Pump. Fun (PUMP) Price: Soars 54% as Platform Burns Through $62 Million in Buybacks

TLDR

- Pump.fun has spent over $62 million buying back its native PUMP token, absorbing 16.5 billion tokens to reduce selling pressure

- The platform created 595,000 new tokens in August and reclaimed the top spot with 46.6% market share among Solana launchpads

- PUMP token has gained 12% in the past month and is trading at $0.003522, up 54% from its August low

- Over 70,800 unique holders now own PUMP tokens, with smaller wallets making up 46% of distribution

- Despite high activity, traders lost $66 million in August with over 60% ending in the red

The Pump.fun platform has launched an aggressive buyback campaign for its native token PUMP, spending over $62.6 million to purchase 16.5 billion tokens. The buybacks target an average cost of $0.003785 per token.

Pump.Fun (PUMP) Price

Pump.Fun (PUMP) Price

Daily repurchases have ranged between $1.3 million and $2.3 million over the past week. The platform uses revenue from user fees to fund these buybacks.

Pump.fun generates income primarily from fees collected when users launch memecoins on the platform. Since launch, total platform revenue has exceeded $775 million according to DefiLlama data.

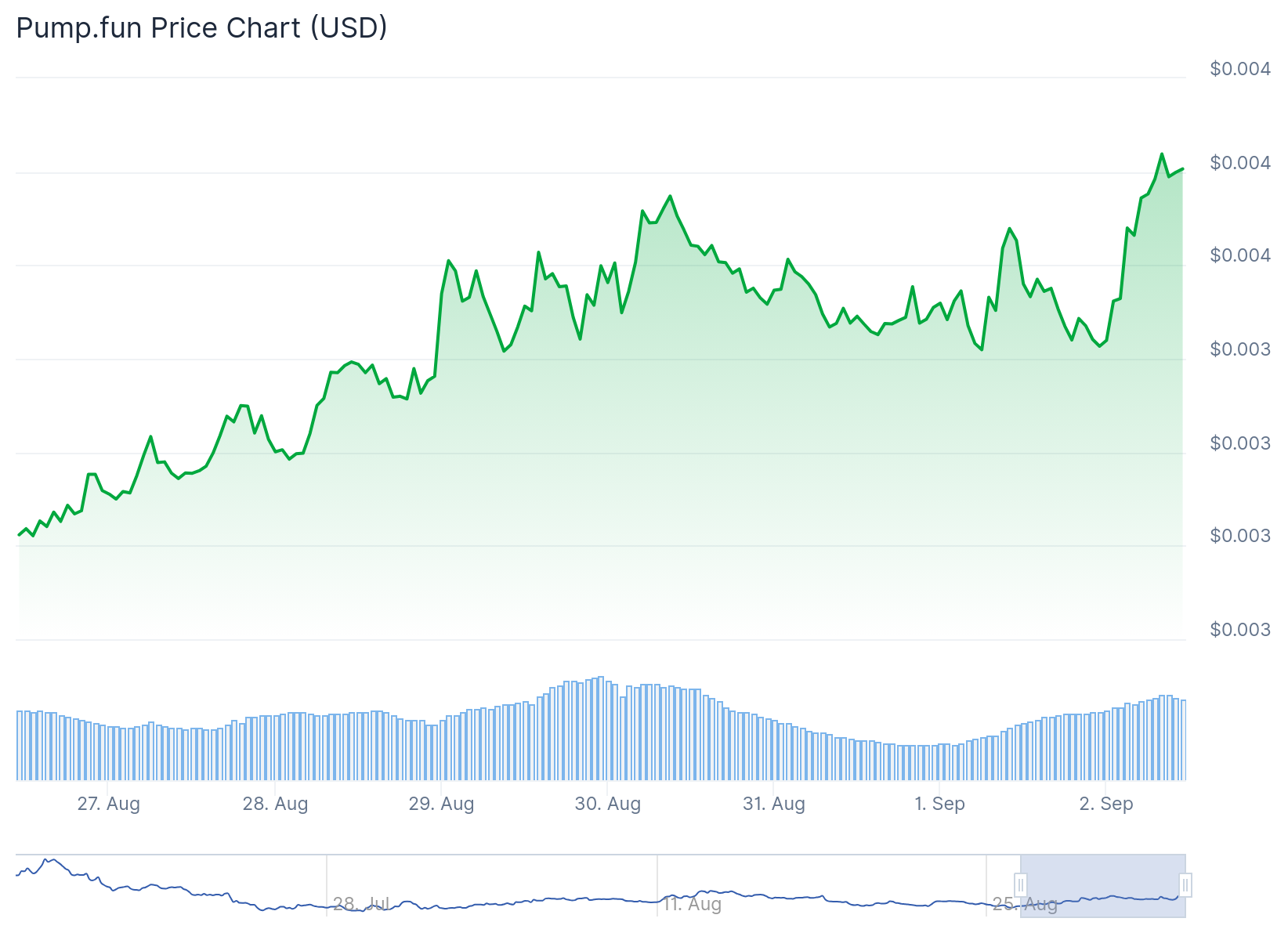

The buyback strategy appears to be working for PUMP’s price performance. The token has gained more than 12% over the past month and around 9% over the past week.

PUMP currently trades at $0.003522, representing a 54% increase from its August low of $0.002282. The consistent buying pressure from the platform has helped stabilize price action.

User participation in PUMP has grown steadily. The number of unique token holders has reached over 70,800 addresses.

Smaller wallets holding less than 10,000 PUMP tokens now account for 46% of total distribution. This broadening ownership base indicates growing retail engagement with the token.

Platform Dominance Returns

Pump.fun faced competition challenges earlier this year when rival platform LetsBonk temporarily took market share. On July 7, LetsBonk surpassed Pump.fun in 24-hour revenue rankings.

Throughout July, LetsBonk continued to gain ground against Pump.fun on multiple occasions. The competition heated up in the Solana memecoin launchpad space.

However, recent data shows Pump.fun has reclaimed its dominant position. Over the last seven days, the platform captured 73% market share with $4.5 billion in trading volume.

LetsBonk’s market share has dropped to less than 9% with $543 million in volume. The competitive gap has widened back in Pump.fun’s favor.

August Performance Metrics

August proved to be a record month for platform activity despite user losses. Pump.fun registered over 1.3 million active addresses during the month.

The platform created 595,000 new tokens in August, more than any competitor. This surge helped secure a 46.6% market share position.

Source: TradingView

Source: TradingView

However, users collectively lost $66 million during August trading activity. More than 60% of traders ended the month with losses.

About 882,000 wallets, representing 65.4% of users, lost between $0 and $1,000. No single trader earned more than $1 million during the month.

The platform bought back $58.7 million worth of PUMP tokens in August alone. Total buybacks have now exceeded $66.6 million since the program began.

Revenue data shows Pump.fun experienced a sharp drop from July 28 to August 3. Weekly revenue fell to just $1.72 million, the lowest since March 2024.

The platform currently faces a $5.5 billion class-action lawsuit filed on January 30, with accusations of using guerrilla marketing tactics to create artificial hype around volatile tokens.

The post Pump. Fun (PUMP) Price: Soars 54% as Platform Burns Through $62 Million in Buybacks appeared first on CoinCentral.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

‘Groundbreaking’: Barry Silbert Reacts to Approval of ETF with XRP Exposure