ECB’s Lagarde Warns Of Stablecoin Liquidity Risks: Don’t `Wait For A Crisis’

European Central Bank president Christine Lagarde is warning that stablecoins pose serious liquidity risks unless policymakers close loopholes that let foreign issuers skirt EU rules.

“We know the dangers,” she said in prepared remarks for the European Systemic Risk Board conference. “And we do not need to wait for a crisis to prevent them.”

Lagarde highlighted concerns over “multi-issuance schemes,” where stablecoins are jointly issued by entities inside and outside the EU.

She said such schemes could leave European investors exposed in a run, since non-EU issuers aren’t bound by the bloc’s Markets in Crypto Assets (MiCA) framework, which mandates safeguards like prohibiting redemption fees.

“In a crisis, investors would naturally prefer to redeem in the jurisdiction with the strongest safeguards,” she said. “But the reserves held in the EU may not be sufficient to meet such concentrated demand.”

She compared the risk to past banking mismanagement, emphasizing that liquidity shortfalls can be prevented with proper planning.

“The risk of liquidity mismanagement across jurisdictions is one we have seen before,” she said.

International Cooperation ”Indispensable”

Lagarde said ”international cooperation is indispensable” and urged policymakers to not allow multi-issuance schemes to operate in the EU unless they are “supported by robust equivalence regimes in other jurisdictions.”

In addition to the possible liquidity risks, ECB officials have already warned that Europe’s financial stability and autonomy might be at risk given the US Administration’s push to promote crypto assets and dollar-backed stablecoins.

“The measures taken by the new US Administration to promote crypto-assets and US dollar-backed stablecoins raise concerns for Europe’s financial stability and strategic autonomy,” said Piero Cipollone, an executive board member at the ECB, in April.

“They could potentially result not just in further losses of fees and data, but also in euro deposits being moved to the United States and in a further strengthening of the role of the dollar in cross-border payments,” Cipollone added.

The ECB executive board member also noted that businesses “are increasingly open to accepting stablecoins for customer payments,” which “could have far-reaching implications for monetary sovereignty.”

Stablecoin Market Booms After GENIUS Act Signing

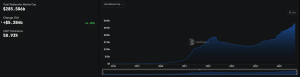

The stablecoin market has grown by over $80 billion since the start of the year, with the sector’s capitalization climbing from around $204 billion in January to $285 billion as of Sept. 4, according to data from DefiLlama.

Stablecoin market overview (Source: DefiLlama)

That’s after US President Donald Trump signed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act into law on July 18. This is the first comprehensive US federal regulatory framework for stablecoins, bringing some clarity to a previously uncertain legal area.

Similar to the MiCA framework, the GENIUS Act also establishes reserve requirements for issuers in the US, and also requires them to have anti-money laundering (AML) and counter-terrorism policies in place. It protects consumers as well, while still promoting innovation.

EU, US And China Kick Off Stablecoin Race

While the EU tries to address gaps in stablecoin regulations and the US progresses with establishing rules for issuers, China may also be exploring the launch of a yuan-backed stablecoin.

Reports last month suggested that the Chinese government was also considering a stablecoin backed by its renminbi currency because of the slow rollout of a digital yuan.

You May Also Like

Pepe Coin Price Prediction: Why Pepeto Could Claim Top Meme Coin Status as PEPE Crashes 80% From Its Peak

Pepeto Price Prediction 2026 to 2030: Why the Micro Cap Math Points to Returns Old Meme Coins Cannot Match