gas fees, staking, governance, and exclusive access to events and developer tools.

Early backers can earn very high yields as an incentive for presale participation. The current APY is around 90%.Momentum is building fast. The Bitcoin Hyper presale surged past $12M, with massive whale purchases underlining investor confidence.

Whale buys include:

- $161.3K

- $100.6K

- $74.9K

Learn how to buy $HYPER with our guide and see why we think the token price could jump from its current $0.012815 to a whopping $0.32, a 2397% increase.

Why Bitcoin Hyper Could Elevate Bitcoin’s Role in Crypto

If Bitcoin develops into a Hyper-enabled, programmable, DeFi-compatible chain, it could attract a new wave of developers and innovative products. By then, Bitcoin might shift from just a store of value to functioning more like Ethereum—a platform for digital financial innovation.

What is Bitcoin Hyper? It’s the key to a faster, cheaper, programmable Bitcoin. And in turn, the $HYPER token is the key to Layer 2, tied to ecosystem access, staking, and governance.Bitcoin’s recent price momentum—fueled by favorable regulations and Fed sentiment—could support Hyper’s utility story, possibly driving $BTC to new highs.

In fact, Bitcoin Hyper could be launching at just the right time – the latest VanEck report maintained that Bitcoin could reach $180K by the end of the year.

A Vision for Bitcoin’s Next Chapter

Bitcoin Hyper isn’t just another memecoin. It positions itself as the real Layer-2 solution that Bitcoin has long needed – fast, smart, and programmable. By blending Solana-level performance with Bitcoin’s rock-solid foundation, Bitcoin Hyper ($HYPER) is laying the groundwork for an entirely new crypto narrative.

As always, do your own research. This isn’t financial advice.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?