History Haunts: Bitcoin’s 67% September Loss Rate Fuels Talk of a Curse

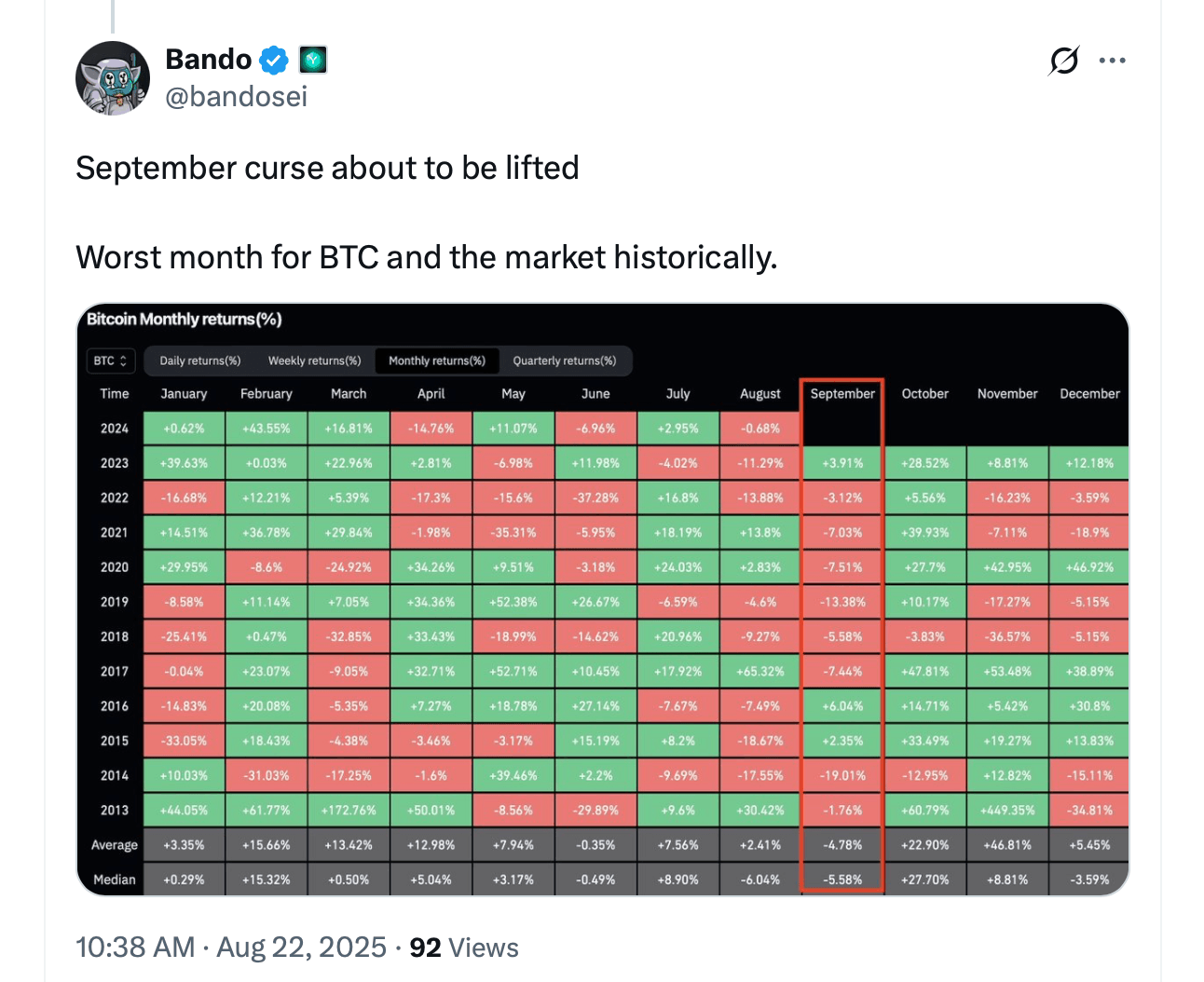

From 2013 through 2024, bitcoin’s September track record has leaned negative, and with August winding down, chatter across social media is filled once again with talk of a “September curse.”

From Repo Spikes to Tax Drains: September’s Mix Could Batter Bitcoin Again

September 2025 is just three days out, and as usual, traders are already weighing bitcoin’s prospects for the month. Historical data from coinglass.com shows the coin has often struggled in September.

It managed gains last year and in 2023, 2016, and 2015. Historically, bitcoin closes September lower about 67% of the time, a pattern that continues to spark conversation.

“For your information, September has long been the worst month for bitcoin returns. Perfect time to stack cheap,” one user commented on X on Monday. Trendspider added to the mix, “September isn’t just tough for stocks. It’s been one of BTC’s weakest months since 2015.”

Illya Gerasymchuk noted that repo rates typically climb and borrowing slows at quarter-end, which includes the month of September. The X account added that Sept. 15 marks the corporate tax deadline in the U.S., a factor that drains global liquidity and often weighs on asset prices like cryptocurrencies.

Some believe, this time around, it will be different due to certain factors.

Some believe, this time around, it will be different due to certain factors.

But while September is often a drag, October and the fourth quarter as a whole have typically brought positive momentum. Bitcoin has closed October in the green 83% of the time. Much like the “September curse,” October has earned its own lore, often living up to the nickname “Uptober.” The streak began in 2013 with a blistering +60.79%.

2014 slipped −12.95%, but 2015 roared back with +33.49%, and 2016 tacked on +14.71%. The 2017 rally surged +47.81%, while 2018 saw a modest dip of −3.83%. Strength returned in 2019 with +10.17%, carried through 2020’s +27.7% and 2021’s +39.93%, and even leaner stretches showed gains: 2022 notched +5.56%, 2023 added +28.52%, and 2024 wrapped with a steady +10.76%.

You May Also Like

With retail investor traffic and institutional investors entering the market, what's next for BNB Chain?

Real Madrid Stars ‘Broken’ And ‘Think They Are Sh*t’ After Copa KO