Bitcoin Sees Labor Day Lull, but Institutional Bulls Remain Unfazed

The digital asset’s price didn’t move much on Monday after shedding more than 3% over the past seven days, but the subdued price action hasn’t dampened institutional enthusiasm.

BTC Treads Water on Labor Day Weekend and Metaplanet Buys the Dip

“I’ve always said that I really believe in the next several years, bitcoin hits a million dollars. There’s no question bitcoin hits a million dollars.” Those were Eric Trump’s words during a fireside chat on Friday at the 2025 Hong Kong Bitcoin Asia conference. Trump is a strategic advisor to Japanese bitcoin treasury firm Metaplanet. And just as the cryptocurrency dipped below $109K on Labor Day, Metaplanet snapped up 1,009 BTC, bringing the firm’s total bitcoin holdings to 20,000 BTC.

(Institutional investors are following the time-tested strategy of buying low, which has been helping reduce bitcoin’s volatility / Metaplanet on X)

(Institutional investors are following the time-tested strategy of buying low, which has been helping reduce bitcoin’s volatility / Metaplanet on X)

Bitcoin ( BTC) appears to no longer go through the wild rallies and crashes that characterized much of its history. Many attribute this recent reduction in volatility to the deluge of institutional investors like Metaplanet, who don’t sell at the slightest hint of a price decline. If anything, they do the opposite; they buy the dip.

And so while bitcoin was mostly flat over 24 hours on Monday, down 2-3% for the week, only retail investors seem to be melancholic. The Metaplanets of the world and the rest of the so-called “smart money,” are not only buying the dip this weekend, they are also raising billions to buy even more of the cryptocurrency down the road.

