Think AI Just Arrived in Fintech? Actually, AI Grew Up in Fintech.

\

2006: A Fingerprint is Not “Just a Picture”

I’ve always worked on tech projects since I graduated from university. In the beginning, I didn’t really notice how the big math and Excel projects I worked on were actually connected to real situations and business problems. It might sound obvious now, but it honestly wasn’t clear to me at the time. Luckily, I got the chance to join a company that believed that everything that had worked before would work anywhere, at any time, and big lessons emerged because of it.

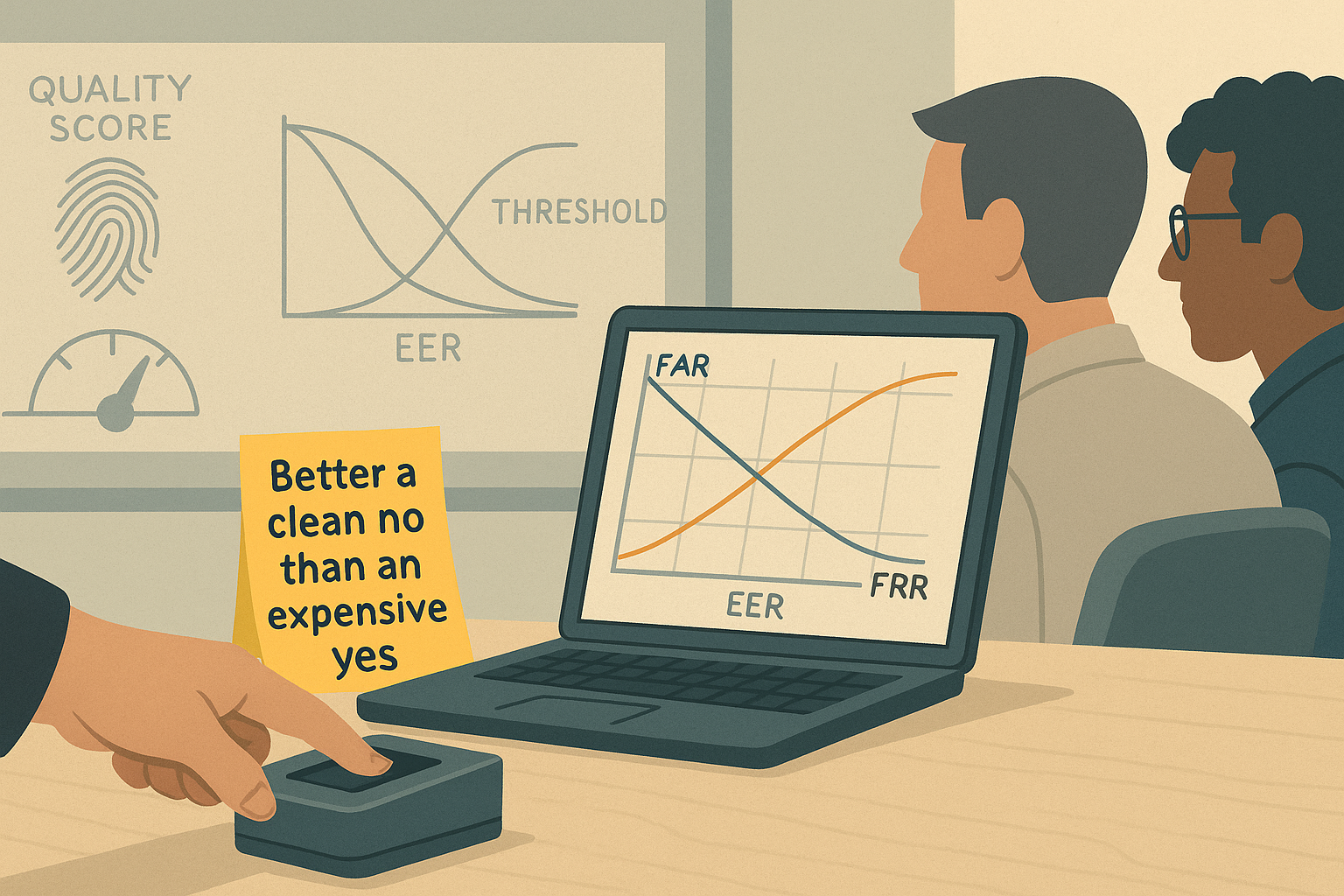

\ I wasn’t a software engineer; I sat with the risk teams. Still, I ended up on a biometrics project in 2006. Very quickly, I learned that capturing a fingerprint wasn’t “just a picture.” That was the starting point for transforming those “weird lines” into identity patterns that we could read and quantify as image quality scores, false positives and false negatives, with the big objective of understanding what to trade off and how. It is still valid today in risk management: a clean, strong “no” can be better than an expensive, risky “yes.”

