Nobel Prize Jean Tirole winner warns of hidden stablecoin risks

Nobel Prize-winning economist, Jean Tirole, warns retail investors of the hidden risks behind viewing stablecoins as “safe assets” considering it still has insufficient supervision.

- Nobel Prize winner Jean Tirole warns that investors may gravitate towards riskier assets if U.S. government bonds fail to perform well.

- Stablecoin market cap rose by $16 billion in the past month to $280 billion, according to data from McKinsey.

In an interview with Financial Times, 2014 Nobel laureate Jean Tirole warned retail investors that stablecoins could push governments into multibillion-dollar bailouts if the tokens pegged to fiat currencies end up unraveling in the future.

“If it is held by retail or institutional depositors who thought it was a perfectly safe deposit, then the government will be under a lot of pressure to rescue the depositors so they don’t lose their money,” he said.

Tirole, a professor at the Toulouse School of Economics, warned that as stablecoins are backed by fiat-based assets such as US government bonds, they could end up becoming unpopular because the underlying assets’ offers relatively low yields. The Nobel-prize winner brought up previous instances where the returns were “negative for a number of years” and payouts after inflation were even lower.

Stablecoins are currently dominating the financial systems as more governments gravitate towards stablecoin regulations, especially countries like the United States with the Genius Act and Hong Kong with its Stablecoin Ordinance issuers’ license. They are expected to gain further popularity as more governments and institutions are jumping on the bandwagon.

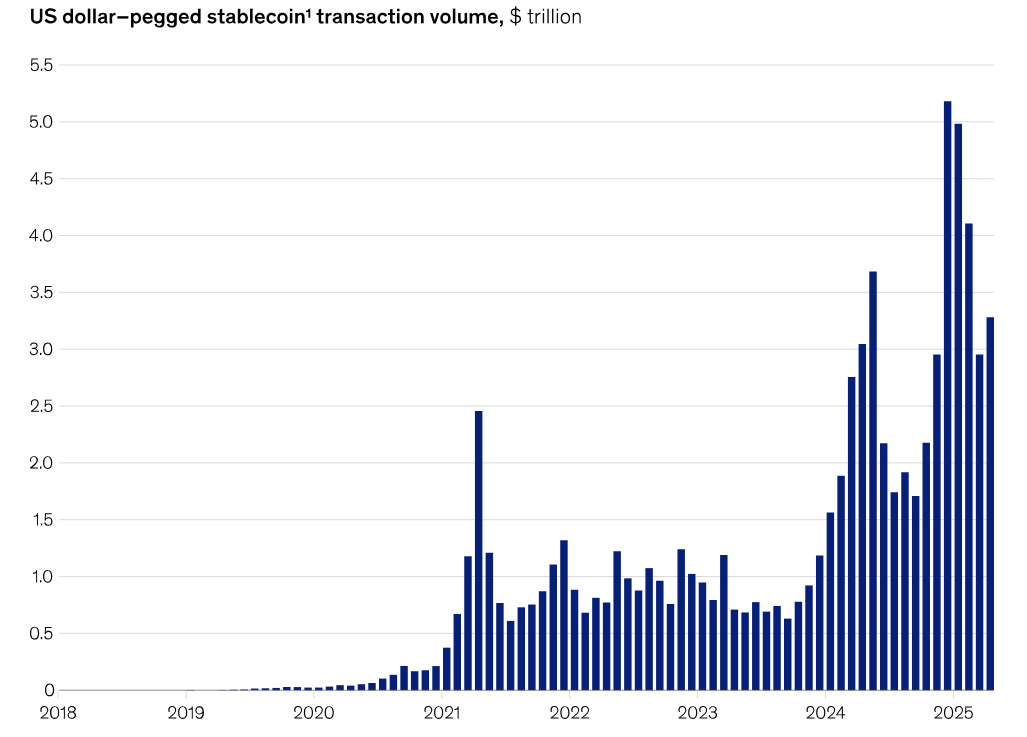

According to a McKinsey report, the stablecoin market cap recently hit an all-time high of $280 billion. The value increased by $16 billion in the past month alone, with Tether (USDT) leading the charge with 60% of the market cap share.

The stablecoin market is predicted to surpass $400 billion by the end of 2025 and expand as high as $2 trillion by the time 2028 rolls around.

Nobel Prize winner worries about reserve asset supervision

Nobel laureate Jean Tirole said that he was “very, very worried” about the supervision regarding stablecoins and the risks of depositors going on a run if investors begin to doubt the underlying assets that stablecoins are pegged to.

Although they are now regarded by users as “perfectly safe deposits,” Tirole believes that stablecoins could trigger losses and a possible government-led bailouts. He warned that stablecoin issuers could be attracted to investing in other assets that are riskier and offer higher return.

He stated that higher risks could increase the chances of stablecoin’s reserve asset losing value and triggering a run on the asset. In this case, he predicted that “the price of the stablecoins might [also] go down,” as they lost their peg to a sovereign currency.

However, such risks could be mitigated if global supervisors are able to properly regulate digital tokens to make sure the collapse does not happen. Though, Tirole said that in order for the United States to tackle this problem, they must set aside personal financial stakes in cryptocurrency.

“Some key members of the [U.S.] administration . . . have a personal financial interest in [cryptocurrency]. And beyond the personal interest, there’s ideology,” said Tirole, possibly referring to the Trump family’s various crypto-related projects, including Trump Media’s crypto-backed ETFs and World Liberty Financials’ USD1.

You May Also Like

The Channel Factories We’ve Been Waiting For

How ZKP’s Daily Presale Auction Is Creating a New Standard for 1,000x Returns