Samsung Stock: Exclusive Nvidia Vera Rubin Deal Sends Shares to Record High

TLDR

- Samsung reportedly won an exclusive deal to supply HBM4 chips for the premium tier of Nvidia’s next-gen Vera Rubin AI processors.

- Samsung is targeting $700 per HBM4 unit — about 30% higher than the previous generation.

- Bloomberg Intelligence estimates that price point would deliver 50–60% operating margins for Samsung.

- Shares climbed as much as 5.4% on the Korea Exchange, hitting a record high.

- SK Hynix had priced its own HBM4 for Nvidia in the mid-$500s and may now look to raise prices.

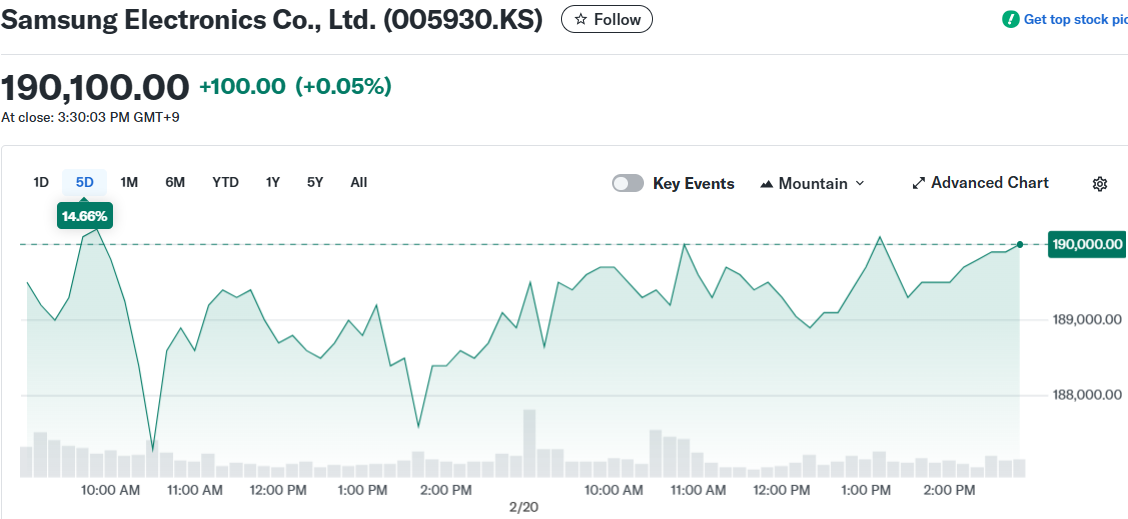

Samsung Electronics shares hit a record high after reports surfaced that it has likely secured an exclusive position supplying the premium tier of Nvidia’s next-generation AI processors.

Samsung Electronics Co., Ltd. (005930.KS)

Samsung Electronics Co., Ltd. (005930.KS)

The stock jumped as much as 5.4% on the Korea Exchange when trading resumed after a three-day holiday, driven by two separate reports from South Korean outlets ChosunBiz and Chosun Ilbo.

According to ChosunBiz, Nvidia plans to divide HBM4 memory suppliers for its upcoming Vera Rubin processors into two tiers — a general-purpose lineup and a high-performance lineup. Samsung is reportedly the sole supplier for that top tier.

While the general-purpose models will make up the bulk of production, the high-end tier is expected to carry higher price margins.

The $700 Price Tag

Chosun Ilbo reported Samsung is targeting around $700 per HBM4 unit — roughly 30% above the prior generation.

Bloomberg Intelligence analyst Masahiro Wakasugi said that price would imply operating margins of 50–60% on Samsung’s HBM4 business. Samsung declined to comment on the figures.

For comparison, SK Hynix had priced its HBM4 chips for Nvidia in the mid-$500 range back in August. Wakasugi noted the pricing gap between the two could narrow in 2026 if Samsung ramps up HBM supply to Nvidia.

Closing the Gap on SK Hynix

Samsung had fallen behind SK Hynix in the early stages of the AI memory cycle, with SK Hynix faster to secure Nvidia supply deals.

That gap is narrowing. Just last week, Samsung announced it had begun mass production of HBM4 chips and shipped commercial products to customers — the first memory producer to reach that milestone.

HBM4 is the most advanced version of high bandwidth memory, a key component in AI chips due to the speed and memory demands of running large AI models.

Nvidia unveiled its Vera Rubin chip lineup earlier this year, with a release scheduled for the second half of 2026.

A global memory shortage has supported both Samsung and SK Hynix this year, helping drive South Korea’s Kospi index up 34% — the world’s best-performing stock market in 2026.

Samsung shares closed up 0.05% on Friday following the earlier record surge.

The post Samsung Stock: Exclusive Nvidia Vera Rubin Deal Sends Shares to Record High appeared first on Blockonomi.

You May Also Like

What Pacers Must Consider In Extensions For Bennedict Mathurin Or Aaron Nesmith

TRON (TRX) Daily Market Analysis 22 February 2026