500 projects sorted out, these 8 low-market-cap tokens may have the most potential to be listed on Binance

Author: DANNY , Crypto KOL

Compiled by: Felix, PANews

Binance recently released a report on future investments, which discussed the current problems of "Low Float, High FDV" (low circulation, high fully diluted valuation) projects, and mentioned that it will increase the number of low-market-cap tokens listed in the future, especially projects with low valuations or medium quality.

Crypto KOL DANNY reviewed 150 pages of documents and studied 500 altcoins to list 8 low-market-cap projects with the greatest potential to be listed on Binance. This article will take you through these 8 project tokens.

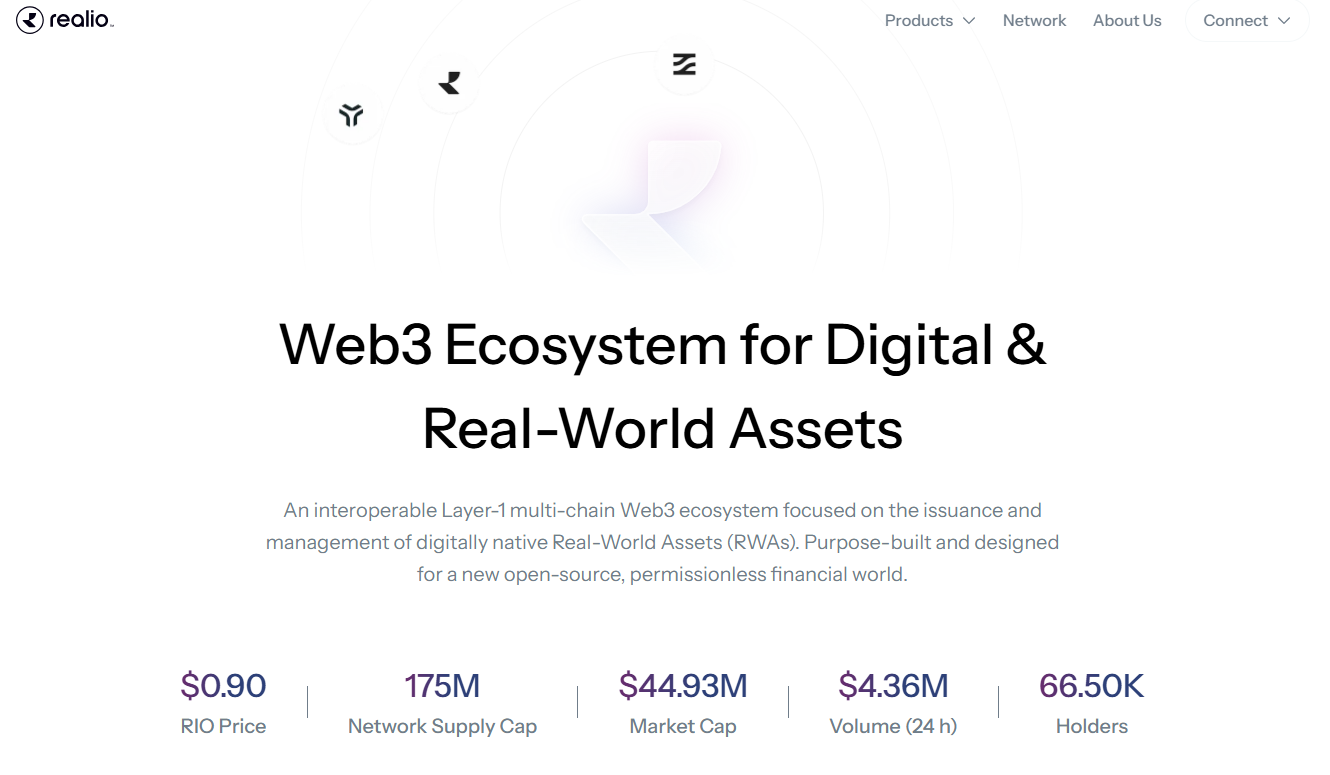

Realio ( RIO )

Realio is a Web3 ecosystem running on different L1 blockchains, focusing on the tokenization of real estate private placement instruments and providing DeFi liquidity pools for real assets.

