XRP’s $5 Target Attracts Attention, But Ozak AI’s $1 Launch Goal Could Deliver 100x

The post XRP’s $5 Target Attracts Attention, But Ozak AI’s $1 Launch Goal Could Deliver 100x appeared first on Coinpedia Fintech News

Crypto markets are buzzing with bold predictions as the bull cycle continues to unfold, and two names that are capturing investor attention are XRP and Ozak AI (OZ). XRP, one of the most established altcoins in the market, is aiming for a $5 target that could solidify its position as a top digital asset, especially after gaining legal clarity in the U.S.

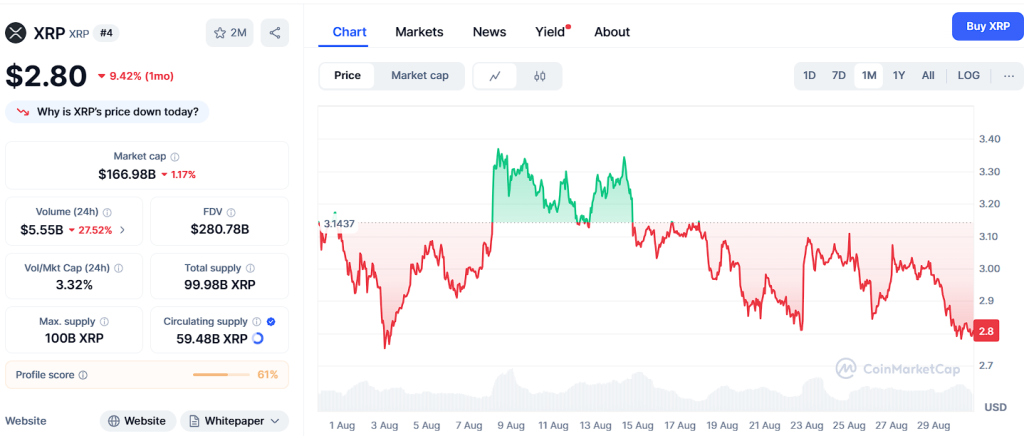

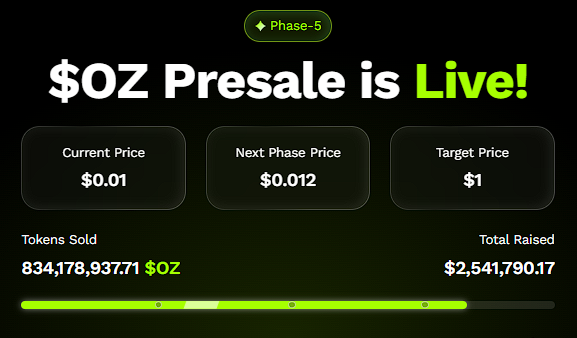

On the other hand, Ozak AI, currently in its presale phase, is setting its sights on a $1 launch goal, which analysts believe could deliver 100x returns for investors. With XRP trading at $2.80 and Ozak AI priced at just $0.01 in its 5th presale stage, both projects present unique opportunities, but the upside potential for Ozak AI appears to outshine XRP’s more measured growth.

XRP Overview – From $2.80 to $5

XRP has been one of the most resilient cryptocurrencies over the past decade. Backed via Ripple Labs, it’s designed for cross-border payments and liquidity answers, imparting banks and financial establishments with a faster and inexpensive alternative to conventional systems like SWIFT. Currently priced at $2.80, XRP has regained sturdy momentum after years of felony challenges with the SEC, which had created uncertainty inside the U.S. market.

With clearer regulatory status, XRP is now located to scale its adoption globally, especially in regions where remittance solutions are in high demand. If momentum is maintained, XRP’s price goal of $5 seems increasingly more conceivable in the coming bull cycle. Analysts highlight 3 key resistance stages to look at: $3.20, $4.00, and $5.00, at the same time as support zones sit at $2.50, $2.20, and $1.90. If XRP can maintain above $2.50, the path to better valuations seems sustainable.

However, despite its potential to nearly double from current levels, XRP is unlikely to deliver the kind of life-changing returns investors saw in its early years. That’s where presale projects like Ozak AI enter the spotlight.

Youtube embed:

Next 500X AI Altcoin

Ozak AI Overview – The $1 Launch Target

Ozak AI is a next-generation blockchain project that merges the power of artificial intelligence with decentralized applications, offering AI-driven tools for predictive analytics, automated trading, and intelligent investment strategies. Currently priced at $0.01 in its 5th OZ presale stage, Ozak AI has already raised millions of dollars and secured listings on CoinGecko and CoinMarketCap before even launching—a strong indication of early adoption and credibility.

The project has also undergone a CertiK audit, boosting investor confidence, while forming partnerships with DEX3, HIVE, and SINT to accelerate ecosystem growth. With a clear roadmap that includes upcoming DEX and CEX listings, Ozak AI’s presale momentum suggests strong demand ahead of its official launch.

Analysts believe Ozak AI could reach $1 within its first year of trading, representing a 100x increase from the current presale price. This projection stems not only from presale traction but also from the rising global demand for AI integration within blockchain applications. The convergence of these two high-growth industries could give Ozak AI an edge over many established altcoins.

XRP vs. Ozak AI

When comparing XRP and Ozak AI, the risk/reward dynamics become clear. XRP, trading at $2.80 with a $5 target, offers stability and strong utility backed by institutional adoption. It is a relatively safe play for investors seeking steady, long-term growth. Ozak AI, however, is a high-risk, high-reward presale. Its upside potential is far greater, with early investors positioned to gain 100x returns if the project executes its roadmap and gains mainstream traction.

Both assets benefit from strong narratives—XRP from being a proven leader in cross-border payments, and Ozak AI from its position at the forefront of AI-powered blockchain innovation. Investors may see value in diversifying into both, with XRP providing security and Ozak AI offering the chance at exponential returns.

XRP’s climb toward $5 is generating well-deserved attention, particularly as the project cements its role in global finance with institutional adoption and regulatory clarity. Yet, for investors chasing massive upside, Ozak AI’s $1 launch goal could prove far more transformative, potentially delivering 100x gains from its $0.01 presale price. With AI and crypto being two of the hottest sectors of the decade, Ozak AI stands out as one of the most ambitious and rewarding opportunities of 2025.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides an innovative platform that focuses on predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized community technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto lovers and corporations make the perfect choices.

For more, visit

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

You May Also Like

Saudi Awwal Bank Adopts Chainlink Tools, LINK Near $23

Pump.fun CEO to Call Low-Cap Gem to Test New ‘Callouts’ Feature — Is a 100x Incoming?