Little Pepe Presale Hits $25M, Almost Sold Out Before Ethereum L2 Launch

Little Pepe ($LILPEPE) is quickly attracting attention, having raised over $25M of its $25.4M target. Given that the presale is ~98% complete, it’s your final chance to hop in before it goes live on central exchanges and its price likely leaps higher.

Its early demand stems from its utility. While $LILPEPE looks like $PEPE’s baby brother, there’s nothing small about what it’s building: a fully-fledged Ethereum Layer-2 (L2) solution that addresses the network’s biggest pain points.

Solana Overrides Ethereum’s TPS by 98%

$PEPE – the OG frog coin – is currently valued at $0.0000105, down ~59% compared to its $0.000026 ATH.

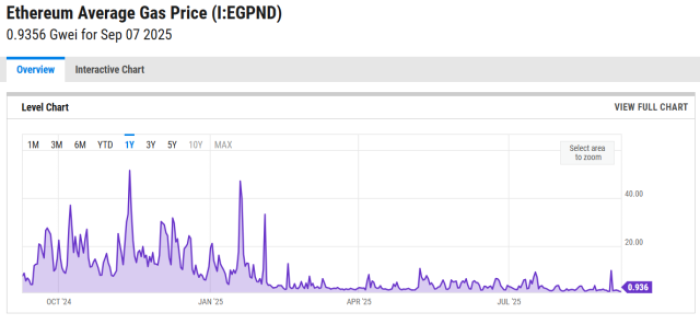

As an ERC-20 token held on the Ethereum network, steep gas fees and slow transactions likely discourage traders from purchasing the iconic meme coin.Right now, Ethereum’s average gas fees cost just 0.9356 Gwei. However, spikes earlier this year highlight how unpredictable and expensive trading can become. Of course, this doesn’t help $PEPE’s price volatility.

And neither does the fact that the network continues to struggle with scalability. Ethereum currently only processes 15.7 transactions per second (TPS), a whopping 98% lower than Solana’s 813.7 TPS.

Its max theoretical throughput lags far behind at 119.1 TPS, versus Solana’s 65K TPS.

Making matters worse is its unimpressive throughput. Ethereum processes over 56.6K transactions, while Solana handles over 2.9M in the same span.

Block times add to the network’s woes. Ethereum averaged 12.04 seconds, 30x slower than Solana’s 0.4 seconds.

Additionally, Ethereum’s cause is hindered by the network’s 12-minute transaction finalization time. Solana takes just 12.8 seconds, and thus is a sizable 60x faster.

Crypto projects are often held back by high costs and delays on Ethereum’s base layer. But fear not: Little Pepe is getting set to launch a L2 solution that solves these issues.

Little Pepe L2 to Make Ethereum Faster & Cheaper

Little Pepe’s custom EVM-compatible L2 enables apps and games to migrate onto the network quickly and cheaply without code having to be rewritten.

The L2 is built for everyone – developers, traders, meme lovers, and NFT creators – offering fast transactions that cost less than a cent. So, you can anticipate games, decentralized dApps and NFTs without the high fees that notoriously push users away.

Essentially, it bundles transactions and processes them off-chain before settling them back on Ethereum. In turn, it boosts the network’s speed, scalability, and efficiency.$LILPEPE is behind the L2, plus it powers transactions, staking rewards, governance (parenting rights), and liquidity.

Given that a tremendous 30% (30B) of $LILPEPE’s 100B token supply is set aside for chain reserves, the meme coin eyes stable, long-term network growth.

An additional 10% ($10B) $LILPEPE earmarked for marketing and centralized exchange reserves further strengthens the project’s sustainability. It also supports the team’s ambition to break into CoinMarketCap’s top 100.

In fact, Little Pepe’s foundation for lasting growth is already visible. With 25.7K+ X followers and 29K+ Telegram subscribers, it demonstrates organic growth ahead of larger promotional efforts and major listings.

Visit the official Little Pepe presale before it ends.

Purchase $100 $LILPEPE to Join a $777K Prize Draw

With a presale that’s nearly sold out, a custom-built EVM-compatible chain, and robust tokenomics, $LILPEPE is much more than just another frog-themed meme coin.

For early adopters, $LILPEPE is a great way to get exposure to a meme coin project with real infrastructure at an ultra low cost.

You can buy $LILPEPE on presale for just $0.0021. But don’t wait around, as it’s gearing up for a ~5% increase.

By investing $100 into the presale and sharing the project’s posts across social media channels, you can also enter Little Pepe’s $777K giveaway.

This article isn’t financial advice. Do your own homework and never invest more than you’d be sad to lose.

Authored by Leah Waters, Bitcoinist: https://bitcoinist.com/little-pepe-presale-nears-end-at-25m

You May Also Like

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Spot ETH ETFs Surge: Remarkable $48M Inflow Streak Continues