The network features a native dual-token public Proof-of-Stake (PoS) consensus mechanism for Realio’s utility token RIO (Realio Network Token) and other real-world assets (RWA) such as hybrid digital security tokens, RST (Realio Security Token) and LMX (Liquidity Mining Fund).

- Price: $0.9

- Market value: $43.93 million

Related reading: BlackRock is here, and RWA is hot again

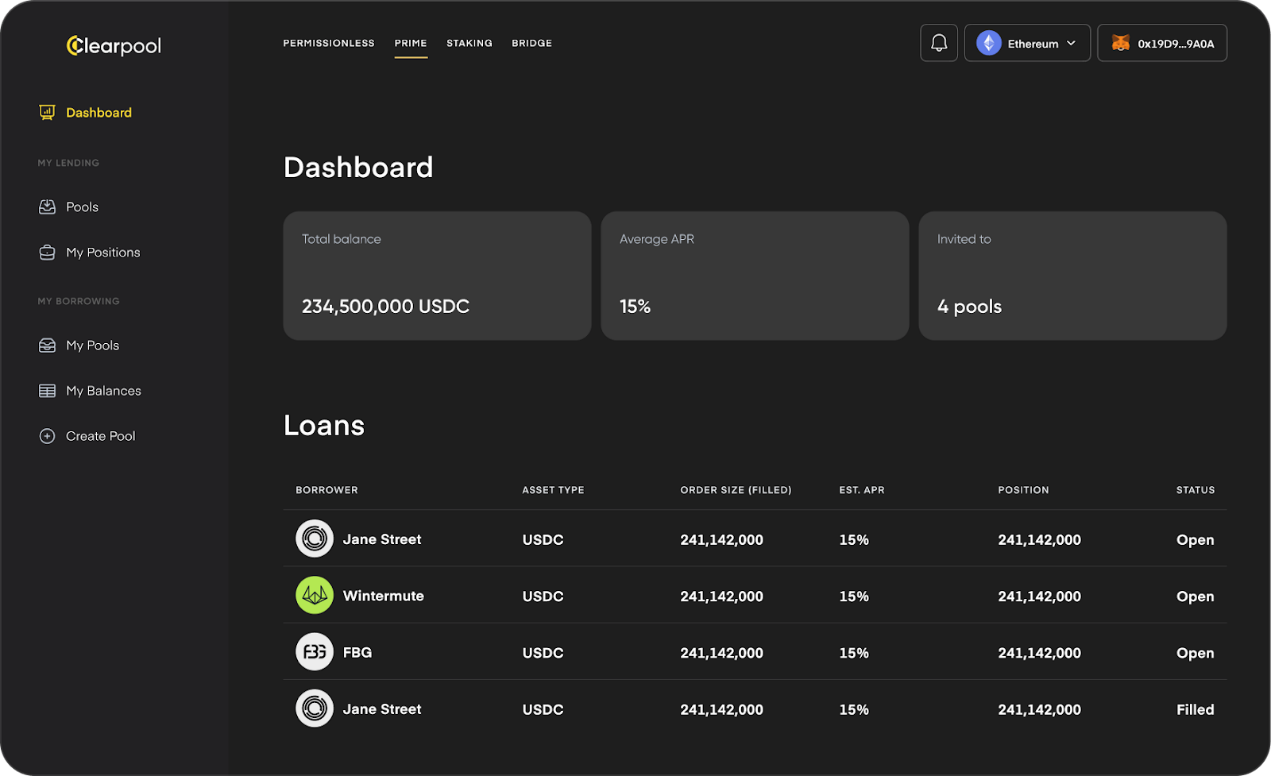

Clearpool ( CPOOL )

The Clearpool platform enables institutional borrowers to obtain unsecured loans directly from the DeFi ecosystem. The project introduces a dynamic interest rate model influenced by market supply and demand.

Clearpool is built on Ethereum and Polygon and is backed by Sequoia Capital India, Arrington Capital, Sino Global Capital, HashKey, and Wintermute. CPOOL is the utility and governance token of the Clearpool protocol and is tradable on KuCoin, Gate, AscendEX, and Uniswap.

- Price: $0.216

- Market value: $153 million

Related reading: Can the newly launched AI trading robot double the size of Clearpool’s on-chain capital market?

enqAI ( ENQAI )

enqAI is a decentralized and uncensored AI model network that aims to create a decentralized and uncensored ecosystem. It has image/audio generation and large language models, powered by a decentralized GPU network, which enables unbiased, agenda-free and uncensored operations, allowing the development and use of AI to be controlled by no centralized institution.

