Ripple and Grayscale Celebrate First Birthday: Is XRP ETF Next?

September 2025 marks the first anniversary of one of Grayscale’s most popular Trusts that is yet to be converted into a spot ETF – the XRP fund.

The largest crypto asset manager to it to X to celebrate the achievement by outlining some of the characteristics of XRP and the network behind it.

What Happened in 1 Year?

CryptoPotato reported the XRP Trust launch, which saw the light of day on September 5, 2024, and was immediately followed by an impressive price increase for the underlying asset. Yet, its valuation at the time of under $0.6 was nowhere near the heights of today at almost $2.8.

The product had an impressive initial year as it enables investors to gain exposure to the token without having to worry about the challenges of buying, storing, and safekeeping it, as the website explains. The Trust tracks the XRP market price, but the fees and expenses are more modest.

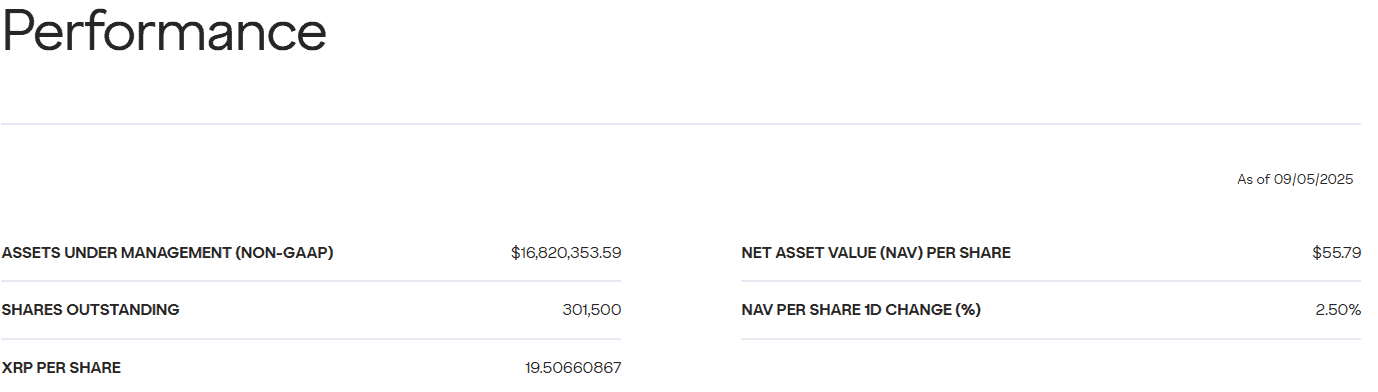

With 301,500 outstanding shares, the total assets under management have skyrocketed to almost $17 million, according to the site as of Friday’s closing.

Grayscale’s XRP Trust Performance

Grayscale’s XRP Trust Performance

ETF Next?

As with its BTC and ETH Trusts, Grayscale was quick to file with the US SEC to convert its XRP product into a fully regulated spot exchange-traded fund. This happened shortly after Donald J. Trump was inaugurated as the 47th US president, Gary Gensler stepped down as SEC Chair, and it became more than evident that there would be more favorable regulations for the cryptocurrency industry.

Given its success in converting its Bitcoin and Ethereum Trusts into spot ETFs, the filing with the securities regulator is regarded as almost a guaranteed path for an XRP ETF. However, Grayscale has tons of competition in that field as the total number of such applications sitting on the SEC’s desk is 15.

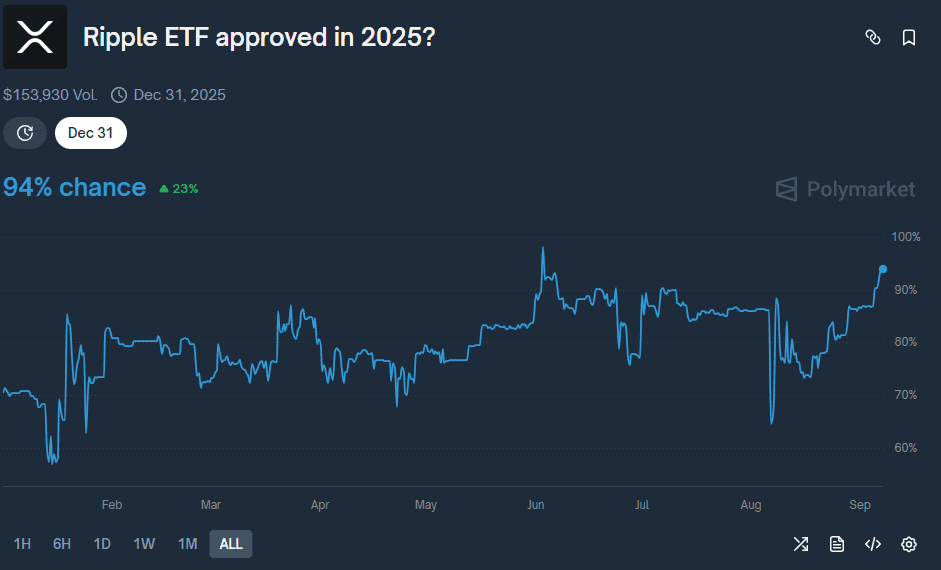

The odds for an approval by the end of the year on Polymarket have skyrocketed to 94% after dipping below 70% just a few weeks ago. Moreover, many experts believe that the actual chances are closer to 100%.

Ripple ETF Approval Odds on Polymarket

Ripple ETF Approval Odds on Polymarket

The post Ripple and Grayscale Celebrate First Birthday: Is XRP ETF Next? appeared first on CryptoPotato.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

XRP Price News: Elon Musk Confirms X Money Crypto Plans as Pepeto’s Three Products Approach Launch and the 537x Window Stays Open