\ When everyone starts a project, the goals and outcomes are fundamental. Ours were how to control fraud and avoid financial losses while maintaining good customer service and experience at the branch desk. So, it was critical to decide where we rejected an application, what to do with the gray area (those cases on the edge), and how to manage change with our employees and, at the same time, with our customers, who could perceive it as a privacy invasion. We were also aware that some good users would fail the check. It felt basic and primitive compared to our advanced identity systems today, but the lesson is still relevant: experience, metrics, and thresholds matter more than tech trends.

\ So, what metrics did we follow? FAR (false acceptance rate) and FRR (false rejection rate). We focused on the mistakes (false results), and even worse, they move in opposite directions. Then we found the EER (equal error rate), which is where those two lines cross. It started to make sense and looked more like the math curves I used to build in the finance faculty, but now I could see them in the real world. Defining where to stop, or where to set the threshold, depends on our risk appetite (that means accepting that we will lose some money), which is more relevant than a class grade. This was the first moment when I realized that something I had previously considered “just a picture,” with the proper technology, could become valuable data we could use for risk and mathematical models. What a crazy realization, and beyond that, it represented a big opportunity to secure the profitability of a credit business… wow.

\

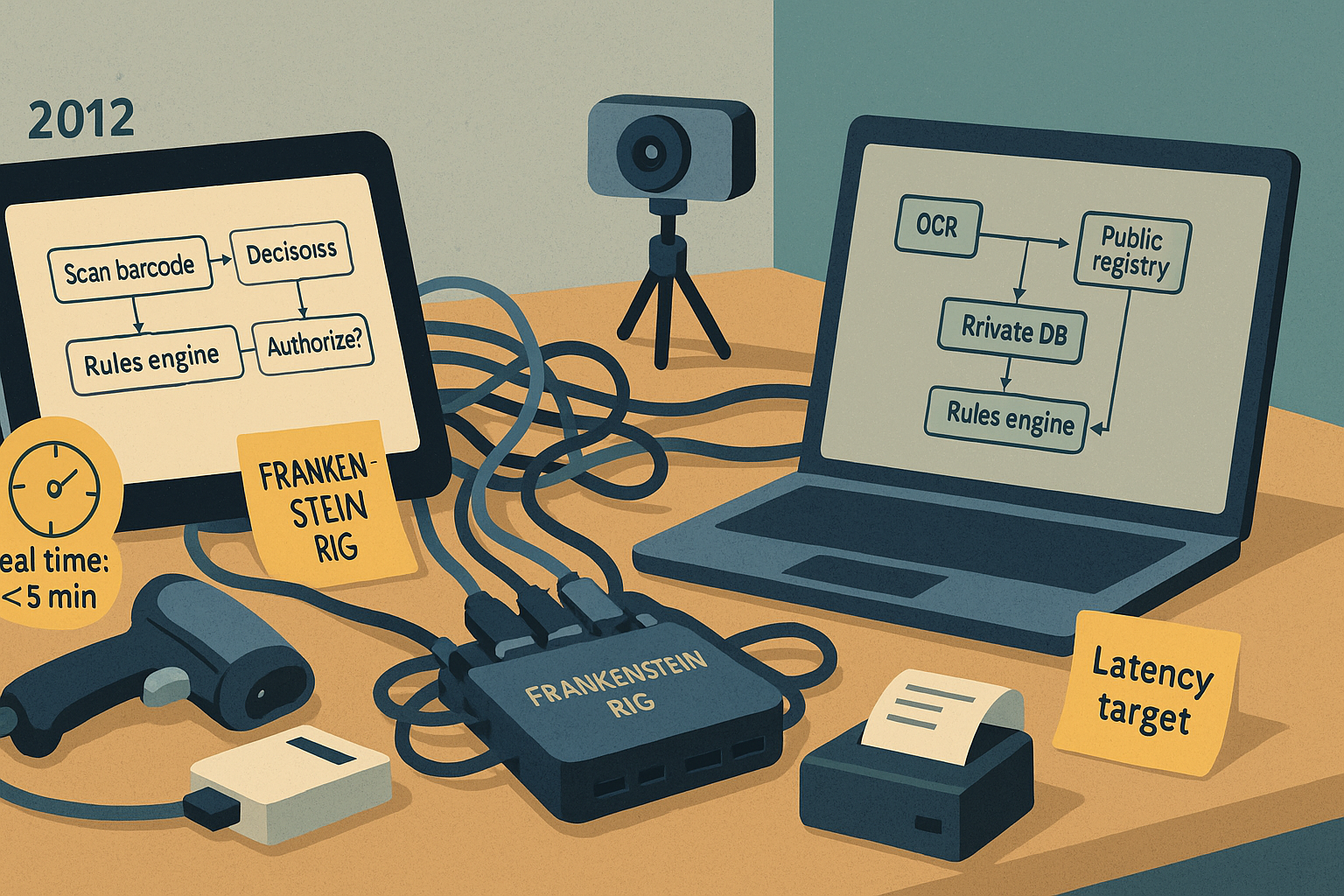

2012: “Real Time” Meant a Few Minutes

Fast forward to 2012. With a great team of engineers and colleagues, we built a flow that, by today’s standards, sounds slow (under a few minutes end-to-end), but back then, it was a breakthrough. We used the first-generation iPad, hacked ways to plug in external hardware not made by Apple (giant devices), and got external applications running. We ran OCR on pictures from external cameras with no more than 8 megapixels. Almost without realizing it, we programmed bots to do our first web scraping on public registries, and we queried private databases. Then those activities became checks that we configured in a rules engine to decide whether to recommend authorizing a transaction.

\ At a certain point, it looked like a “LEGO” game: how to adapt the camera, where to place the fingerprint reader, and how to add a scanner to read barcodes. We also had to figure out how to connect the devices when the tablet did not have ports. The first model looked like “Frankenstein” hardware, impossible for one person to carry while moving across a retail store to look for clients. After a few iterations, it still looked ugly, but it worked. We learned a lot from this project: our new system was “fast enough” and aligned with the business needs. After months, the design improved, and today that first version could be a museum piece, a reminder that we built a unique device with the tools we had at the time.

\ So, 6 years passed between those two experiences, and I have to say that technology didn’t look very different. Both experiences helped me understand why technology was the path to transform businesses and also to connect theoretical knowledge into practical projects, where math can expedite decisions that define financial success or failure. Then, data became critical because it drives decisions that represent money or loss. If you are not yet into data, models, and technology, or if you think they are separate things, your time is running out.