- Price: $0.03

- Market value: $29.47 million

Related reading: A panoramic review of the Web3+AI track: more than 130 projects, who will be the next “Golden Dog”?

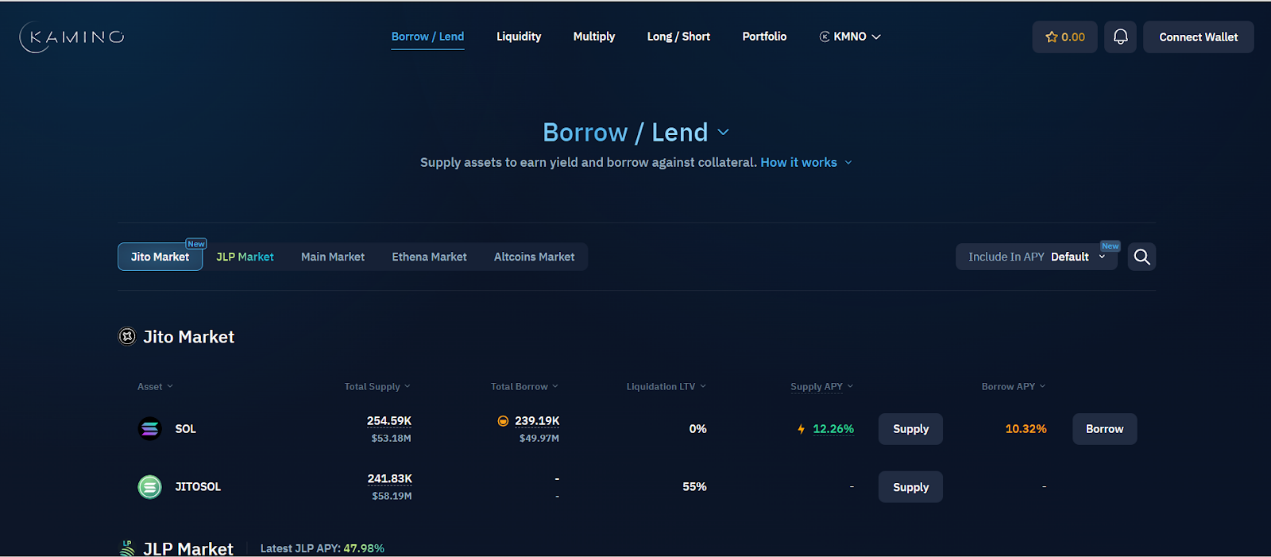

Kamino ( KMNO )

Kamino Finance was originally created to provide users with the easiest way to provide liquidity and earn yield on the chain. Today, Kamino integrates lending, liquidity, and leverage into a secure DeFi product suite. On Kamino, users can: borrow and lend assets, provide leveraged liquidity to centralized liquidity DEXs, build their own automated liquidity strategies, and use centralized liquidity positions as collateral.

- Price: $0.147

- Market value: $200 million

Related reading: Breakpoint is here again, a look at the potential Alpha of the Solana ecosystem

