Bitcoin News Today: Dennis Potter Defends Bitcoin’s Low Fees Amid Security Concerns

The post Bitcoin News Today: Dennis Potter Defends Bitcoin’s Low Fees Amid Security Concerns appeared first on Coinpedia Fintech News

As Bitcoin adoption spreads worldwide, the debate over transaction fees and network security continues to intensify. Low fees make Bitcoin more accessible, particularly in developing countries, but some argue that cheap transactions could eventually undermine the long-term security of the network.

Dennis Potter: Low Fees Are a Positive Force

Bitcoin advocate Dennis Potter believes that low fees are not a weakness but an opportunity.

Potter pointed to the network’s strong fundamentals, emphasizing that miners are currently well-compensated:

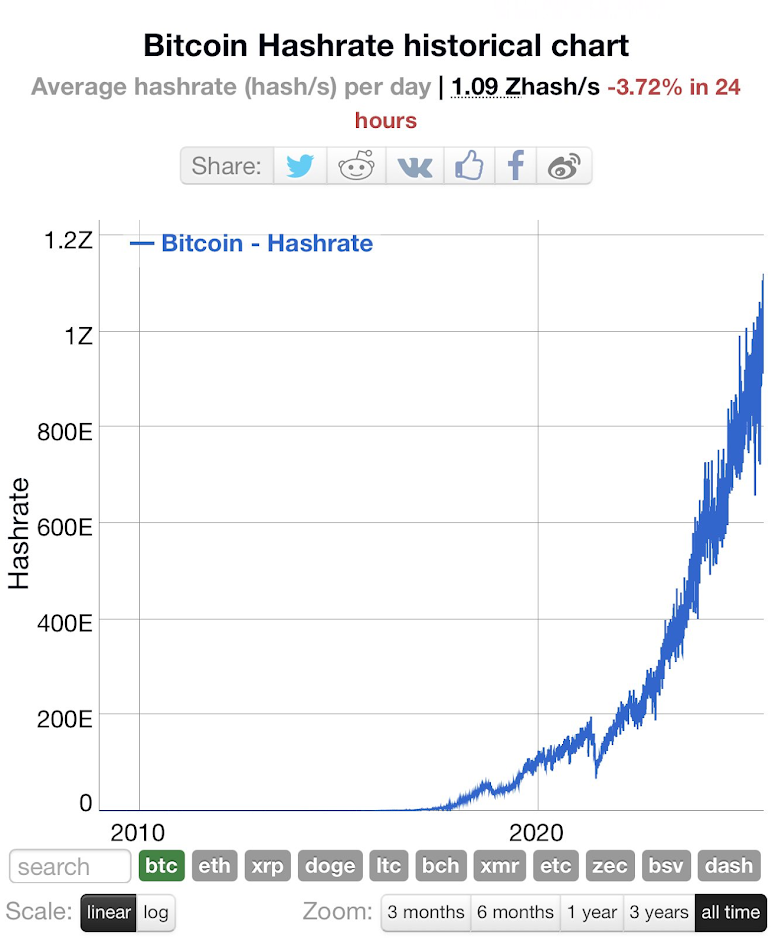

“Hashrate ATH. Average reward near ATH. Not a problem. Security intact and growing.”

He also dismissed calls for premature changes to the Bitcoin codebase:

“We can solve the problem when there are signs it’s a problem. Adding code to solve a problem that is more than 10 years away is short term thinking disguised as long term thinking.”

J.Dog’s Reply: A Security Budget Issue Ahead

Responding to Potter, community member J.Dog warned that the issue may not be urgent today but could become serious in the future.

He noted that with the Bitcoin halving cutting rewards every four years and many transactions shifting off-chain, miner incentives could weaken.

According to J.Dog, building a robust on-chain economy and driving demand for block space is key to ensuring long-term security.

Bitcoin Hashrate Reaches 1 Zetahash for the First Time in History

Bitcoin recently reached a historic milestone: 1 Zetahash of mining power for the first time in history. One observer explained:

The massive surge in hashrate signals:

- Security Resilience – A 51% attack is already prohibitively expensive; each additional watt of hash power makes such attacks even less realistic.

- Miner Efficiency – Higher hashrate squeezes out the least efficient miners, forcing them to capitulate or sell BTC, while more efficient miners can afford to hold.

- Shift to Stranded & Dual-Purpose Energy – A growing share of mining uses energy that would otherwise go to waste (like oil rig flare gas) or doubles as heating systems. These miners face lower costs and less pressure to sell their BTC, reducing overall sell pressure on the market.

This dynamic creates a healthier ecosystem, where efficient, sustainable miners dominate and Bitcoin’s price stability benefits from reduced forced selling.

The Road Ahead for Bitcoin

The debate highlights a central question for Bitcoin’s future: should developers take action now to prepare for declining rewards, or wait until signs of strain emerge?

For Potter, the answer is clear: Bitcoin is stronger than ever today, with record hashrate and miner revenue. For critics like J.Dog, ignoring the security budget could risk cracks in the foundation years down the line.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

According to Dennis Potter, no. He points to record hashrate and high miner rewards as proof that Bitcoin’s security is intact.

Many analysts believe fees could rise as block rewards decline after halvings, making transaction fees a bigger part of miner revenue.

It refers to the total rewards miners earn (block rewards + transaction fees) that incentivize them to secure the network.

Supporters argue yes, as long as miner rewards remain strong. Critics warn fees must rise long-term to maintain network security.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Your Crypto Companion: Navigating the Fast-Paced Digital Market