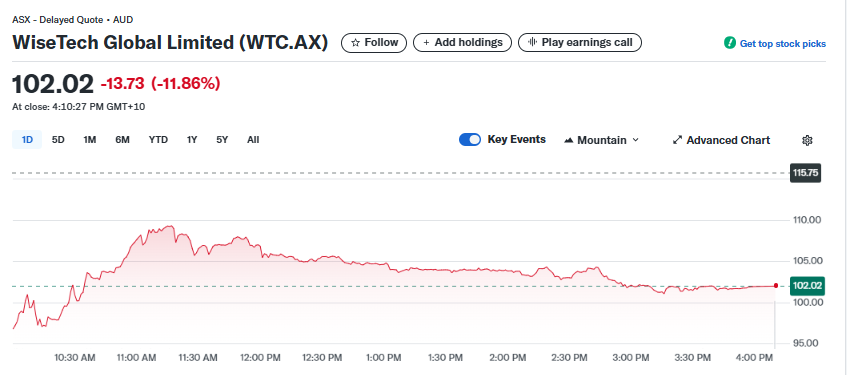

WiseTech (WTC.AX) Stock: Sinks Almost 12% After Missing Full-Year Revenue Estimates

TLDRs;

- WiseTech shares fell nearly 12% after posting weaker-than-expected FY revenue of US$778.7 million.

- A US$2.1 billion E2open acquisition has investors concerned about debt and integration risks.

- Margins are expected to compress to 40–41% EBITDA, compared to 53% previously, adding pressure on profitability.

- WiseTech guided for US$1.4 billion FY2025 revenue, but markets remain skeptical about execution.

WiseTech Global Ltd. (ASX: WTC) suffered one of its steepest single-day declines in recent months, with shares closing down nearly 12% on Wednesday

The Australian logistics software provider reported full-year revenue of US$778.7 million, falling short of analyst expectations of US$796.9 million.

The shortfall marks a rare stumble for the Sydney-based firm, which has enjoyed a consistent growth trajectory in recent years. Investors reacted swiftly, wiping off billions in market capitalization and underscoring growing unease over WiseTech’s ambitious expansion plans.

WiseTech Global Limited (WTC.AX)

WiseTech Global Limited (WTC.AX)

Acquisition Concerns Add to Pressure

In May, WiseTech announced the US$2.1 billion acquisition of U.S.-based supply chain software company E2open Parent Holdings, its largest deal to date.

The transaction, fully funded through debt, pushed WiseTech’s net leverage to 3.5x, raising red flags among analysts about the company’s ability to balance debt servicing with operational growth.

Historically, WiseTech has completed over 55 smaller acquisitions, integrating them successfully into its flagship CargoWise platform. However, the E2open takeover represents a far larger challenge, with integration expected to take 12–36 months. The market now questions whether WiseTech can replicate its past success at a much larger scale.

Margin Compression Raises Questions

Beyond revenue concerns, WiseTech warned of margin pressures in the near term. The company’s EBITDA margins are projected to fall from 53% to between 40–41%, largely due to acquisition-related costs and integration expenses.

While management emphasized that the E2open deal would deliver long-term synergies estimated at US$85–120 million annually by FY2027, short-term profitability dilution appears to have shaken investor confidence. Many analysts see the compression as a signal that WiseTech’s model faces real tests when stretched by mega-deals.

Looking Ahead to 2025 Guidance

Despite current turbulence, WiseTech issued optimistic guidance for the year ahead, projecting US$1.4 billion in revenue for FY2025.

Company executives argue that the E2open acquisition will significantly expand WiseTech’s global footprint and deepen its role in end-to-end supply chain management.

Founder and executive chairman Richard White called the acquisition a “transformational step” for WiseTech, highlighting the combined firm’s ability to deliver broader logistics solutions at scale.

Yet, the timing of the revenue miss has left markets skeptical. Investors appear unwilling to overlook execution risks at a moment when WiseTech is carrying unprecedented debt and managing its most complex integration ever.

If WiseTech can stabilize revenue growth and demonstrate early progress in integrating E2open, confidence may return. For now, however, the market’s verdict remains cautious, with shares retreating sharply from recent highs.

The post WiseTech (WTC.AX) Stock: Sinks Almost 12% After Missing Full-Year Revenue Estimates appeared first on CoinCentral.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week