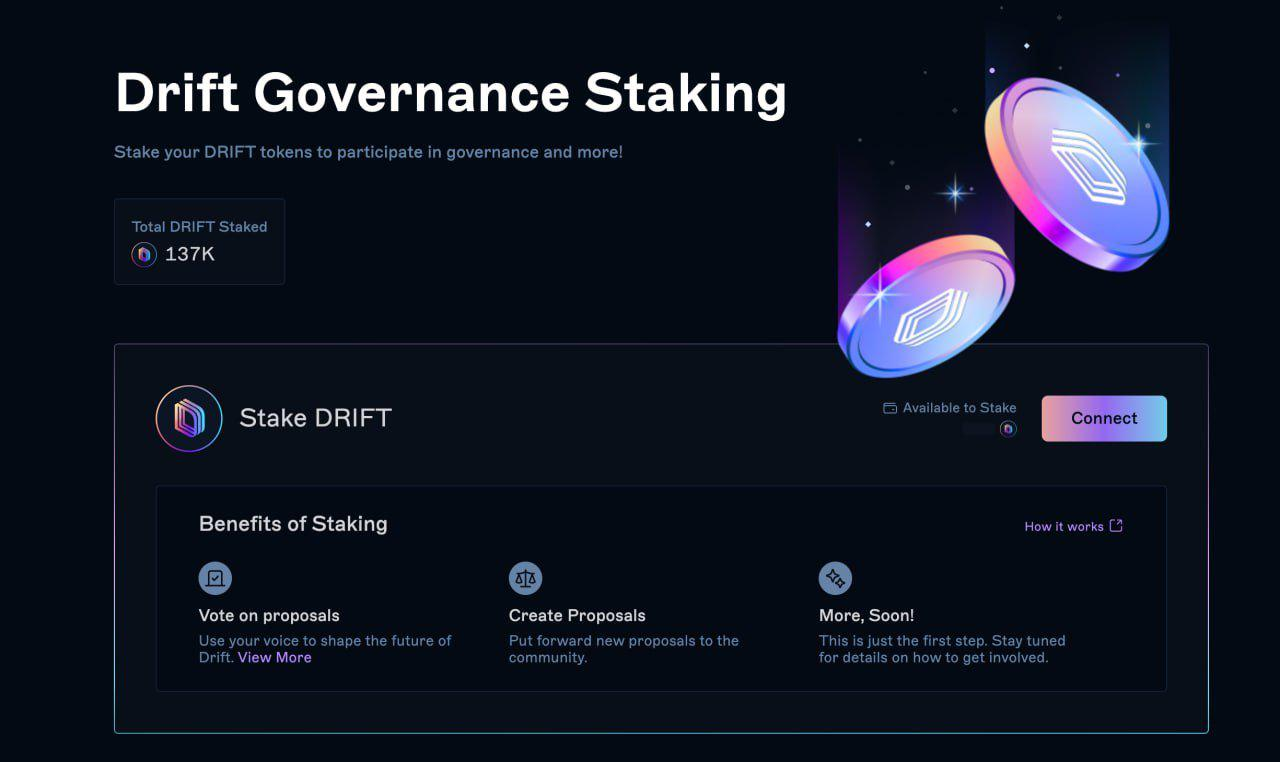

Drift ( DRIFT )

Drift is a fully on-chain perpetual and spot DEX built on Solana. Drift uses a dynamic virtual automated market maker (vAMM) technology to improve capital efficiency and allow users to trade with up to 10x leverage. In addition, Drift supports a cross-margin trading system, allowing users to manage their portfolio risks more flexibly.

- Price: $1.82

- Market value: $457.68 million

Related reading: Drift Protocol explained: the largest perpetual exchange on Solana

Truth Terminal ( GOAT )

Truth Terminal is a semi-autonomous AI robot based on Meta's Llama 3.1 language model optimization. It is not a crypto project itself, but it has played a key role in identifying and promoting GOAT tokens. The robot is designed to explore unsupervised creative risks in the era of meme culture and large language models (LLM). Truth Terminal has received $50,000 in funding from a16z co-founder Marc Andreessen.

- Price: $0.82

- Market value: $823 million

Related reading: How does the smart money on GOAT achieve a thousand-fold return? Mature trading strategy plus luck to catch the golden dog

HyperGPT ( HGPT )

HyperGPT is a Web3 AI marketplace that uses blockchain to overcome challenges in traditional AI applications. The HyperGPT platform aims to provide a marketplace powered by blockchain technology where people can buy, sell, and exchange artificial intelligence applications in a secure and transparent manner.

- Price: $0.0317

- Market value: $19.21 million

GraphLinq Chain ( GLQ )

GraphLinq Chain aims to simplify the development of complex automation in a decentralized and trustless manner, eliminating the need for intermediaries.

The GraphLinq ecosystem consists of two main components: GraphLinq Chain and GraphLinq Protocol. GraphLinq Protocol is an automation process management solution designed to allow users to easily deploy and manage various types of automation without coding skills. The protocol consists of four key components: IDE, Application, Engine, and Marketplace. GraphLinq Chain is a blockchain designed specifically to support GraphLinq Protocol. The chain is a Proof of Authority (POA) blockchain that provides a secure and scalable platform for running automation.

- Price: 0.1 USD

- Market value: $34.47 million

Related reading: AI narrative continues to heat up, here are 10 undervalued AI altcoins worth paying attention to

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Marathon Digital BTC Transfers Highlight Miner Stress