Alibaba Group Holding Limited ($BABA) Stock: AI and Cloud Growth Ignite 19% Rally Despite Quick Commerce Drag

TLDR

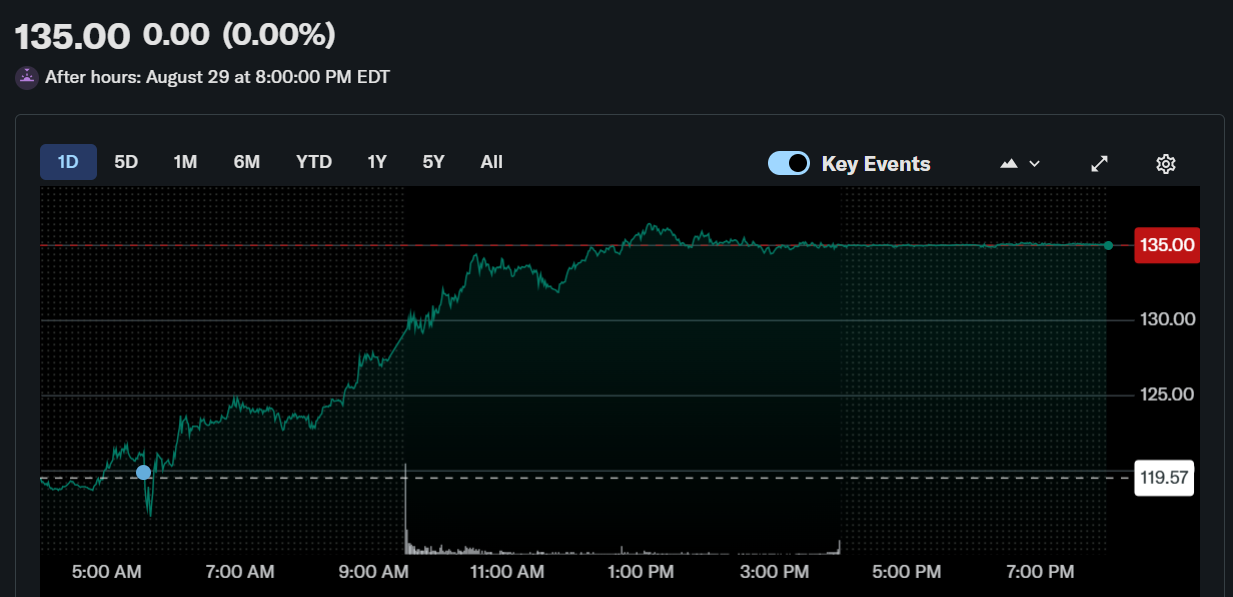

- Alibaba’s U.S. stock surged 12.9% to $135 after Q2 FY25 results on August 29

- Hong Kong-listed shares soared 19% to their highest level since March

- Cloud revenue rose 26% to 33.4 billion yuan, beating expectations

- Alibaba is developing a new AI chip, fueling further investor confidence

- Quick commerce expansion drags profits but investors focus on long-term AI

Alibaba Group Holding Limited (NYSE: BABA) closed at $135.00 on August 29, up 12.90%, as investors cheered accelerating growth in its cloud division and optimism around artificial intelligence.

Alibaba Group Holding Limited (BABA)

The rally marked the stock’s best close in months and came after Alibaba’s Q2 FY25 results highlighted both progress and challenges.

Cloud Unit Shines with 26% Growth

For the quarter ended June 30, Alibaba reported revenue of 247.65 billion yuan ($34.73 billion), a modest 2% year-over-year rise that fell short of analyst forecasts. Still, the bright spot was Alibaba Cloud, which posted a 26% annual revenue surge to 33.4 billion yuan, far outpacing expectations of 18% growth.

The company noted that AI-related product revenue grew triple digits for the eighth straight quarter, signaling strong momentum as enterprises adopt Alibaba’s infrastructure for inference and training workloads. CEO Eddie Wu said investments in AI are “yielding tangible results,” with analysts at Jefferies calling cloud “the long-term growth engine.”

AI Chip Development Boosts Sentiment

On top of the cloud results, CNBC reported that Alibaba is developing a new AI chip, a move that could strengthen its competitive edge against global tech giants. The news fueled Monday’s rally in Hong Kong, where Alibaba’s shares jumped 19%, reaching their highest since March.

Core E-Commerce Growth and Instant Commerce Costs

Alibaba’s core China commerce division generated 140 billion yuan in revenue, up 10% year-over-year. Yet profitability took a hit as EBITA fell 21%, driven by subsidies in the company’s aggressive push into “instant commerce” — one-hour deliveries through its Taobao app.

The instant commerce market pits Alibaba against rivals Meituan and JD.com, both locked in heavy spending battles. Jiang Fan, head of e-commerce, admitted losses are steep but argued repeat customers will drive efficiency. Analysts at Nomura and Morningstar suggested Alibaba is better positioned than in past food delivery battles, with its ecosystem integration offering competitive advantages.

Investor Perspective: AI Over Food Delivery Losses

While quick commerce remains a drag, investors are clearly prioritizing Alibaba’s AI and cloud trajectory. Net income surged 78% year-over-year, offsetting the revenue miss and supporting the stock rally. Analysts believe the cloud division could follow a path similar to Microsoft Azure and Google Cloud in monetizing AI services.

Performance Overview: BABA vs. Hang Seng

Despite the five-year decline, Alibaba’s stock has been a standout performer in 2025:

- YTD Return: +63.18% vs Hang Seng’s +27.70%

- 1-Year Return: +64.72% vs Hang Seng’s +42.41%

- 3-Year Return: +48.99% vs Hang Seng’s +30.72%

- 5-Year Return: -50.48% vs Hang Seng’s +1.72%

The long-term chart reflects Alibaba’s volatile journey, but investors now see a clearer growth path centered on AI, cloud acceleration, and ecosystem strength, with near-term profitability taking a back seat.

The post Alibaba Group Holding Limited ($BABA) Stock: AI and Cloud Growth Ignite 19% Rally Despite Quick Commerce Drag appeared first on CoinCentral.

You May Also Like

The Channel Factories We’ve Been Waiting For

How ZKP’s Daily Presale Auction Is Creating a New Standard for 1,000x Returns