\

Today It is Not a “New Tech Era,” It is The “AI Speedup Era.”

Let’s fast forward to 2025. Thirteen years have passed, and devices are completely different, so what we lived in 2012 now sounds anecdotal. With a phone, we have a device that opens limitless possibilities and becomes a complete platform. You can watch videos, play music, and also turn it into a payment receiver or sender, and even into a complete credit solution. Today it is difficult to imagine a business that cannot run in your hands, taking intelligent notes, replying to emails, and running tasks that follow your instructions, or even acting on your behalf.

\ One of the biggest shifts is that it is no longer only about matching data or automating flows; it is about suggesting the next best action. Think about those first biometric systems where we looked up records in a database to validate identity and then added new sources of data to make an analyst’s decision easier. Today, a system can make a highly accurate decision to move forward, considering the data and also applying clear criteria throughout the process.

\ LLMs (large language models) have changed how the development world works. It is no longer acceptable for engineers to write code the way they did a year ago. Cursor, V0, and GitHub Copilot have transformed how solutions are built. In the same way, automation processes are in a different phase, because Make and n8n have integrated LLMs and can now do more than repetitive tasks. A developer can ask for a sample webhook and get it working in minutes. A risk or business analyst can describe a new rule in plain language and get the exact SQL to monitor it. Add to that the ability to generate better QA tests than before, without engineers writing every use case and forgetting some of them. This is not a replacement for judgment. It is a smarter and faster way to build in the fintech ecosystem.

\

Practical Recommendations For Those Building the Future of Fintech and Payments:

-

Think about the problem and stay close to it; technology and AI are powerful tools to build and solve real problems, smarter and faster.

-

What is fast today will not be tomorrow, so accept that “fast enough” keeps changing. Build today and be prepared to rebuild even before launch.

-

Trending topics appear and disappear; without fundamentals, there is no innovation and no real solutions. Do not forget that metrics, models, and risk thresholds still define success.

-

Hacking needs to be the rule; do not stop experimenting and shipping solutions. The best lessons come from testing things and building on top of them.

-

AI allows us to build more and create more value, not the opposite. What took a full team in 2012 can now be done by one person if they use the right tools and stay curious. Now imagine a whole team working that way; incredible things can be delivered in a short time.

\

Closing Thoughts

Now we are focused on speed and velocity. We do not know what tomorrow will bring. What I can guarantee is that if we take advantage of what is happening, instead of wasting time regretting the past, we will find a way to impact more people, create more value, and build a better world to live in.

You May Also Like

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!

Zero Knowledge Proof Sparks 300x Growth Discussion! Bitcoin Cash & Ethereum Cool Off