Overview of Market Metrics

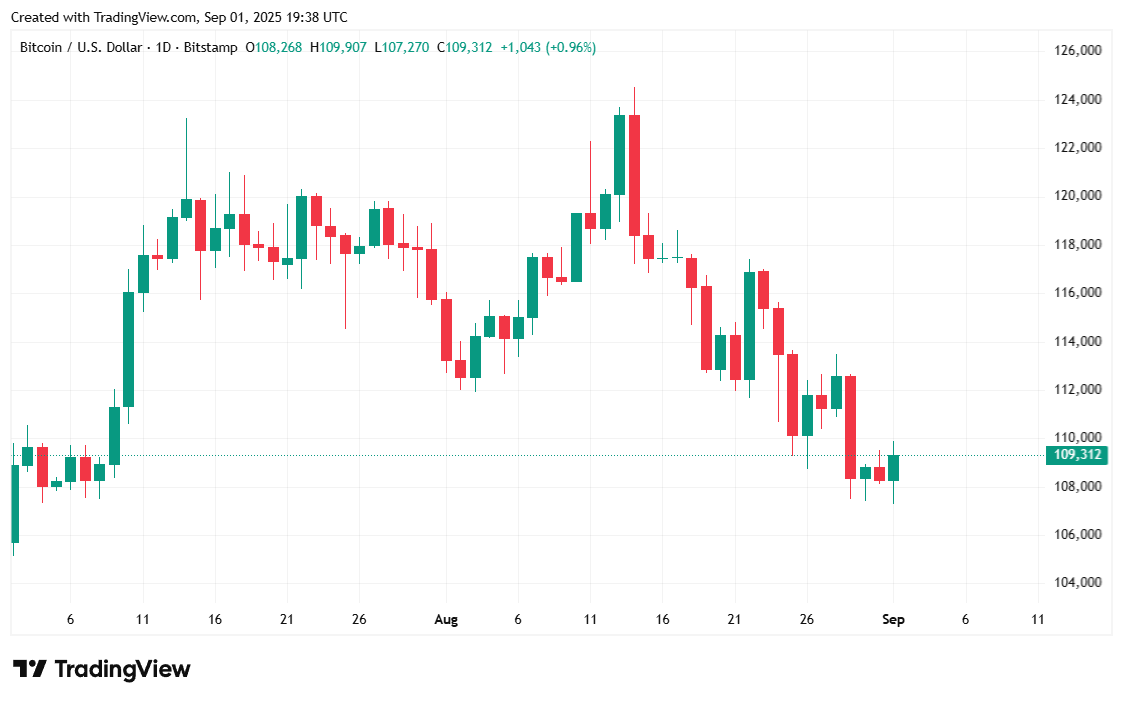

Bitcoin was trading at $109,236.39 at the time of writing, according to Coinmarketcap, up slightly by 0.24% for the day, but still down 2.02% for the week. The cryptocurrency’s price has moved between $107,271.18 and $109,890.58 over the past 24 hours.

( Bitcoin price / Trading View)

( Bitcoin price / Trading View)

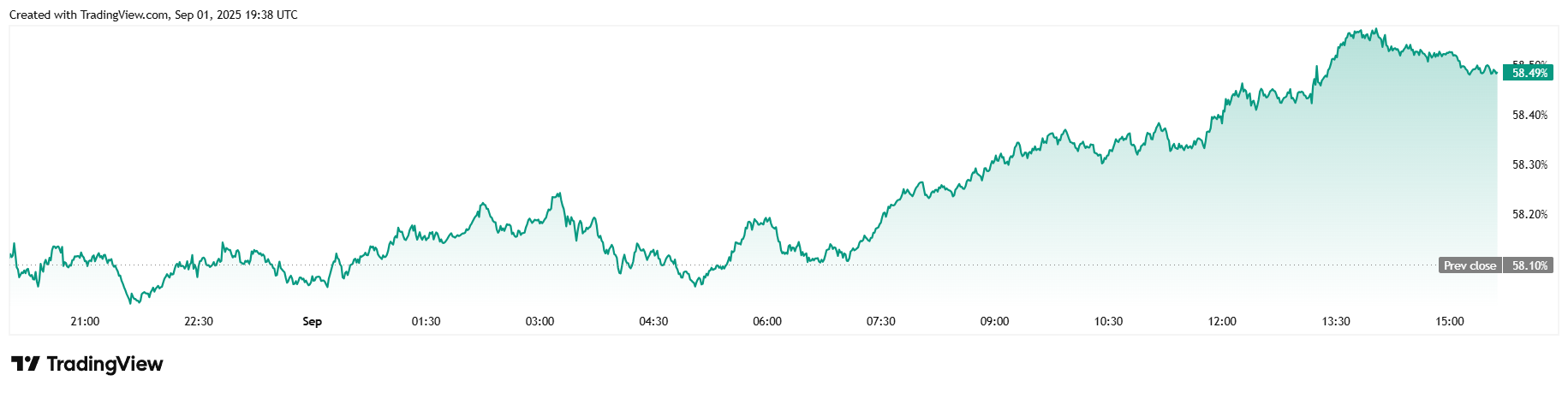

Trading volume was up 32.94% at $62.28 billion, despite the Labor Day holiday. Market capitalization was also slightly up by 0.21% at $2.17 trillion. Bitcoin dominance rose 0.67% to reach 58.49% at the time of reporting, according to data from Coinmarketcap.

( BTC dominance / Trading View)

( BTC dominance / Trading View)

Total bitcoin futures open interest was mostly flat at $80.33 billion over 24 hours, a small 0.39% increase. Bitcoin liquidations on Coinglass came to a total of $58.95 million for the day. That sum comprises $36.20 million in long liquidations and a smaller $22.75 million in shorts.

You May Also Like

![[Pastilan] End the confidential fund madness](https://www.rappler.com/tachyon/2024/05/commission-on-audit-may-28-2024.jpg?resize=75%2C75&crop=301px%2C0px%2C720px%2C720px)

[Pastilan] End the confidential fund madness

XMR Above $700, MNT Gains Utility Momentum, and Zero Knowledge Proof (ZKP) Sets a $1.7B Launch Target