Ethereum Price Firms On Macro Data While Rollblock Gains Interest From Performance-Driven Crypto Desks

Crypto markets are seeing a mix of momentum and steady footing. Rollblock (RBLK) has pulled in over $11.5 million during its presale, with the token climbing 500% as interest grows from performance-driven investors. Simultaneously, the Ethereum price wave is maintaining its position on favourable macro indicators, and it remains strong despite declining volumes.

All these actions emphasize how incumbency and new initiatives are influencing the market mood, as investors are considering long-term adoption versus near-term positioning in the digital asset ecosystem.

Why RBLK’s Tokenomics Appeal to Performance-Driven Investors

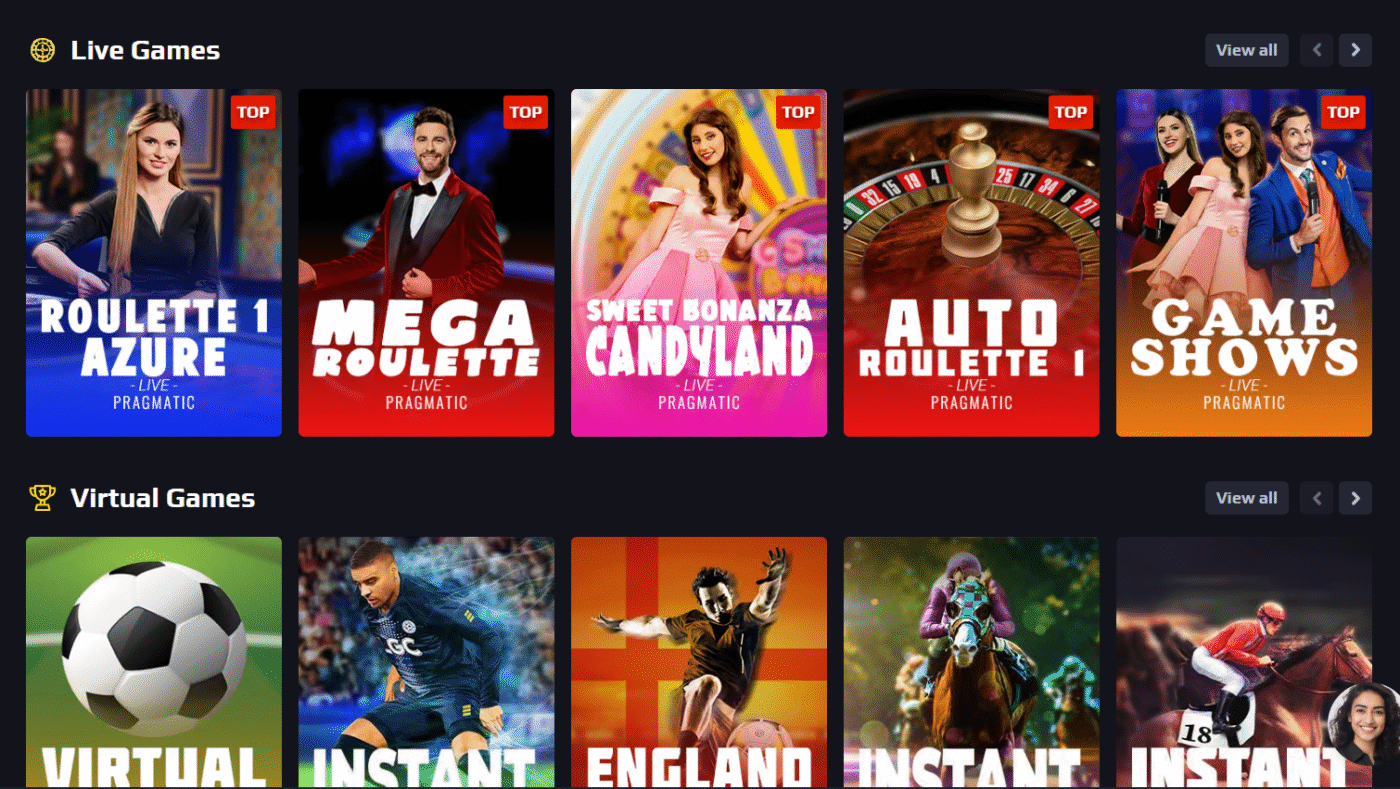

Rollblock (RBLK) is carving a strong position in crypto circles, drawing attention from investors who prefer performance-driven projects over speculation. Its presale has already brought in over $11.5 million, with more than $15 million in wagers flowing through its live iGaming platform. That level of adoption, alongside 55,000 registered users and a catalog of 12,000 games, shows the project is much more than a presale promise.

Unlike typical early-stage tokens, Rollblock operates on a fully functional platform that includes poker, blackjack, roulette, and a sportsbook covering global events. Sign-ups take seconds, rewards are transparent, and the project is both licensed and independently audited.

This provides a trust factor often missing in similar ventures. The RBLK token depends directly on the platform revenue. Each week, 30% of profits are used for buybacks, with most of those tokens burned permanently and the rest staked for up to 30% APY.

Key drivers behind Rollblock’s rise include:

- $11.5M raised in presale and $15M+ wagers already processed

- Licensed under Anjouan Gaming and verified by SolidProof

- Weekly burns paired with staking rewards up to 30% APY

- A 12,000+ game library plus sportsbook integration

Priced at $0.068 after a 500% surge, Rollblock’s presale momentum signals room for further growth. Analysts forecast RBLK could reach $1 in 2025 as adoption expands.

Macro Tailwinds Keep Ethereum Price Firm

Ethereum price has shown resilience, consolidating near $4,328 after weeks of strong momentum. The chart reflects a healthy climb from the $3,500 region earlier in the summer to highs close to $4,956, followed by a period of sideways movement as buyers and sellers battle for direction.

Short-term support is just below $4,200, and moving averages are also offering a buffer effect, indicating that the larger uptrend is still intact even though volumes are decelerating.

Source

The recent commentary by Joseph Lubin has given Ethereum confidence, in which he observed that Wall Street was increasingly using ETH as a financial foundation that would one day overtake Bitcoin. This institutional adoption is arousing optimism that Ethereum will keep expanding its value in the world of finance.

Analysts remain divided on near-term targets. Some see consolidation above $4,200 as a launchpad for a retest of $5,000, while more cautious forecasts place Ethereum trading between $4,000 and $4,300 in the short run. Longer term, projections stretch toward $6,000 if adoption trends accelerate, setting the stage for Ethereum to remain a frontrunner in the next cycle.

Rollblock’s Bold Path Against Ethereum’s Strength

Rollblock’s presale success, with over $11.5 million raised and a 500% surge, has positioned it as a standout contender. While Ethereum’s price steadies on macro support and institutional adoption, RBLK’s deflationary tokenomics and growing user base are fueling bold predictions. Some analysts believe its momentum could one day challenge Ethereum’s dominance, marking Rollblock as more than a rising star but a project with the potential to redefine market leadership.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Ethereum Price Firms On Macro Data While Rollblock Gains Interest From Performance-Driven Crypto Desks appeared first on Blockonomi.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Your money, your move: Engage in your financial future